Horngren's Cost Accounting, Student Value Edition (16th Edition)

16th Edition

ISBN: 9780134476032

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

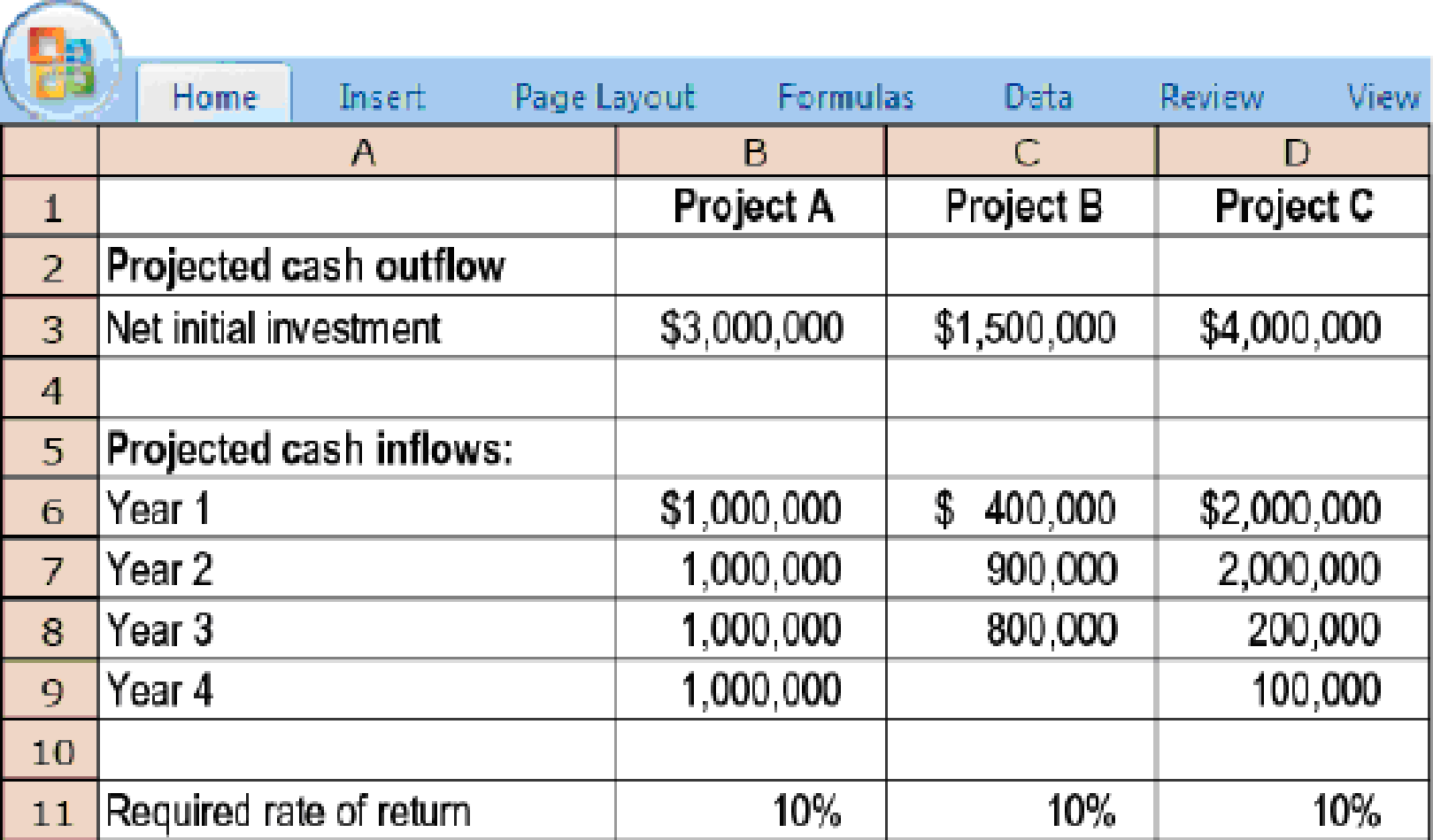

Chapter 21, Problem 21.27E

Payback and

- 1. Because the company’s cash is limited, Andrews thinks the payback method should be used to choose between the capital budgeting projects.

Required

- a. What are the benefits and limitations of using the payback method to choose between projects?

- b. Calculate the payback period for each of the three projects. Ignore income taxes. Using the payback method, which projects should Andrews choose?

- 2. Bart thinks that projects should be selected based on their NPVs. Assume all

cash flows occur at the end of the year except for initial investment amounts. Calculate the NPV for each project. Ignore income taxes. - 3. Which projects, if any, would you recommend funding? Briefly explain why.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please give me true answer this financial accounting question

What is the book value per share and earning per share on these financial accounting question?

I want to correct answer general accounting

Chapter 21 Solutions

Horngren's Cost Accounting, Student Value Edition (16th Edition)

Ch. 21 - Capital budgeting has the same focus as accrual...Ch. 21 - List and briefly describe each of the five stages...Ch. 21 - Prob. 21.3QCh. 21 - Only quantitative outcomes are relevant in capital...Ch. 21 - How can sensitivity analysis be incorporated in...Ch. 21 - Prob. 21.6QCh. 21 - Describe the accrual accounting rate-of-return...Ch. 21 - Prob. 21.8QCh. 21 - Lets be more practical. DCF is not the gospel....Ch. 21 - All overhead costs are relevant in NPV analysis....

Ch. 21 - Prob. 21.11QCh. 21 - Distinguish different categories of cash flows to...Ch. 21 - Prob. 21.13QCh. 21 - How can capital budgeting tools assist in...Ch. 21 - Distinguish the nominal rate of return from the...Ch. 21 - A company should accept for investment all...Ch. 21 - Prob. 21.17MCQCh. 21 - Which of the following statements is true if the...Ch. 21 - Prob. 21.19MCQCh. 21 - Nicks Enterprises has purchased a new machine tool...Ch. 21 - Prob. 21.21ECh. 21 - Capital budgeting methods, no income taxes. Yummy...Ch. 21 - Capital budgeting methods, no income taxes. City...Ch. 21 - Prob. 21.24ECh. 21 - Capital budgeting with uneven cash flows, no...Ch. 21 - Comparison of projects, no income taxes. (CMA,...Ch. 21 - Payback and NPV methods, no income taxes. (CMA,...Ch. 21 - DCF, accrual accounting rate of return, working...Ch. 21 - Prob. 21.29ECh. 21 - Prob. 21.30ECh. 21 - Project choice, taxes. Klein Dermatology is...Ch. 21 - Prob. 21.32ECh. 21 - Selling a plant, income taxes. (CMA, adapted) The...Ch. 21 - Prob. 21.36PCh. 21 - NPV and AARR, goal-congruence issues. Liam...Ch. 21 - Payback methods, even and uneven cash flows. Sage...Ch. 21 - Replacement of a machine, income taxes,...Ch. 21 - Recognizing cash flows for capital investment...Ch. 21 - NPV, inflation and taxes. Fancy Foods is...Ch. 21 - NPV of information system, income taxes. Saina...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need help with this accounting questionsarrow_forwardDon't use ai given answer accounting questionsarrow_forwardNovak Company has the following stockholders' equity accounts at December 31, 2025. Common Stock ($100 par value, authorized 7,600 shares) $459,100 Retained Earnings 266,700 a. Prepare entries in journal form to record the following transactions, which took place during 2026 1. 290 shares of outstanding stock were purchased at $97 per share. (These are to be accounted for using the cost method.) 2. A $22 per share cash dividend was declared. 3. The dividend declared in (2) above was paid. 4. The treasury shares purchased in (1) above were resold at $101 per share. 5. 500 shares of outstanding stock were purchased at $103 per share. 6. 380 of the shares purchased in (5) above were resold at $96 per share. b. Prepare the stockholders' equity section of Novak Company's balance sheet after giving effect to these transactions, assuming that the net income for 2026 was $86,300. State law requires restriction of retained earnings for the amount of treasury stock. The answer is not 705,118arrow_forward

- How would Adele’s financial statements have been impacted on the date of the sale of the concert tickets on December 17, 2015? What accounts would be affected? When will adele recognize revenue from the two concerts at the Bridgestone Arena in Nashville, Tennessee? How would Adele’s financial statements be impacted on the dates of these two concerts?arrow_forwardHow are Adele's financial statements impacted when tickets to her North American tour sell out within a few minutes? Adele released her third album, 25, in late 2015, quickly shattering several records. The album 25 was the first album to sell more than three million copies in a week and also racked up the most records sold in a week with 3.38 million records sold that first week. Her single Hello from 25 was the first track to be downloaded more than one million times in one week. 25 was also the best-selling album of 2015. Soon after 25 was released, Adele's North American tour dates were announced. On December 17, 2015, tickets for the dates on this tour went on sale at 11 am EST and sold out within minutes for all of the 56 concerts dates on the tour. A total of 750,000 tickets were available; reportedly over 10 million fans tried to buy tickets through Ticketmaster. (Tickets were also available through Adele's website.) Fans able to obtain tickets paid at the time of purchase. On…arrow_forwardCAL Ltd. sold $6,700,000 of 10% bonds, which were dated March 1, 2023, on June 1, 2023. The bonds paid interest on September 1 and March 1 of each year. The bonds' maturity date was March 1, 2033, and the bonds were issued to yield 12%. CAL's fiscal year-end was February 28, and the company followed IFRS. On June 1, 2024, CAL bought back $2,700,000 worth of bonds for $2,600,000 plus accrued interest. (a) Using 1. a financial calculator, or 2. Excel function PV, calculate the issue price of the bonds and prepare the entry for the issuance of the bonds. Hint: Use the account Interest Expense in your entry). there are 3 entries to be made herearrow_forward

- Don't use ai to answer I will report you answerarrow_forward1. Stampede Company has two service departments — purchasing and maintenance, and two production departments — fabrication and assembly. The distribution of each service department's efforts to the other departments is shown below: FROM TO Purchasing Maintenance Fabrication Assembly Purchasing 0% 45% 45% 10% Maintenance 55% 0% 30% 15% The direct operating costs of the departments (including both variable and fixed costs) were as follows: Purchasing $ 138,000 Maintenance 60,000 Fabrication 114,000 Assembly 90,000 The total cost accumulated in the fabrication department using the direct method is: The answer is not 194100 2. Bifurcator Company produces three products — X, Y, and Z — from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Last year all three products were…arrow_forwardGeneral accounting question please solvearrow_forward

- Due Jan 26 11:59pm Module 2 Discussion Provide and discuss an example of a situation where a company would use a job cost sheet. As part of your analysis, be sure to explain the nature and importance of a job cost sheet. or Discuss the advantages and disadvantages of Job Order Costing. Be sure to include specific examples of the advantages/disadvantages that you discuss. 21 Replies, 18arrow_forwardNonearrow_forwardAbcarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License