Concept explainers

Statement of

Direct method: The direct method uses the cash basis of accounting for the preparation of the statement of cash flows. It takes into account those revenues and expenses for which cash is either received or paid.

Cash flows from operating activities: Cash flows from operating activity represent the net cash flows from the general operation of the business by comparing the cash receipt and cash payments.

Cash Receipts: It encompasses all the cash receipts from sale of goods and on account receivable.

Cash Payments: It encompasses all the cash payments that are made to suppliers of goods and all expenses that are paid.

The below table shows the way of calculation of cash flows from operating activities:

| Cash flows from operating activities (Direct method) |

| Add: Cash receipts. |

| Cash receipt from customer |

| Less: Cash payments: |

| To supplier |

| For operating expenses |

| Income tax expenses |

| Net cash provided from or used by operating activities |

Table (1)

Cash flows from investing activities: Cash provided by or used in investing activities is a section of statement of cash flows. It includes the purchase or sale of equipment or land, or marketable securities, which is used for business operations.

The below table shows the way of calculation of cash flows from investing activities:

| Cash flows from investing activities |

| Add: Proceeds from sale of fixed assets |

| Sale of marketable securities / investments |

| Deduct: Purchase of fixed assets/long-lived assets |

| Purchase of marketable securities |

| Net cash provided from or used by investing activities |

Table (2)

Cash flows from financing activities: Cash provided by or used in financing activities is a section of statement of cash flows. It includes raising cash from long-term debt or payment of long-term debt, which is used for business operations.

The below table shows the way of calculation of cash flows from financing activities:

| Cash flows from financing activities |

| Add: Issuance of common stock |

| Proceeds from borrowings |

| Proceeds from issuance of debt |

| Issuance of bonds payable |

| Deduct: Payment of dividend |

| Repayment of debt |

| Interest paid |

| Redemption of debt |

| Repurchase of stock |

| Net cash provided from or used by financing activities |

Table (3)

T-Account: For all the business transactions,

To Prepare: T-account for

Explanation of Solution

Cash Account: (all amounts are in 000s)

| Cash Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Operatingactivities: | December 31, 2016 | Operatingactivities: | |||

| From customers | 2,495 | To suppliers of goods | 675 | |||

| For expense | 425 | |||||

| Investing activities: | Investing activities: | |||||

| Sale of land | 165 | Purchase of equipment | 900 | |||

| Sale of equipment | 15 | |||||

| Financing activities: | Financing activities: | |||||

| Payment of dividends | 450 | |||||

| Balance | 225 | |||||

Table (4)

| Accounts Receivable Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Increase in accounts receivable | 150 | ||||

| Balance | 150 | |||||

Table (5)

Inventory:

| Inventory Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Increase in inventory | 375 | ||||

| Balance | 375 | |||||

Table (6)

Land:

| Land Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Increase in land | 75 | ||||

| Lease liability | 150 | December 31, 2016 | Balance | 75 | ||

Table (7)

| Accumulated Depreciation – Building Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Accumulated depreciation | 30 | ||||

| December 31, 2016 | Balance | 30 | ||||

Table (8)

Equipment:

| Equipment Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Increase in equipment | 600 | December 31, 2016 | Sale of equipment | 300 | |

| December 31, 2016 | Balance | 900 | ||||

Table (9)

Accumulated Depreciation - Equipment:

| Accumulated Depreciation - Equipment Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Accumulated depreciation | 45 | ||||

| December 31, 2016 | Increase in equipment | 270 | December 31, 2016 | Balance | 315 | |

Table (10)

Patent:

| Patent Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Decrease in patent | 300 | ||||

| December 31, 2016 | Balance | 300 | ||||

Accounts Payable:

| Accounts Payable Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Increase in accounts payable | 300 | ||||

| Balance | 300 | |||||

Table (11)

Accrued Expense Payable:

| Accrued Expense Payable Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Increase in accrued expense payable | 75 | ||||

| Balance | 75 | |||||

Table (12)

Lease Liability – Land:

| Lease Liability – LandAccount | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Increase in lease liability | 150 | ||||

| Balance | 150 | |||||

Table (13)

Common Stock:

| Common Stock Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Increase in common stock | 150 | ||||

| Balance | 150 | |||||

Table (14)

Paid-in Capital:

| Paid-in Capital Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Increase in paid-in capital | 75 | ||||

| Balance | 75 | |||||

Table (15)

| Retained Earnings Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | December 31, 2016 | Balance of retained earnings | 300 | |||

| Payment of cash dividend | 450 | Balance | 975 | |||

| Retained earning | 225 | |||||

Table (16)

Sales:

| Sales Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Sales revenue | 2,645 | ||||

| Balance | 2,645 | |||||

Table (17)

Gain on Sale of Land:

| Gain on Sale of Land Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Gain on sale of land | 90 | ||||

| Balance | 90 | |||||

Table (18)

Cost of Goods Sold:

| Cost of Goods Sold Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Cost of Goods Sold | 600 | ||||

| Balance | 600 | |||||

Table (19)

Depreciation Expense - Building:

| Depreciation Expense – Building Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Depreciation Expense - Building | 30 | ||||

| Balance | 30 | |||||

Table (20)

Depreciation Expense - Equipment:

| Depreciation Expense – Equipment Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Depreciation Expense – Equipment | 315 | ||||

| Balance | 315 | |||||

Table (21)

Loss on Sale of Equipment:

| Loss on Sale of Equipment Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Loss on sale of building | 15 | ||||

| Balance | 15 | |||||

Table (22)

Amortization of Patent:

| Amortization of Patent Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Amortization of patent | 300 | ||||

| Balance | 300 | |||||

Table (23)

Operating Expenses:

| Operating Expenses Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Operating expense | 500 | ||||

| Balance | 500 | |||||

Table (24)

Net income (income summary):

| Net Income (income summary)Account | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) |

|

| December 31, 2016 | Net income | 975 | ||||

| Balance | 975 | |||||

Table (25)

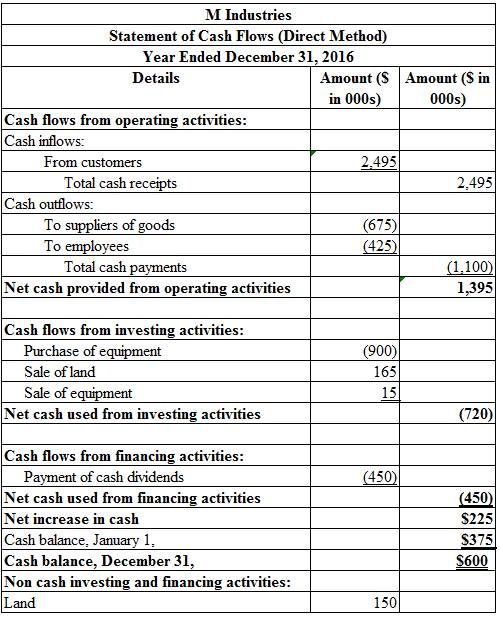

To Prepare: The statement of cash flows using direct method for M Industries for the year ended December 31, 2016.

Answer to Problem 21.20P

Table (26)

Explanation of Solution

Working notes:

Calculate the amount of cash received from customers:

Calculate the amount of cash paid to suppliers:

Calculate the amount of cash paid for operating expenses:

Calculate the amount of purchase of equipment:

Calculate the amount of sale of land:

Hence, the opening cash balance is $375 million and closing cash balance is $600 million.

Want to see more full solutions like this?

Chapter 21 Solutions

LooseLeaf Intermediate Accounting w/ Annual Report; Connect Access Card

- Harmony Books is a direct marketer of educational books. The following information about its revenue and cost structure is available: ⚫ Selling Price: $25.00 per book Variable Costs: 。 Production: $8.00 per book 。 Selling and Administration: $3.50 per book ⚫ Fixed Costs: $94,500 What is the break-even point in books for Harmony Books?arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forwardA company purchases a machine for $150,000. It is estimated that the machine has a useful life of 10 years and will then be sold for $12,000. Using the straight-line method, calculate the annual depreciation expense to be charged for each year of useful life.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education