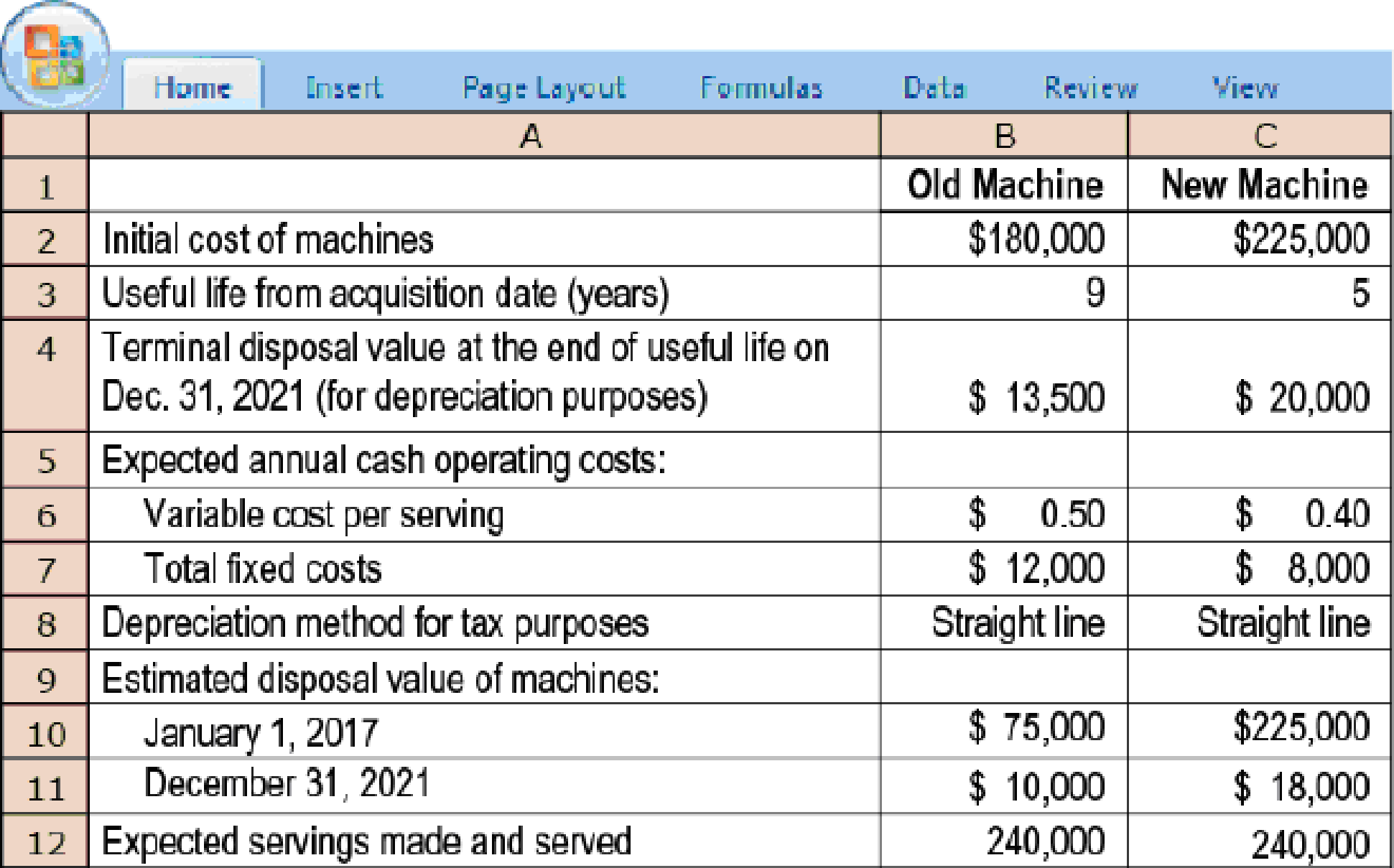

Replacement of a machine, income taxes, sensitivity. (CMA, adapted) The Kuhl Brothers own a frozen custard ice cream shop. The brothers currently are using a machine that has been in use for the last 4 years. On January 1, 2017, the Kuhl Brothers are considering buying a new machine to make their frozen custard. The Kuhl Brothers have two options: (1) continue using the old freezing machine or (2) sell the old machine and purchase a new freezing machine. The seller of the new machine is not interested in a trade-in of Kuhl’s old machine. The following information has been obtained:

The Kuhl Brothers are subject to a 25% income tax rate. Any gain or loss on the sale of machines is treated as an ordinary tax item and will affect the taxes paid by the Kuhl Brothers in the year in which it occurs. The Kuhl Brothers have an after-tax required

- 1. The Kuhl Brothers ask you whether they should buy the new machine. To help in your analysis, calculate the following:

Required

- a. One-time after-tax cash effect of disposing of the old machine on January 1, 2017

- b. Annual recurring after-tax cash operating savings from using the new machine (variable and fixed)

- c. Cash tax savings due to differences in annual

depreciation of the old machine and the new machine - d. Difference in after-tax cash flow from terminal disposal of new machine and old machine

- 2. Use your calculations in requirement 1 and the

net present value method to determine whether the Kuhl Brothers should continue to use the old machine or acquire the new machine. - 3. How much more or less would the recurring after-tax cash operating savings of the new machine need to be for the Kuhl Brothers to earn exactly the 8% after-tax required rate of return? Assume that all other data about the investment do not change.

Trending nowThis is a popular solution!

Chapter 21 Solutions

HORNGRENS COST ACCOUNTING W/ACCESS

- PLEASE HELP ME WITH THISarrow_forwardThis is an individual assignment. You are required to create a formal topic-to-sentence outline and a full five-paragraph essay [containing an introductory paragraph, 3 body paragraphs and a concluding paragraph], followed by an appropriate Works Cited list, and an annotated bibliography of one source used in the essay. Your essay must be based on ONE of the following prompts. EITHER A. What are the qualities of a socially responsible individual? OR B. Discuss three main groupings of life skills required by Twenty-first Century employers. Additionally, you will state which one of the expository methods [Analysis by Division OR Classification] you chose to guide development of your response to the question selected, and then provide a two or three sentence justification of that chosen method. Your essay SHOULD NOT BE LESS THAN 500 words and SHOULD NOT EXCEED 700 words. You are required to use three or four scholarly / reliable sources of evidence to support the claims made in your…arrow_forwardWhat is the gross profit rate on these general accounting question?arrow_forward

- Luctor Actual overhead costs Actual qty of the allocation base used Estimated overhead costs Estimated qty of the allocation base Predetermined OH allocation rate Data table Activity Allocation Base Supplies Number of square feet Travel Number of customer sites Allocation Rate $0.07 per square foot $23.00 per site Print Done Clear all Check answer 12:58 PMarrow_forwardWere the overheads over applied or under applied and by how much for this general accounting question?arrow_forwardThe Trainer Tire Company provided the following partial trial balance for the current year ended December 31. The company is subject to a 45% income tax rate.arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT