Introduction:

Break-even point in terms of sales units: The break-even point in sales units is the company’s fixed costs divided by the contribution margin of the company. Here, the contribution margin of the company is the selling price less the variable cost.

Break-even point in terms of sales dollars: The break-even point in sales dollars is the company’s fixed costs divided by the contribution margin ratio of the company. Here, the contribution margin of the company is the selling price less the variable cost. And the contribution margin ratio of the company is the contribution margin divided by the selling price.

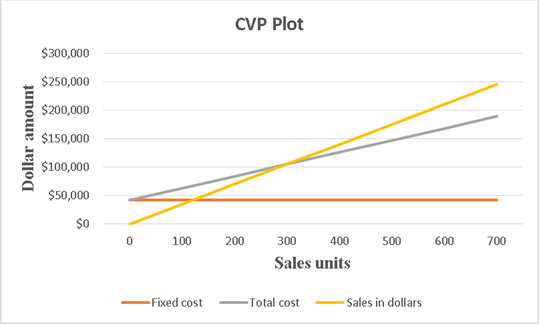

CVP Chart: CVP chart is the short form of a cost volume profit chart. It shows the relationship between the units produced in a particular period, total cost involved and the sales revenues in that period.

Contribution margin income statement: It is a statement where variable costs are deducted from the sales dollars to get the contribution margin and then all fixed costs are deducted from the contribution margin to get the net

1.

To calculate:

(a) Estimated Break-even point in terms of sales units

(b) Estimated Break-even point in terms of sales dollars

Answer to Problem 3BPSB

Solution:

(a) Estimated Break-even point in terms of sales units is 300.

(b) Estimated Break-even point in terms of sales dollars is $105,000

Explanation of Solution

Explanations:

Given:

Fixed costs= $42,000

Selling price= $350 per unit

Calculation:

Here, the given variable cost is the forecasted one, so the calculated value is for the estimated break-even point in terms of sales unit.

Here, the given variable cost is the forecasted one, so the calculated value is for the estimated break-even point in terms of sales dollars.

2.

To Prepare:

A CVP chart

Answer to Problem 3BPSB

Solution:

Explanation of Solution

Explanations:

Given:

Maximum number of sales = 700

Maximum sales revenue = $245,000

Fixed costs= $42,000

Forecasted variable cost= $210 per unit

A CVP graph has graph lines for fixed cost, total cost and sales revenue. Here, fixed cost and maximum sales are known. Now total cost at maximum number of sales has to be calculated.

Calculation:

The formula for total cost is given below.

Based on these information, a table showing fixed cost, total cost and sales in dollars at different label of sales can be constructed as shown below.

| Sales units | Fixed cost | Total cost | Sales in dollars |

| 0 | $42,000 | $42,000 | $ - |

| 100 | $42,000 | $63,000 | $ 35,000 |

| 200 | $42,000 | $84,000 | $ 70,000 |

| 300 | $42,000 | $105,000 | $ 105,000 |

| 400 | $42,000 | $126,000 | $ 140,000 |

| 500 | $42,000 | $147,000 | $ 175,000 |

| 600 | $42,000 | $168,000 | $ 210,000 |

| 700 | $42,000 | $189,000 | $ 245,000 |

In the above table, total costs at different units of sales are calculated using the above given formula and sales in dollars are the sales units times the selling price.

By selecting this table in excel sheet, the required CVP chart is prepared as shown below.

3.

To Show:

Contribution margin income statement at break-even point

Answer to Problem 3BPSB

Solution:

| Contribution margin income statement | |

| Sales | $105,000 |

| Less Variable costs | $63,000 |

| Contribution margin | $42,000 |

| Less Fixed cost | $42,000 |

| Net profit | $0 |

Explanation of Solution

Explanations:

Given:

Fixed costs= $42,000

Selling price= $350 per unit

Forecasted variable cost= $210 per unit

Break-even point sales units= 300

Calculation:

Based on these calculations, a contribution margin income statement is prepared as shown below.

| Contribution margin income statement | |

| Sales | $105,000 |

| Less Variable costs | $63,000 |

| Contribution margin | $42,000 |

| Less Fixed cost | $42,000 |

| Net profit | $0 |

At break-even point, net profit must be zero as shown by the above contribution margin income statement.

Want to see more full solutions like this?

Chapter 21 Solutions

Fundamental Accounting Principles

- Please explain the solution to this general accounting problem using the correct accounting principles.arrow_forwardZep Co. manufactures home appliances. During the most productive month of the year, 3,800 refrigerators were manufactured at a total cost of $342,000. In its slowest month, the company made 1,200 refrigerators at a cost of $174,000. Using the high-low method of cost estimation, determine the total fixed costs.arrow_forwardFinancial Accountingarrow_forward

- Please show me the correct way to solve this financial accounting problem with accurate methods.arrow_forwardWhat is the operating cash flow?arrow_forwardAlpine Manufacturing Company's high and low level of activity last year was 62,000 units of product produced in July and 24,000 units produced in December. Machine maintenance costs were $186,500 in July and $89,300 in December. Using the high-low method, determine an estimate of total maintenance cost for a month in which production is expected to be 40,000 units.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education