Concept explainers

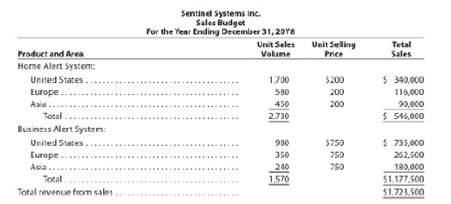

Sentinel systems Inc. prepared the following sales budget for 20Y8:

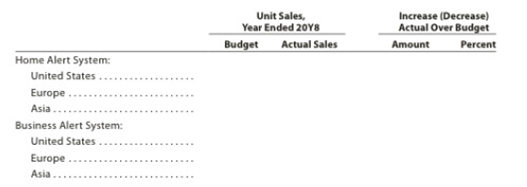

At the end of December 20Y8, the following unit sales data were reported for the year:

| Unit Sales | ||

| Home Alert System |

Business Alert System |

|

| United States | 1,734 | 1,078 |

| Europe | 609 | 329 |

| Asia | 432 | 252 |

For the year ending December 31, 20Y9, unit sales are expected to follow the patterns established during the year ending October 31, 20Y8. The unit selling price for the Home: Alert System is expected to increase to $250, and the unit selling price for the Business Alert System is expected to be increased $820, effective January 1, 20Y9.

Instructions

- 1. Compute the increase or decrease.ase of actual unit sales for the year ended October 31, 20Y8, over budget. Place your answers in a columnar table with the following format:

- 2. Assuming that the increase or decrease in actual sales to budget indicated in part (1) is to continue in 20Y9, compute the unit sales volume to be used for preparing the sales budget for the year ending December 31, 20Y9. Place your answers in a columnar table similar to that in part (1) but with the following column heads. Round budgeted units to the nearest unit.

| 20Y8 | Percentage | 20Y9 |

| Actual | Increase | Budgeted |

| Units | (Decrease) | Units (rounded) |

- 3. Prepare a sales budget for the year ending December 31, 201Y9

Trending nowThis is a popular solution!

Chapter 21 Solutions

Bundle: Financial & Managerial Accounting, 14th + Working Papers for Warren/Reeve/Duchac's Corporate Financial Accounting, 14th + Working Papers, ... & Managerial Accounting, 14th + CengageNOWv2,

- financial accounting isarrow_forwardAnnual loan payment?arrow_forwardQ.no. 45-FINANCIAL ACCOUNTING: On March 1, 2016, E Corp. issued $2,700,000 of 15% nonconvertible bonds at 105, due on February 28, 2026. Each $2,500 bond was issued with 47 detachable stock warrants, each of which entitled the holder to purchase, for $65, one share of Evan's $40 par common stock. On March 1, 2016, the market price of each warrant was $8. By what amount should the bond issue proceeds increase shareholders' equity?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning