Financial and Managerial Accounting - Workingpapers

15th Edition

ISBN: 9781337912112

Author: WARREN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 21, Problem 3CMA

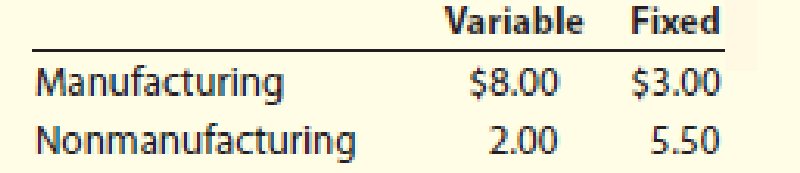

Mill Corporation had the following unit costs for the recent calendar year:

Inventory for Mill’s sole product totaled 6,000 units on January 1 and 5,200 units on December 31. When compared to variable costing income, Mill’s absorption costing income is:

- a. $2,400 lower.

- b. $2,400 higher.

- c. $6,800 lower.

- d. $6,800 higher.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Lui Coffee Company roasts and packs coffee beans. The process begins by placing coffee beans into the Roasting Department. From the Roasting Department, coffee beans are then transferred to the Packing Department. The following is a partial work in process account of the Roasting Department at March 31:

ACCOUNT ACCOUNT NO.

Date

Item

Debit

Credit

BalanceDebit

BalanceCredit

March 1

Bal., 25,000 units, 10% completed

21,250

31

Direct materials, 600,000 units

450,000

471,250

31

Direct labor

244,600

715,850

31

Factory overhead

415,820

1,131,670

31

Goods transferred, 605,000 units

?

31

Bal., ? units, 45% completed

?

Required:1. Prepare a cost of production report, and identify the missing amounts for Work in Process—Roasting Department.

Jane Yoakim, President of Estefan Co., recently read an article that claimed that at least 100 of the country's 500 largest companies were either adopting or considering adopting the last in, first out (LIFO) method for valuing inventories. The article stated that the firms were switching to LIFO to (1) neutralize the effect of inflation in their financial statements, (2) eliminate inventory profits, and (3) reduce income taxes. Ms. Yoakim wonders if the switch would benefit her company.

Estefan currently uses the first-in, first-out (FIFO) method of inventory valuation in its periodic inventory system. The company has a high inventory turnover rate, and inventories represent a significant proportion of the assets.

Ms. Yoakim has been told that the LIFO system is more costly to operate and will provide little benefit to companies with high turnover. She intends to use the inventory method that is best for the company in the long run rather than selecting a method just because it is the…

please help with how im supposed to solve this

Chapter 21 Solutions

Financial and Managerial Accounting - Workingpapers

Ch. 21 - What types of costs are customarily included in...Ch. 21 - Which type of manufacturing cost (direct...Ch. 21 - Which of the following costs would be included in...Ch. 21 - In the variable costing income statement, how are...Ch. 21 - The manager of a company are planning to...Ch. 21 - Since all costs of operating a business are...Ch. 21 - Discuss how financial data prepared on the basis...Ch. 21 - Why might management analyze product...Ch. 21 - Explain why rewarding sales personnel on the basis...Ch. 21 - Explain why service companies use different...

Ch. 21 - Variable costing Marley Company has the following...Ch. 21 - Variable costingproduction exceeds sales Fixed...Ch. 21 - Variable costingsales exceed production The...Ch. 21 - Analyzing income under absorption and variable...Ch. 21 - Contribution margin by segment The following...Ch. 21 - At the end of the first year of operations, 21,500...Ch. 21 - Gallatin County Motors Inc. assembles and sells...Ch. 21 - Fresno Industries Inc. manufactures and sells...Ch. 21 - On March 31, the end of the first month of...Ch. 21 - On April 30, the end of the first month of...Ch. 21 - On October 31, the end of the first month of...Ch. 21 - The following data were adapted from a recent...Ch. 21 - Estimated income statements, using absorption and...Ch. 21 - The following data were adapted from a recent...Ch. 21 - How is the quantity factor for an increase or a...Ch. 21 - Explain why service companies use different...Ch. 21 - Galaxy Sports Inc. manufactures and sells two...Ch. 21 - Prob. 13ECh. 21 - Sales territory and salesperson profitability...Ch. 21 - Prob. 15ECh. 21 - Prob. 16ECh. 21 - Variable costing income statement for a service...Ch. 21 - Variable costing income statement for a service...Ch. 21 - Absorption and variable costing income statements...Ch. 21 - Prob. 2PACh. 21 - During the first month of operations ended May 31,...Ch. 21 - Salespersons report and analysis Walthman...Ch. 21 - Segment variable costing income statement and...Ch. 21 - Absorption and variable costing income statements...Ch. 21 - Income statements under absorption costing and...Ch. 21 - Absorption and variable costing income statements...Ch. 21 - Salespersons report and analysis Pachec Inc....Ch. 21 - Prob. 5PBCh. 21 - Comcast Corporation (CMCSA) is a global media and...Ch. 21 - Prob. 2MADCh. 21 - Prob. 3MADCh. 21 - Segment disclosure by Apple Inc. (AAPL) provides...Ch. 21 - Prob. 1TIFCh. 21 - Inventory effects under absorption costing BendOR,...Ch. 21 - Communication Bon Jager Inc. manufactures and...Ch. 21 - Data for the last fiscal year for Merlene Company...Ch. 21 - Chassen Company, a cracker and cookie...Ch. 21 - Mill Corporation had the following unit costs for...Ch. 21 - Bethany Company has just completed the first month...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- INVOLVE was incorporated as a not-for-profit organization on January 1, 2023. During the fiscal year ended December 31, 2023, the following transactions occurred. 1. A business donated rent-free office space to the organization that would normally rent for $35,600 a year. 2. A fund drive raised $188,000 in cash and $106,000 in pledges that will be paid next year. A state government grant of $156,000 was received for program operating costs related to public health education. 3. Salaries and fringe benefits paid during the year amounted to $209,160. At year-end, an additional $16,600 of salaries and fringe benefits were accrued. 4. A donor pledged $106,000 for construction of a new building, payable over five fiscal years, commencing in 2025. The discounted value of the pledge is expected to be $94,860. 5. Office equipment was purchased for $12,600. The useful life of the equipment is estimated to be five years. Office furniture with a fair value of $10,200 was donated by a local office…arrow_forwardFairfield Company's payroll costs for the most recent month are summarized here: Item Hourly labor unges Description 920 hours $27 per hour 190 hours for Job 101 340 hours for Job 102 Factory supervision Production engineer Factory Janitorial work Selling, general, and administrative salaries Total payroll costs Required: 390 hours for Job 103 Total Cost $ 5,130 9,180 10,530 $ 24,840 4,350 7,100 1,200 8,800 $ 46,298 1. & 2. Prepare the journal entries for payroll and to apply manufacturing overhead to production. The company applies manufacturing overhead to products at a predetermined rate of $54 per direct labor hour Note: If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. View transaction list Journal entry worksheet A B Record Fairfield Company's payroll costs to be paid at a later date. Note Enter debits before credits. S.No Date 1 Account Title Debit Creditarrow_forwardNo wrong answerarrow_forward

- L.L. Bean operates two factories that produce its popular Bean boots (also known as "duck boots") in its home state of Maine. Since L.L. Bean prides itself on manufacturing its boots in Maine and not outsourcing, backorders for its boots can be high. In 2014, L.L. Bean sold about 450,000 pairs of the boots. At one point during 2014, it had a backorder level of about 100,000 pairs of boots. L.L. Bean can manufacture about 2,200 pairs of its duck boots each day with its factories running 24/7. In 2015, L.L. Bean expects to sell more than 500,000 pairs of its duck boots. As of late November 2015, the backorder quantity for Bean Boots was estimated to be about 50,000 pairs. Question: Now assume that 5% of the L.L. Bean boots are returned by customers for various reasons. L. Bean has a 100% refund policy for returns, no matter what the reason. What would the journal entry be to accrue L.L. Bean's sales returns for this one pair of boots?arrow_forwardThe following data were taken from the records of Splish Brothers Company for the fiscal year ended June 30, 2025. Raw Materials Inventory 7/1/24 $58,100 Accounts Receivable $28,000 Raw Materials Inventory 6/30/25 46,600 Factory Insurance 4,800 Finished Goods Inventory 7/1/24 Finished Goods Inventory 6/30/25 99,700 Factory Machinery Depreciation 17,100 21,900 Factory Utilities 29,400 Work in Process Inventory 7/1/24 21,200 Office Utilities Expense 9,350 Work in Process Inventory 6/30/25 29,400 Sales Revenue 560,500 Direct Labor 147,550 Sales Discounts 4,700 Indirect Labor 25,360 Factory Manager's Salary 63,400 Factory Property Taxes 9,910 Factory Repairs 2,500 Raw Materials Purchases 97,300 Cash 39,200 SPLISH BROTHERS COMPANY Income Statement (Partial) $arrow_forwardNo AIarrow_forward

- L.L. Bean operates two factories that produce its popular Bean boots (also known as "duck boots") in its home state of Maine. Since L.L. Bean prides itself on manufacturing its boots in Maine and not outsourcing, backorders for its boots can be high. In 2014, L.L. Bean sold about 450,000 pairs of the boots. At one point during 2014, it had a backorder level of about 100,000 pairs of boots. L.L. Bean can manufacture about 2,200 pairs of its duck boots each day with its factories running 24/7.In 2015, L.L. Bean expects to sell more than 500,000 pairs of its duck boots. As of late November 2015, the backorder quantity for Bean Boots was estimated to be about 50,000 pairs. Question: Assume that a pair of 8" Bean Boots are ordered on December 3, 2015. The order price is $109. The sales tax rate in the state in which the boots are order is 7%. L.L. Bean ships the boots on January 29, 2016. Assume same-day shipping for the sake of simplicity. On what day would L.L. Bean recognize the…arrow_forwardFinancial accounting questionarrow_forward2 Questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

How to Estimate Project Costs: A Method for Cost Estimation; Author: Online PM Courses - Mike Clayton;https://www.youtube.com/watch?v=YQ2Wi3Jh3X0;License: Standard Youtube License