Introduction:

Break-even point in terms of sales units: The break-even point in sales units is the company’s fixed costs divided by the contribution margin of the company. Here, the contribution margin of the company is the selling price less the variable cost.

Break-even point in terms of sales dollars: The break-even point in sales dollars is the company’s fixed costs divided by the contribution margin ratio of the company. Here, the contribution margin of the company is the selling price less the variable cost. And the contribution margin ratio of the company is the contribution margin divided by the selling price.

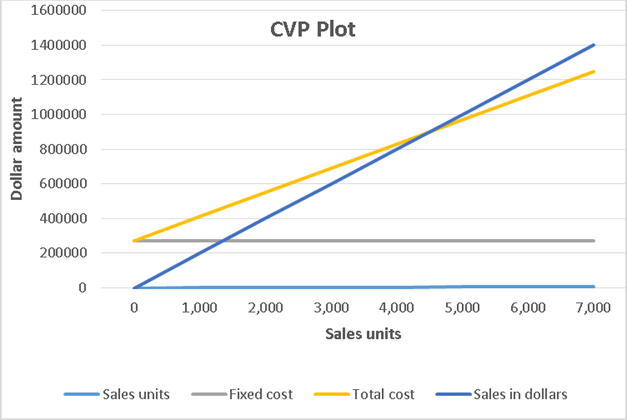

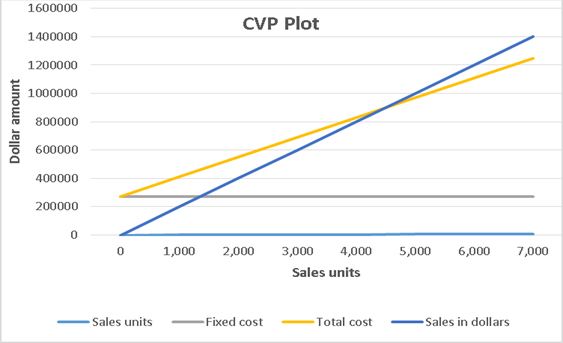

CVP Chart: CVP chart is the short form of a cost volume profit chart. It shows the relationship between the units produced in a particular period, total cost involved and the sales revenues in that period.

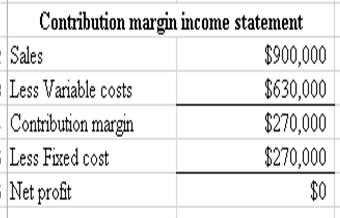

Contribution margin income statement: It is a statement where variable costs are deducted from the sales dollars to get the contribution margin and then all fixed costs are deducted from the contribution margin to get the net

1.

To calculate:

(a) Estimated Break-even point in terms of sales units

(b) Estimated Break-even point in terms of sales dollars

Answer to Problem 3APSA

Solution:

(a) Estimated Break-even point in terms of sales units is 4,500.

(b) Estimated Break-even point in terms of sales dollars is $900,000

Explanation of Solution

Explanations:

Given:

Fixed costs= $270,000

Selling price= $200 per 100 yards

Calculation:

Here, the given variable cost is the forecasted one, so the calculated value is for the estimated break-even point in terms of sales unit.

Here, the given variable cost is the forecasted one, so the calculated value is for the estimated break-even point in terms of sales dollars.

2.

To Prepare:

A CVP chart

Answer to Problem 3APSA

Solution:

Explanation of Solution

Explanations:

Given:

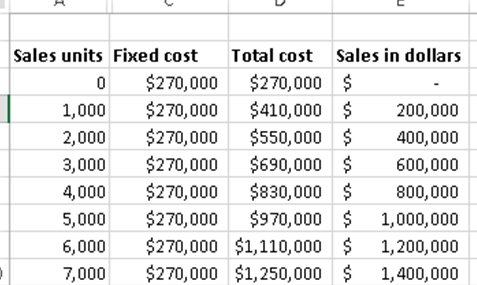

Maximum number of sales = 7,000

Maximum sales revenue = $1,400,000

Fixed costs= $270,000

Forecasted variable cost= $140 per 100 yards

A CVP graph has graph lines for fixed cost, total cost and sales revenue. Here, fixed cost and maximum sales are known. Now total cost at maximum number of sales has to be calculated.

Calculation:

The formula for total cost is given below.

Based on these information, a table showing fixed cost, total cost and sales revenue at different label of sales can be constructed as shown below.

In the above table, Total costs at different units of sales are calculated using the above given formula and sales in dollars are the sales units times the selling price.

By selecting this table in excel sheet, the required CVP chart is prepared as shown below.

3.

To Show:

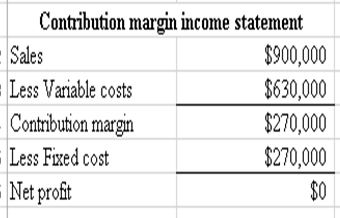

Contribution margin income statement at break-even point

Answer to Problem 3APSA

Solution:

Explanation of Solution

Explanations:

Given:

Fixed costs= $270,000

Selling price= $200 per 100 yards

Forecasted variable cost= $140 per 100 yards

Break-even point sales units= 4,500

Calculation:

Based on these calculations, a contribution margin income statement is prepared as shown below.

At break-even point, net profit must be zero as shown by the above contribution margin income statement.

Want to see more full solutions like this?

Chapter 21 Solutions

Fundamental Accounting Principles

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forwardI am trying to find the accurate solution to this financial accounting problem with appropriate explanations.arrow_forward

- I need help finding the correct solution to this financial accounting problem with valid methods.arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forwardI need help with this financial accounting problem using proper accounting guidelines.arrow_forward

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardWhen incorporating his sole proprietorship, Joe transfers all of its assets and liabilities. Included in the $30,000 of liabilities assumed by the corporation is $500 that relates to a personal expenditure. Under these circumstances, the entire $30,000 will be treated as boot. / Provide explanation please a. True b. Falsearrow_forward

- In determining whether § 357(c) applies, assess whether the liabilities involved exceed the bases of all assets a shareholder transfers to the corporation./ Provide explanation please. a. True b. Falsearrow_forwardI will unhelpful if wrong.arrow_forwardplease don't solve using wrong values i will mark as unhelpful.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education