Concept explainers

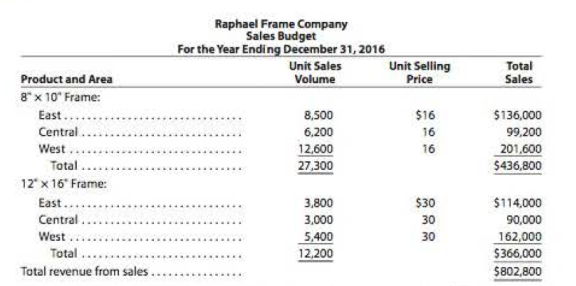

For 2016, Raphael Frame Company prepared the .sales budget that follows.

At the end of December 2016, the following unit sales data were reported for the year.

| Unit Sales | ||

| 8" × 10" Frame | 12" × 16" Frame | |

| East | 8,755 | 3,686 |

| Central | 6,510 | 3,090 |

| West | 12,348 | 5,616 |

For the year ending December 31, 2017, unit sales are expected to follow die patterns established during the year ending December 31, 2016. The unit selling price for the 8" × 10" frame is expected to increase to $17 and die unit selling price for die 12" × 16" frame is expected to increase to $32, effective January 1, 2017.

Instructions

1. Compute the increase or decrease of actual unit sales for the year ended December 31, 2016, over budget. Place your answers in a columnar table with the following format:

| Unit Sales, Year Ended 2016 | Increase (Decrease) Actual Over Budget | |

| Budget Actual Sales | Amount Percent | |

| 8" × 10" Frame: | ||

| East | ||

| Central | ||

| West | ||

| 12"× 16" Frame: | ||

| East | ||

| Central | ||

| West |

2. Assuming that the increase or decrease in actual sales to budget indicated in part (1) is to continue in 2017, compute the unit sales volume to be used for preparing the sales budget for the year ending December 31, 2017. Place your answers in a columnar table similar to that in part (1) but with the following column heads. Round budgeted units to the nearest unit.

| 2016 Actual Units | Percentage Increase (Decrease) | 2017 Budgeted Units (rounded) |

3. Prepare a sales budget for the year ending December 31, 2017.

Trending nowThis is a popular solution!

Chapter 21 Solutions

Bundle: Financial & Managerial Accounting, Loose-leaf Version, 13th + CengageNOWv2, 1 term (6 months) Printed Access Card Corporate Financial ... Access Card for Managerial Accounting, 13th

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,