College Accounting, Chapters 1-9 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305888531

Author: HEINTZ, James A., Parry, Robert W.

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 22, Problem 13SPB

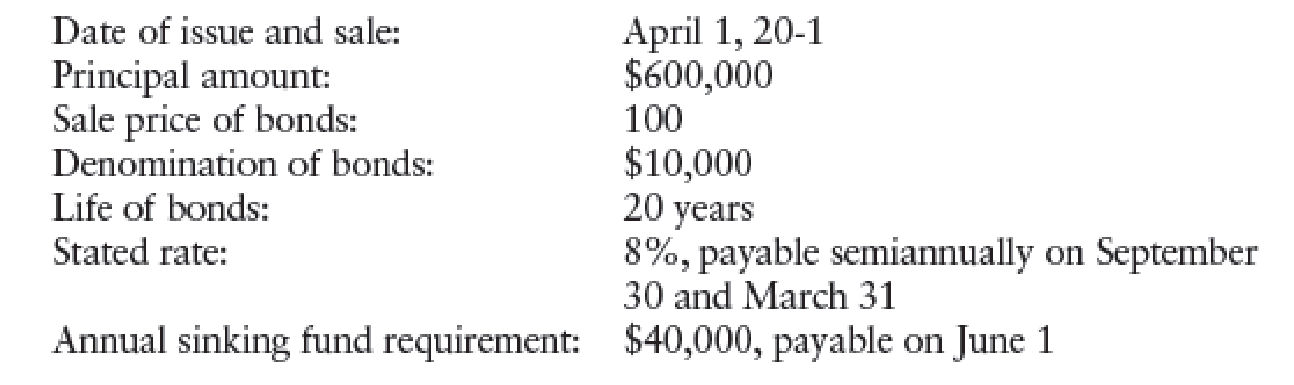

BONDS ISSUED AT FACE VALUE WITH SINKING FUND Creswell Entertainment issued the following bonds:

REQUIRED

Prepare

- (a) Issuance of the bonds.

- (b) Deposit to sinking fund on June 1.

- (c) Interest payment on the bonds on September 30, 20-1.

- (d) Earnings of $3,000 on the sinking fund in 20-1.

- (e) Year-end adjustment on the bonds for 20-1.

- (f) Reversing entry for the beginning of 20-2.

- (g) Interest payments on the bonds on March 31, 20-2.

- (h) Deposit to sinking fund on June 1, 20-2.

- (i) Redemption at maturity from the sinking fund.

- (j) Return of excess cash of $ 1,900 from the sinking fund to the corporation.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Blue Sky Company reports the following costing data on its product for

its first year of operations. During this first year, the company produced

42,000 units and sold 34,000 units at a price of $130 per unit.

Production costs:

Direct materials per unit

Direct lavor per unit

Variable overhead per unit

Fixed overhead for the year

$ 54

$ 20

$6

$ 4,62,000

Selling and administrative cost:

Variable selling and administrative cost per unit

Fixed selling and administrative cost per year

Assume that this company uses variable costing.

$ 9

$ 1,10,000

a. Determine its unit product cost (Omit the '$' sign in your response.)

b. Prepare its income statement for the year under variable costing.

(Input all amounts as positive values except net loss which should be

indicated with a minus sign. Omit the '$' sign in your response.)

Hii expert please given answer

Fitness plus company has budgeted solution general accounting question

Chapter 22 Solutions

College Accounting, Chapters 1-9 (New in Accounting from Heintz and Parry)

Ch. 22 - A secured bond is one that is backed by specific...Ch. 22 - Prob. 2TFCh. 22 - When bonds are issued at face value, the debit to...Ch. 22 - Prob. 4TFCh. 22 - Prob. 5TFCh. 22 - Bonds that give the holder the option of...Ch. 22 - Prob. 2MCCh. 22 - Prob. 3MCCh. 22 - Prob. 4MCCh. 22 - Bond sinking fund earnings are (a) subtracted from...

Ch. 22 - Prob. 1CECh. 22 - Prob. 2CECh. 22 - Prob. 3CECh. 22 - Prob. 4CECh. 22 - Prob. 5CECh. 22 - Prob. 1RQCh. 22 - Prob. 2RQCh. 22 - Prob. 3RQCh. 22 - Prob. 4RQCh. 22 - What accounts are affected when bonds are issued...Ch. 22 - Prob. 6RQCh. 22 - Prob. 7RQCh. 22 - Prob. 8RQCh. 22 - Prob. 9RQCh. 22 - When bonds are redeemed before maturity, how is...Ch. 22 - Prob. 11RQCh. 22 - How should sinking fund earnings be reported on...Ch. 22 - Prob. 13RQCh. 22 - Prob. 1SEACh. 22 - Prob. 2SEACh. 22 - Prob. 3SEACh. 22 - REDEMPTION OF BONDS ISSUED AT FACE VALUE Levesque...Ch. 22 - REDEMPTION OF BONDS ISSUED AT A PREMIUM Brighton...Ch. 22 - REDEMPTION OF BONDS ISSUED AT A DISCOUNT...Ch. 22 - BOND SINKING FUNDS M. J. Adams Corporation pays...Ch. 22 - BONDS ISSUED AT FACE VALUE Ito Co. issued the...Ch. 22 - Prob. 9SPACh. 22 - Prob. 10SPACh. 22 - Prob. 11SPACh. 22 - Prob. 12SPACh. 22 - BONDS ISSUED AT FACE VALUE WITH SINKING FUND...Ch. 22 - Prob. 1SEBCh. 22 - Prob. 2SEBCh. 22 - Prob. 3SEBCh. 22 - Prob. 4SEBCh. 22 - Prob. 5SEBCh. 22 - REDEMPTION OF BONDS ISSUED AT A DISCOUNT Medina...Ch. 22 - Prob. 7SEBCh. 22 - BONDS ISSUED AT FACE VALUE Ramona Arroyo Co....Ch. 22 - Prob. 9SPBCh. 22 - Prob. 10SPBCh. 22 - Prob. 11SPBCh. 22 - BONDS ISSUED AT A DISCOUNT, REDEEMED AT A GAIN...Ch. 22 - BONDS ISSUED AT FACE VALUE WITH SINKING FUND...Ch. 22 - MANAGING YOUR WRITING The business where you work...Ch. 22 - Prob. 1ECCh. 22 - MASTERY PROBLEM Jackson, Inc.s fiscal year ends...Ch. 22 - CHALLENGE PROBLEM This problem challenges you to...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Get correct answer general accountingarrow_forwardA company produces a single product. Last year, fixed manufacturing overhead was $30,000, variable production costs were $48,000, fixed selling and administration costs were $20,000, and variable selling administrative expenses were $9,600. There was no beginning inventory. During the year, 3,000 units were produced and 2,400 units were sold at a price of $40 per unit. Under variable costing, net operating income would be ........arrow_forwardNeed help with this accounting questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License