Bundle: Financial & Managerial Accounting, 13th + Working Papers, Volume 1, Chapters 1-15 For Warren/reeve/duchac’s Corporate Financial Accounting, ... 13th + Cengagenow™v2, 2 Terms Access Code

13th Edition

ISBN: 9781337062268

Author: Carl S. Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 23, Problem 23.3CP

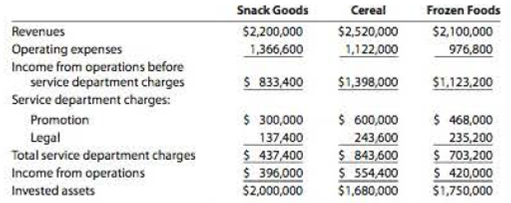

Evaluating divisional performance

The three divisions of Yummy Foods are Snack Goods, Cereal, and Frozen Foods. The divisions are structured as investment centers. The following responsibility reports were prepared for the three divisions for the prior year:

- 1. Which division is making the best use of invested assets and should be given priority for future capital investments?

- 2. Assuming that the minimum acceptable

rate of return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions? - 3. Can you identify opportunities for improving the company’s financial performance?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What is the debt to equity ratio on these financial accounting question?

What is the future value of 17 periodic payments of $9,680 each made at the end of each period and compounded at 10%?

Provide correct solution with explanation for this general accounting question

Chapter 23 Solutions

Bundle: Financial & Managerial Accounting, 13th + Working Papers, Volume 1, Chapters 1-15 For Warren/reeve/duchac’s Corporate Financial Accounting, ... 13th + Cengagenow™v2, 2 Terms Access Code

Ch. 23 - Prob. 1DQCh. 23 - Differentiate between a profit center and an...Ch. 23 - Weyerhaeuser developed a system that assigns...Ch. 23 - What is the major shortcoming of using income from...Ch. 23 - In a decentralized company in which the divisions...Ch. 23 - How does using the return on investment facilitate...Ch. 23 - Why would a firm use a balanced scorecard in...Ch. 23 - Prob. 8DQCh. 23 - When is the negotiated price approach preferred...Ch. 23 - When using the negotiated price approach to...

Ch. 23 - Prob. 23.1APECh. 23 - Prob. 23.1BPECh. 23 - Service department charges The centralized...Ch. 23 - Service department charges The centralized...Ch. 23 - Income from operations for profit center Using the...Ch. 23 - Prob. 23.3BPECh. 23 - Prob. 23.4APECh. 23 - Profit margin, investment turnover, and ROI Briggs...Ch. 23 - Residual income The Consumer Division of Hernandez...Ch. 23 - Prob. 23.5BPECh. 23 - Transfer pricing The materials used by tile North...Ch. 23 - Transfer pricing The materials used by the...Ch. 23 - Budget performance reports for cost centers...Ch. 23 - Divisional income statements The following data...Ch. 23 - Service department charges and activity bases For...Ch. 23 - Prob. 23.4EXCh. 23 - Service department charges In divisional income...Ch. 23 - Service department charges and activity bases...Ch. 23 - Divisional income statements with service...Ch. 23 - Prob. 23.8EXCh. 23 - Prob. 23.9EXCh. 23 - Rate of return on investment The income from...Ch. 23 - Residual income Based on the data in Exercise...Ch. 23 - Determining missing items in return on investment...Ch. 23 - Prob. 23.13EXCh. 23 - Prob. 23.14EXCh. 23 - Prob. 23.15EXCh. 23 - Determining missing items from computations Data...Ch. 23 - Prob. 23.17EXCh. 23 - Prob. 23.18EXCh. 23 - Building a balanced scorecard Hit-n-Run Inc. owns...Ch. 23 - Decision on transfer pricing Materials used by the...Ch. 23 - Prob. 23.21EXCh. 23 - Budget performance report for a cost center...Ch. 23 - Prob. 23.2APRCh. 23 - Divisional income statements and rate of return on...Ch. 23 - Effect of proposals on divisional performance A...Ch. 23 - Prob. 23.5APRCh. 23 - Prob. 23.6APRCh. 23 - Prob. 23.1BPRCh. 23 - Prob. 23.2BPRCh. 23 - Prob. 23.3BPRCh. 23 - Prob. 23.4BPRCh. 23 - Prob. 23.5BPRCh. 23 - Prob. 23.6BPRCh. 23 - Prob. 23.1CPCh. 23 - Prob. 23.2CPCh. 23 - Evaluating divisional performance The three...Ch. 23 - Evaluating division performance over time The...Ch. 23 - Evaluating division performance Last Resort...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 2. Financial Accounting: On January 1, a company lends a corporate customer $178,000 at 7.25% interest. What is the amount of interest revenue that should be recorded for the quarter ending March 31?arrow_forwardIf total assets equal $336,000 and total owners' equity equals $115,500, then total liabilities must equal: A. $451,500 B. $220,500 C. Cannot be determined from the information given D. $115,500arrow_forwardPlease given answerarrow_forward

- Coronado company recently signed a lease for a new office building for a lease period of 11 years. Under the lease agreement, a security deposit of $14, 560 is made, with the deposit to be returned at the expiration of the lease, with interest compounded at 5% per year. What amount will the company receive at the time the lease expires?arrow_forwardA company had expenses other than the cost of goods sold of $51,000. Determine Sales and Gross Profit given the cost of goods sold was $25,000 and the net income was $60,000.arrow_forwardWhich of the following statements is correct? A. The left side of a T-account is the credit side. B. Debits decrease asset and expense accounts and increase C. Liability The left side of a T-account is the debit side. D. Credits increase asset and expense accounts and decrease liability E. In certain circumstances the total amount debited need not equal particular transaction.arrow_forward

- Cool water's total liabilities arearrow_forwardLarry's Building Supplies (LBS) is a local hardware store. LBS uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a Sold merchandise for cash (cost of merchandise b $224,350) Received merchandise returned by customers as unsatisfactory (but in perfect condition) for a cash refund (original cost of merchandise $1,900) $ 5,00,000 $ 3,000 c Sold merchandise (costing $3,000) to a customer on account with terms n/30 $5,000 d Collected half of the balance owed by the customer in (c) $2,500 e Granted a partial allowance relating to credit sales the customer in (c) had not yet paid $ 950 Required: 1. Compute Net Sales and Gross Profit for LBS. 2. Compute the gross profit percentage.arrow_forwardGeneral Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

GE McKinsey Matrix for SBU Strategies; Author: Wolters World;https://www.youtube.com/watch?v=FffD1Ze76JQ;License: Standard Youtube License