Concept explainers

Problem 22-3B

Manufacturing: Preparation and analysis of

P3

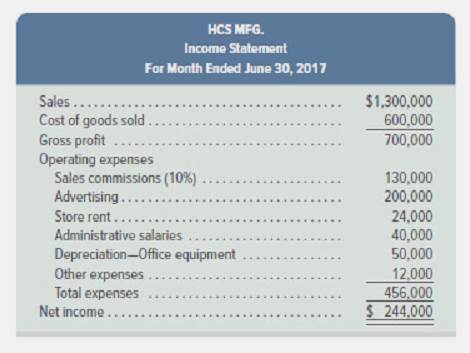

HCS MFG. makes its product for $60 per unit and sells it for $130 per unit. The sales staff receives a commission of 10% of dollar sales. Its June income statement follows.

Management expects June’s results to be repeated in July, August, and September without any changes in strategy. Management, however, has another plan. It believes that unit sales will increase at a rate of 10% each month for the next three months (beginning with July) if the kern’s selling price is reduced to $115 per unit and advertising expenses are increased by 25% and remain at that level for all three months. The cost of its product will remain at $60 per unit, the sales staff will continue to earn a 10% commission, and the remaining expenses will stay the same.

Required

- Prepare budgeted income statements for each of the months of July, August, and September that show the expected results from implementing the proposed changes. Use a three- column format, with one column for each month.

Check Budgeted net income: July, $102,500; August, $150,350; September, $202,985

Analysis Component

2. Use the budgeted income statements from part 1 to recommend whether management should implement the proposed plan. Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 22 Solutions

Fundamental Accounting Principles

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning