COST ACCOUNTING

16th Edition

ISBN: 9781323694008

Author: Horngren

Publisher: PEARSON C

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 23, Problem 23.34P

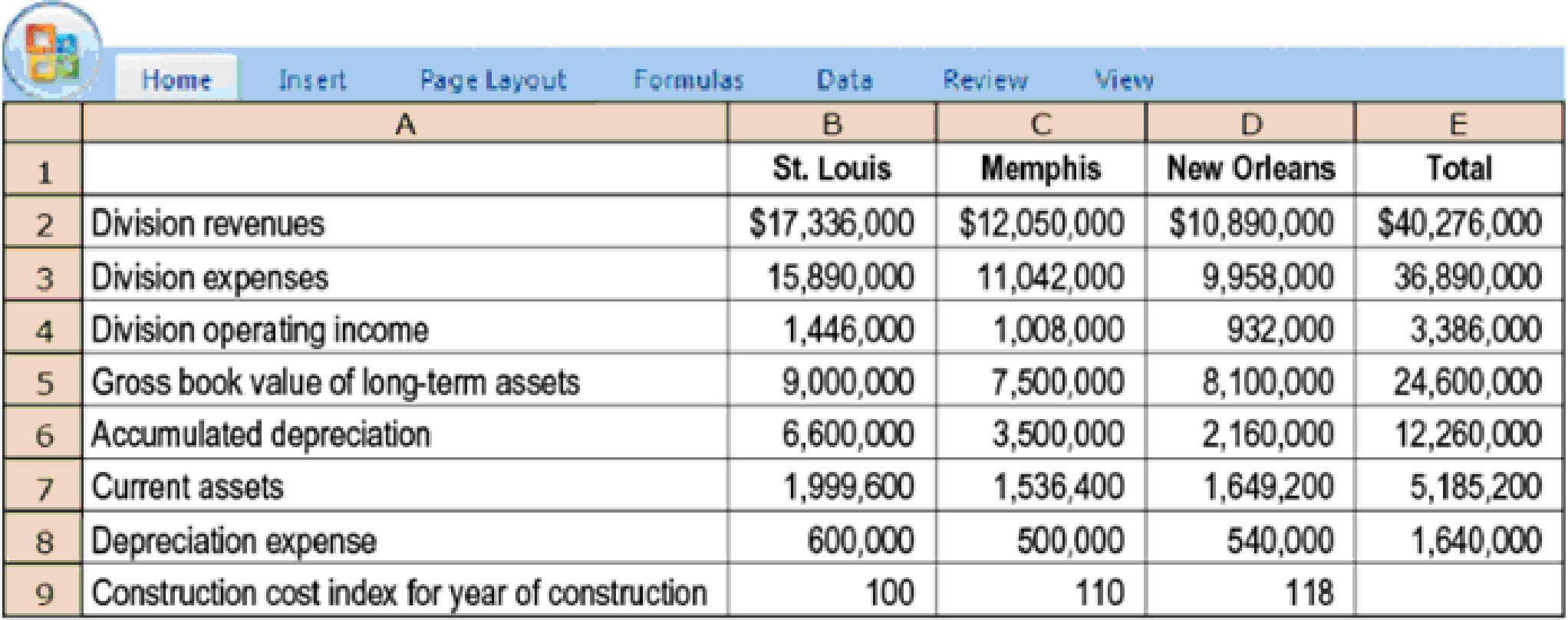

- 1. Calculate ROI for each division using net book value of total assets. Required

- 2. Using the technique in Figure 23-2, compute ROI using current-cost estimates for long-term assets and

depreciation expense. The construction cost index for 2017 is 122. Estimated useful life of operational assets is 15 years. - 3. How does the choice of long-term asset valuation affect management decisions regarding new capital investments? Why might this choice be more significant to the St. Louis division manager than to the New Orleans division manager?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Driver Sports Company makes snowboards, downhill skis, cross-country skis, skateboards, surfboards, and in-line skates. The company has found it beneficial to split operations into two divisions based on the climate required for the sport: Snow Sports and

Non-Snow Sports. The following divisional information is available for the past year:

E (Click the icon to view the information.)

Read the requirements.

Requirements

Data table

1. Calculate each division's ROI.

Sales

Operating Income

Total Assets

Current Liabilities

2. Top management has extra funds to invest. Which division will most likely

receive those funds? Why?

3. Can you explain why one division's ROI is higher? How could management gain

more insight?

Snow Sports

$ 5,300,000 $

990,000 $

4,400,000 $

400,000

Non-Snow Sports

8,400,000 $

816,000 $

3,400,000 $

650,000

Driver's management has specified a target 15% rate of return.

Print

Done

Print

Done

K

Ace Paints is a national paint manufacturer and retailer. The company is segmented into

five divisions: Paint Stores (branded retail locations), Consumer (paint sold through home

improvement stores). Automotive (sales to auto manufacturers), International, and Administration

Read the requirements

Requirement 1. Calculate each division's ROL Round all of your answers to four decimal places

Begin by selecting the formula to calculate return on investment (ROI), and then enter the amounts to calculate each division's ROI. (Round your calculations to four decimal places and enter your

antwer as a percent rounded to two decimal places, XXX%)

Requirements

1. Calculate each division's ROI. Round all of your answers to four decimal

places

2. Calculate each division's profit margin ratio. Interpret your results

3. Calculate each division's asset tumover ratio. Interpret your results

4. Use the expanded ROI formula to confirm your results from Requirement 1,

Interpret your results.

5

Calculate…

Calculate division margins in percentage terms prior to allocating fixed overhead costs.

Chapter 23 Solutions

COST ACCOUNTING

Ch. 23 - Prob. 23.1QCh. 23 - Prob. 23.2QCh. 23 - What factors affecting ROI does the DuPont method...Ch. 23 - RI is not identical to ROI, although both measures...Ch. 23 - Describe EVA.Ch. 23 - Give three definitions of investment used in...Ch. 23 - Distinguish between measuring assets based on...Ch. 23 - Prob. 23.8QCh. 23 - Why is it important to distinguish between the...Ch. 23 - Prob. 23.10Q

Ch. 23 - Managers should be rewarded only on the basis of...Ch. 23 - Explain the role of benchmarking in evaluating...Ch. 23 - Explain the incentive problems that can arise when...Ch. 23 - Prob. 23.14QCh. 23 - Prob. 23.15QCh. 23 - During the current year, a strategic business unit...Ch. 23 - Assuming an increase in price levels over time,...Ch. 23 - If ROI Is used to evaluate a managers performance...Ch. 23 - The Long Haul Trucking Company is developing...Ch. 23 - ABC Inc. desires to maintain a capital structure...Ch. 23 - ROI, comparisons of three companies. (CMA,...Ch. 23 - Prob. 23.22ECh. 23 - ROI and RI. (D. Kleespie, adapted) The Sports...Ch. 23 - ROI and RI with manufacturing costs. Excellent...Ch. 23 - ROI, RI, EVA. Hamilton Corp. is a reinsurance and...Ch. 23 - Goal incongruence and ROI. Comfy Corporation...Ch. 23 - ROI, RI, EVA. Performance Auto Company operates a...Ch. 23 - Capital budgeting, RI. Ryan Alcoa, a new associate...Ch. 23 - Prob. 23.29ECh. 23 - ROI, RI, EVA, and performance evaluation. Cora...Ch. 23 - Prob. 23.31ECh. 23 - Prob. 23.32ECh. 23 - ROI performance measures based on historical cost...Ch. 23 - ROI, measurement alternatives for performance...Ch. 23 - Multinational firms, differing risk, comparison of...Ch. 23 - ROI, Rl, DuPont method, investment decisions,...Ch. 23 - Division managers compensation, levers of control...Ch. 23 - Executive compensation, balanced scorecard. Acme...Ch. 23 - Financial and nonfinancial performance measures,...Ch. 23 - Prob. 23.40PCh. 23 - Prob. 23.41PCh. 23 - RI, EVA, measurement alternatives, goal...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dantrell Palmer has just been appointed manager of Kirchner Glass Products Division. He has two years to make the division profitable. If the division is still showing a loss after two years, it will be eliminated, and Dantrell will be reassigned as an assistant divisional manager in another division. The divisional income statement for the most recent year is as follows: Upon arriving at the division, Dantrell requested the following data on the divisions three products: He also gathered data on a proposed new product (Product D). If this product is added, it would displace one of the current products; the quantity that could be produced and sold would equal the quantity sold of the product it displaces, although demand limits the maximum quantity that could be sold to 20,000 units. Because of specialized production equipment, it is not possible for the new product to displace part of the production of a second product. The information on Product D is as follows: Required: 1. Prepare segmented income statements for Products A, B, and C. 2. Determine the products that Dantrell should produce for the coming year. Prepare segmented income statements that prove your combination is the best for the division. By how much will profits improve given the combination that you selected? (Hint: Your combination may include one, two, or three products.)arrow_forwardGrate Care Company specializes in producing products for personal grooming. The company operates six divisions, including the Hair Products Division. Each division is treated as an investment center. Managers are evaluated and rewarded on the basis of ROI performance. Only those managers who produce the best ROIs are selected to receive bonuses and to fill higher-level managerial positions. Fred Olsen, manager of the Hair Products Division, has always been one of the top performers. For the past two years, Freds division has produced the largest ROI; last year, the division earned an operating income of 2.56 million and employed average operating assets valued at 16 million. Fred is pleased with his divisions performance and has been told that if the division does well this year, he will be in line for a headquarters position. For the coming year, Freds division has been promised new capital totaling 1.5 million. Any of the capital not invested by the division will be invested to earn the companys required rate of return (9 percent). After some careful investigation, the marketing and engineering staff recommended that the division invest in equipment that could be used to produce a crimping and waving iron, a product currently not produced by the division. The cost of the equipment was estimated at 1.2 million. The divisions marketing manager estimated operating earnings from the new line to be 156,000 per year. After receiving the proposal and reviewing the potential effects, Fred turned it down. He then wrote a memo to corporate headquarters, indicating that his division would not be able to employ the capital in any new projects within the next eight to 10 months. He did note, however, that he was confident that his marketing and engineering staff would have a project ready by the end of the year. At that time, he would like to have access to the capital. Required: 1. Explain why Fred Olsen turned down the proposal to add the capability of producing a crimping and waving iron. Provide computations to support your reasoning. 2. Compute the effect that the new product line would have on the profitability of the firm as a whole. Should the division have produced the crimping and waving iron? 3. Suppose that the firm used residual income as a measure of divisional performance. Do you think Freds decision might have been different? Why? 4. Explain why a firm like Grate Care might decide to use both residual income and return on investment as measures of performance. 5. Did Fred display ethical behavior when he turned down the investment? In discussing this issue, consider why he refused to allow the investment.arrow_forwardJarriot, Inc., presented two years of data for its Furniture Division and its Houseware Division. Required: 1. Compute the ROI and the margin and turnover ratios for each year for the Furniture Division. (Round your answers to four significant digits.) 2. Compute the ROI and the margin and turnover ratios for each year for the Houseware Division. (Round your answers to four significant digits.) 3. Explain the change in ROI from Year 1 to Year 2 for each division.arrow_forward

- accoutingarrow_forwardAdrenaline Sports Company makes snowboards, downhill skis, cross-country skis, skateboards, surfboards, and in-line skates. The company has found it beneficial to split operations into two divisions based on the climate required for the sport: Snow Sports and Non-Snow Sports. The following divisional information is available for the past year: (Click the icon to view the information.) Read the requirements. 1. Compute each division's sales margin. Interpret your results. First enter the formula, then calculate each divisions sales margin. (Enter the sales margin as a percent rounded to the nearest whole percent.) Sales margin Data table Snow Sports Non-Snow Sports Adrenaline's management has specified a target 14% rate of return. Sales $ 5,600,000 $ $ 8,700,000 $ et more help. Operating Income 952,000 $ 1.479,000 $ Print C Total Assets Current Liabilities 4,300,000 $ 6,300,000 $ Done 410,000 710,000 Requirements X 1. Compute each division's sales margin. Interpret your results. 2.…arrow_forwardAustin BBQ has seen rapid growth in the last five years. It started with one store and is now located in 15 different locations across five cities. The CEO has noticed that costs are increasing and so is beginning to standardize practices across the various locations. Which of the following perspectives is most consistent with the CEO's efforts? Group of answer choices 1.Rational System 2.Natural System 3.Open System 4.Operational Systemarrow_forward

- Millard Corporation is a wholesale distributor of office products. It purchases office products from manufacturers and distributes them in the West, Central, and East regions. Each of these regions is about the same size and each has its own manager and sales staff The company has been experiencing losses for many months. In an effort to improve performance, management has requested that the monthly income statement be segmented by sales region. The company's first effort at preparing a segmented income statement for May is given below. Sales Regional expenses traceable): Cost of goods sold Advertising Salaries Utilities Depreciation Shipping expense Total regional expenses Regional income (less) before corporate expenses Corporate expenses Advertising (general) General administrative expense Mest $311,000 92,000 110,000 59,000 8.900 25,000 15,000 309,900 1.100 14,000 20,000 34,000 5 (32,900) Sales Region Central $800,000 245,000 245,000 59,000 15,500 33,000 28,000 hiso 2 East…arrow_forwardasarrow_forwardSwain Athletic Gear (SAG) operates six retall outlets in a large Midwest city. One is in the center of the city on Cornwall Street and the others are scattered around the perimeter of the city. Management at SAG is concerned about declining sales and profitability of the Cornwall store and believes that outlet has been a drag on profits in recent years. The most recent Income statement for the Cornwall store follows. SWAIN ATHLETIC GEAR Cornwall Street Store Income Statement For the Year Ending February 28 Sales revenue Costs Cost of goods sold Advertising Store administrative salaries Sales commissions Leases and utilities Allocated corporate support Total costs Net loss before tax benefit Tax benefit at 25% Net loss The CFO at SAG has asked for your advice on closing the Cornwall Street store. If the Cornwall Street store is closed, neither total corporate support costs nor operations or costs of the other stores are expected to change. Required: a. Using the worksheet below,…arrow_forward

- Superior Markets, Incorporated, operates three stores in a large metropolitan area. A segmented absorption costing income statement for the company for the last quarter is given below: Sales Cost of goods sold Gross margin Selling and administrative expenses: Selling expenses Administrative expenses Total expenses Net operating income (loss) Selling expenses: Sales salaries Direct advertising General advertising* Store rent Depreciation of store fixtures Delivery salaries Depreciation of delivery equipment Total selling expenses *Allocated on the basis of sales dollars. Administrative expenses: Store managers' salaries General office salaries* Superior Markets, Incorporated Income Statement For the Quarter Ended September 30 Insurance on fixtures and inventory Utilities Employment taxes General office-other* Total $ 3,000,000 1,657, 200 1,342,800 Total administrative expenses *Allocated on the basis of sales dollars. 817,000 383,000 1,200,000 $ 142,800 a. The breakdown of the selling…arrow_forwardMillard Corporation is a wholesale distributor of office products. It purchases office products from manufacturers and distributes them in the West, Central, and East regions. Each of these regions is about the same size and each has its own manager and sales staff. The company has been experiencing losses for many months. In an effort to improve performance, management has requested that the monthly income statement be segmented by sales region. The company's first effort at preparing a segmented income statement for May is given below. Sales Regional expenses (traceable): Cost of goods sold Advertising Salaries Utilities Depreciation Shipping expense Total regional expenses Regional income (loss) before corporate expenses Corporate expenses: Advertising (general) General administrative expense Total corporate expenses Net operating income (loss) Variable expenses: Total variable expenses Traceable fixed expenses: Total traceable fixed expenses Common fixed expenses: Total common…arrow_forwardMillard Corporation is a wholesale distributor of office products. It purchases office products from manufacturers and distributes them in the West, Central, and East regions. Each of these regions is about the same size and each has its own manager and sales staff. The company has been experiencing losses for many months. In an effort to improve performance, management has requested that the monthly income statement be segmented by sales region. The company’s first effort at preparing a segmented income statement for May is given below. Sales Region West Central East Sales $ 311,000 $ 796,000 $ 703,000 Regional expenses (traceable): Cost of goods sold 94,000 240,000 312,000 Advertising 105,000 236,000 240,000 Salaries 54,000 54,000 107,000 Utilities 8,700 16,100 13,600 Depreciation 21,000 35,000 28,000 Shipping expense 17,000 31,000 36,000 Total regional expenses 299,700 612,100 736,600 Regional income (loss) before corporate expenses 11,300…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Introduction to Divisional performance measurement - ACCA Performance Management (PM); Author: OpenTuition;https://www.youtube.com/watch?v=pk8Mzoqr4VA;License: Standard Youtube License