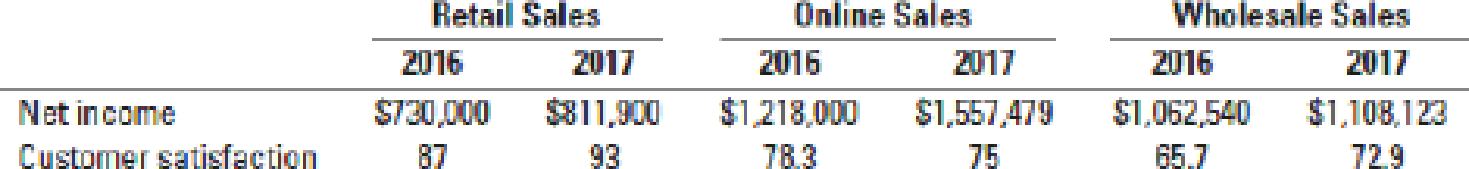

Executive compensation, balanced scorecard. Acme Company recently introduced a new bonus plan for its corporate executives. The company believes that current profitability and customer satisfaction levels are equally important to the company’s long-term success. As a result, the new plan awards a bonus equal to 0.5% of salary for each 1% increase in business unit net income or 1% increase in the business unit’s customer satisfaction index. For example, increasing net income from $1 million to $1.1 million (or 10% from its initial value) leads to a bonus of 5% of salary, while increasing the business unit’s customer satisfaction index from 50 to 60 (or 20% from its initial value) leads to a bonus of 10% of salary. There is no bonus penalty when net income or customer satisfaction declines. In 2016 and 2017, Acme’s three business units reported the following performance results:

- 1. Compute the bonus as a percent of salary earned by each business unit executive in 2017.

Required

- 2. What factors might explain the differences between improvement rates for net income and those for customer satisfaction in the three units? Are increases in customer satisfaction likely to result in increased net income right away?

- 3. Acme’s board of directors is concerned that the 2017 bonus awards may not accurately reflect the executives’ overall performance. In particular, the board is concerned that executives can earn large bonuses by doing well on one performance dimension but underperforming on the other. What changes can it make to the bonus plan to prevent this from happening in the future? Explain briefly.

Want to see the full answer?

Check out a sample textbook solution

Chapter 23 Solutions

Horngren's Cost Accounting, Student Value Edition (16th Edition)

- calculate sunrise technologies' price earnings ratioarrow_forwardProvide correct answer the following requirements on these financial accounting questionarrow_forwardYour firm has been the auditor of Caribild Products, a listed company, for a number of years. The engagement partner has asked you to describe the matters you would consider when planning the audit for the year ended 31January 2022. During recent visit to the company you obtained the following information: (a) The management accounts for the 10 months to 30 November 2021 show a revenue of $260 million and profit before tax of $8 million. Assume sales and profits accrue evenly throughout the year. In the year ended 31 January 2021 Caribild Products had sales of $220 million and profit before tax of $16 million. (b) The company installed a new computerised inventory control system which has operated from 1 June 2021. As the inventory control system records inventory movements and current inventory quantities, the company is proposing: (i) To use the inventory quantities on the computer to value the inventory at the year-end (ii) Not to carry out an inventory count at the year-end (c) You…arrow_forward

- what is the average collection period?arrow_forwardAnnika Corporation sells products A, B, and C. Annika sells four units of A for each unit of C, and three units of B for each unit of A. The contribution margins are $1.20 per unit of A, $1.80 per unit of B, and $3.50 per unit of C. Fixed costs are $750,000. How many units of A would Annika Corporation sell at the breakeven point? [Financial Accounting]arrow_forwardDetermine the administrative costsarrow_forward

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning