Variance interpretation

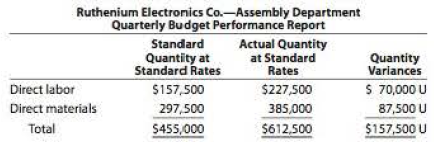

You have been asked to investigate some cost problems in the Assembly Department of Ruthenium Electronics Co., a consumer electronics company. To begin your investigation, you have obtained the following budget performance report for department for the last quarter:

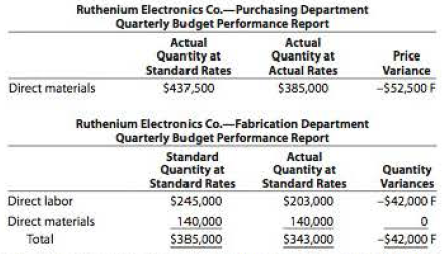

The following reports were also obtained:

You also interviewed the Assembly Department supervisor. Excerpts from the interview follow:

Q: What explains the poor performance in your department?

A: Listen, you've got to understand what it's been like in this department recently. Lately, it seems no matter how hard we try, we can't seem to make the standards. I'm not sure what is going on, but we've been having a lot of problems lately.

Q: What kind of problems?

A: Well, for instance, all this quarter we've been requisitioning purchased parts from the material storeroom, and the pans just didn't fit together very well I'm not sure what is going on. but during most of this quarter we've had to scrap and sort purchased pans—just to get our assemblies put together. Naturally, all this takes time and material. And that's not all.

Q: Go on.

A: All this quarter, the work that we've been receiving from the Fabrication Department has been shoddy. I mean, maybe around 20% of the stuff that comes in from Fabrication just can't be assembled. The fabrication is all wrong. As a result, we've had to scrap and rework a lot of the stuff. Naturally, this has just shot our quantity variances.

Interpret the variance reports in light of the comments by the Assembly Department supervisor.

Trending nowThis is a popular solution!

Chapter 22 Solutions

FINANCIAL+MANG.-W/ACCESS PRACTICE SET

- Hello tutor solve this question accountingarrow_forwardProvide correct answer is accountingarrow_forwardMilani, Incorporated, acquired 10 percent of Seida Corporation on January 1, 2023, for $190,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2024, Milani purchased an additional 30 percent of Seida for $600,000 which resulted in significant influence over Seida. On that date, the fair value of Seida's common stock was $2,000,000 in total. Seida's January 1, 2024, book value equaled $1,850,000, although land was undervalued by $120,000. Any additional excess fair value over Seida's book value was attributable to a trademark with an eight-year remaining life. During 2024, Seida reported income of $300,000 and declared and paid dividends of $110,000. Required: Prepare the 2024 journal entries for Milani related to its investment in Seida. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheetarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning