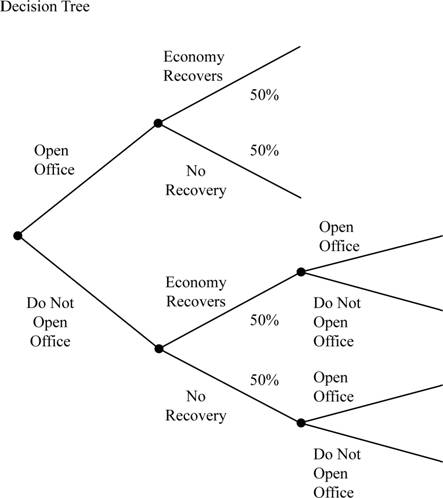

Your company is planning on opening an office in Japan. Profits depend on how fast the economy in Japan recovers from its current recession. There is a 50% chance of recovery this year. You are trying to decide whether to open the office now or in a year. Construct the decision tree that shows the choices you have to open the office either today or one year from now.

To draw: The decision tree.

Introduction:

Decision tree is a tree-like graph which helps to identify strategies which are most likely to achieve goals. A decision tree comprises decision support tools.

Explanation of Solution

Given information:

A company is planning on opening an office in Japan. Company profit depends on Japanʼs economyʼs recovery from its current recession. The chance of recovery from recession is 50.00%.

Possible decision:

Possible decision in the decision tree:

- 1. To open office

- 2. To not open office

If to open office, then two possible decisions:

- 1. Economy recover

- 2. Economy doesn’t recover

If to not open office, then two possible decisions:

- 1. Economy recover

- 2. Economy doesn’t recover

If to not open office and economy recover, then two possible decisions:

- 1. To open office

- 2. To not open office

If to not open office and the economy does not recover, then two possible decisions:

- 1. To open office

- 2. To not open office

Diagram from decision tree:

Want to see more full solutions like this?

Chapter 22 Solutions

EBK CORPORATE FINANCE

Additional Business Textbook Solutions

Managerial Accounting (5th Edition)

Principles Of Taxation For Business And Investment Planning 2020 Edition

Financial Accounting: Tools for Business Decision Making, 8th Edition

Operations Management

Accounting For Governmental & Nonprofit Entities

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Let it denote the effective annual return achieved on an equity fund achieved between time (t-1) and time t. Annual log-returns on the fund, denoted by In(1+i̟²), are assumed to form a series of independent and identically distributed Normal random variables with parameters µ = 7% and σ = 10%. An investor has a liability of £20,000 payable at time 10. Calculate the amount of money that should be invested now so that the probability that the investor will be unable to meet the liability as it falls due is only 5%. Express your answer to the NEAREST INTEGER and do NOT include a "£" sign. Note: From standard Normal tables, we have (-1.645) = 0.05.arrow_forwardFor this question, use this data: myFunc = function (x, y = 2) {z = 7 Z+x^2+y } What is the output of myFunc(2)? O 13. O An error, y is undefined. O Nothing, we have to assign it as a vari O 9.arrow_forwarda medical test has some probability of being positive if the patient has the disease (hasPos) and another probability of testing positive if the person does not have the disease (notHasPos). a random member of the entire population has a real problem of having the disease (actual incidence). Based on the attached information what does the result of the function?arrow_forward

- myFunc = function (x, y = 2) {z = 7 } z+x^2+y Assuming that this was the first thing entered in a new R session, if the next command entered is z+1, what is the output? O 8. ● An error, z does not exist. O 10. O 7.arrow_forwardDon't used Ai solutionarrow_forwardLiterature Review Based Essay on Contemporary Issues of Business Ethics and Corporate Social Responsibility Essay Format Cover Page with your Name Table of Content • Introduction ⚫ Objectives ⚫ Discussion with Literature Support • Conclusion References (10+) Words Limit-3000-3500 wordsarrow_forward

- Please don't use hand ratingarrow_forward"Dividend paying stocks cannot be growth stocks" Do you agree or disagree? Discuss choosing two stocks to help justify your view.arrow_forwardA firm needs to raise $950,000 but will incur flotation costs of 5%. How much will it pay in flotation costs? Multiple choice question. $55,500 $50,000 $47,500 $55,000arrow_forward

- While determining the appropriate discount rate, if a firm uses a weighted average cost of capital that is unique to a particular project, it is using the Blank______. Multiple choice question. pure play approach economic value added method subjective approach security market line approacharrow_forwardWhen a company's interest payment Blank______, the company's tax bill Blank______. Multiple choice question. stays the same; increases decreases; decreases increases; decreases increases; increasesarrow_forwardFor the calculation of equity weights, the Blank______ value is used. Multiple choice question. historical average book marketarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College