EBK HORNGREN'S COST ACCOUNTING

16th Edition

ISBN: 9780134475950

Author: Datar

Publisher: PEARSON CO

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 22, Problem 22.30P

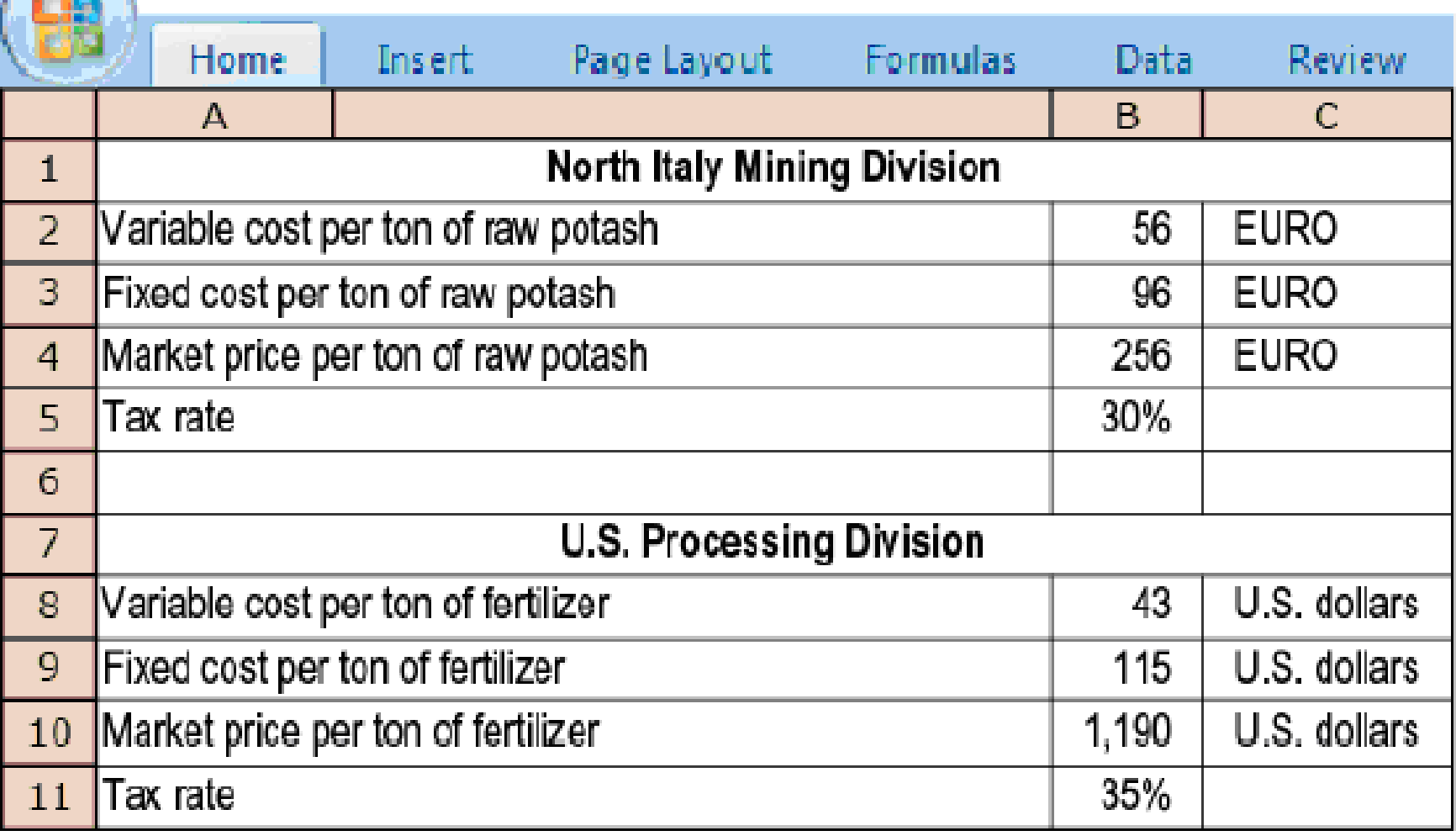

Multinational transfer pricing, global tax minimization. Express Grow Inc., based in Ankeny, lowa, sells high-end fertilizers. Express Grow has two divisions:

- North Italy mining division, which mines potash in northern Italy

- U.S. processing division, which uses potash in manufacturing top-grade fertilizer

The processing division’s yield is 50%: It takes 2 tons of raw potash to produce 1 ton of top-grade fertilizer. Although all of the mining division’s output of 8,000 tons of potash is sent for processing in the United States, there is also an active market for potash in Italy. The foreign exchange rate is 0.80 Euro = $1 U.S. The following information is known about the two divisions:

- A. Compute the annual pretax operating income, in U.S. dollars, of each division under the following transfer-pricing methods: (a) 150% of full cost and (b) market price.

- B. Compute the after-tax operating income, in U.S. dollars, for each division under the transfer-pricing methods in requirement 1. (Income taxes are not included in the computation of cost-based transfer price, and Express Grow does not pay U.S. income tax on income already taxed in Italy.)

- C. If the two division managers are compensated based on after-tax division operating income, which transfer-pricing method will each prefer? Which transfer-pricing method will maximize the total after-tax operating income of Express Grow?

- D. In addition to tax minimization, what other factors might Express Grow consider in choosing a transfer-pricing method?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Overhead rate per direct labor cost?

A business has $210,000 total liabilities. At start-up, the owners invested $500,000 in the business. Unfortunately, the business has suffered a cumulative loss of $200,000 up to the present time. What is the amount of its total assets at the present time?

What is the total period cost for the month under the variable costing approach ?

Chapter 22 Solutions

EBK HORNGREN'S COST ACCOUNTING

Ch. 22 - Prob. 22.1QCh. 22 - Describe three criteria you would use to evaluate...Ch. 22 - What is the relationship among motivation, goal...Ch. 22 - Name three benefits and two costs of...Ch. 22 - Organizations typically adopt a consistent...Ch. 22 - Transfer pricing is confined to profit centers. Do...Ch. 22 - What are the three methods for determining...Ch. 22 - What properties should transfer-pricing systems...Ch. 22 - All transfer-pricing methods give the same...Ch. 22 - Prob. 22.10Q

Ch. 22 - Prob. 22.11QCh. 22 - Prob. 22.12QCh. 22 - Prob. 22.13QCh. 22 - Under the general guideline for transfer pricing,...Ch. 22 - How should managers consider income tax issues...Ch. 22 - Evaluating management control systems, balanced...Ch. 22 - Cost centers, profit centers, decentralization,...Ch. 22 - Prob. 22.18ECh. 22 - Prob. 22.19ECh. 22 - Multinational transfer pricing, effect of...Ch. 22 - Prob. 22.21ECh. 22 - Multinational transfer pricing, global tax...Ch. 22 - Prob. 22.23ECh. 22 - Prob. 22.24ECh. 22 - Transfer-pricing problem (continuation of 22-24)....Ch. 22 - Prob. 22.26PCh. 22 - Prob. 22.27PCh. 22 - Effect of alternative transfer-pricing methods on...Ch. 22 - Goal-congruence problems with cost-plus...Ch. 22 - Multinational transfer pricing, global tax...Ch. 22 - Transfer pricing, external market, goal...Ch. 22 - Prob. 22.32PCh. 22 - Transfer pricing, goal congruence, ethics. Cocoa...Ch. 22 - Prob. 22.34PCh. 22 - Transfer pricing, perfect and imperfect markets....Ch. 22 - Prob. 22.36PCh. 22 - Prob. 22.37P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the total period cost under variable costing?arrow_forwardSubject: Financial Accounting-The Banner Income Fund's average daily total assets were $100 million for the year just completed. Its stock purchases for the year were $20 million, while its sales were $12.5 million. What was its turnover?arrow_forwardSubject: Financial Accounting-The Banner Income Fund's average daily total assets were $100 million for the year just completed. Its stock purchases for the year were $20 million, while its sales were $12.5 million. What was its turnover? No AI ANSWERarrow_forward

- Accurate answerarrow_forwardI don't need ai answer general accounting questionarrow_forwardWhat specifies the accounting for multi-year insurance policies paid in advance? (a) Expense total premium immediately (b) Record as asset and amortize systematically (c) Recognize when coverage provided (d) Split between years equallyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

What is Transfer Pricing for Small Businesses?; Author: Nomad Capitalist;https://www.youtube.com/watch?v=_Q6nN3s1Xjs;License: Standard Youtube License