The current price of Estelle Corporation stock is $25. In each of the next two years, this stock price will either go up by 20% or go down by 20%. The stock pays no dividends. The one-year risk-free interest rate is 6% and will remain constant. Using the Binomial Model, calculate the price of a one-year call option on Estelle stock with a strike price of $25.

To determine: The price of a one year call option on ET stock.

Introduction: A binomial model portrays the development of irregular variables over a progression of time steps, relegating specified probabilities to increase or decrease in the variable. The binomial option pricing model makes the improving supposition that, toward the finish of every period, the price of stocks has just two conceivable values.

Answer to Problem 1P

Explanation of Solution

Determine the increase or decrease in the stock price.

Therefore, the stock price either increases to $30 or decreases to $20

Here

S – Denotes the current stock price

K – Denotes the strike price

C – Denotes the call price

B – Denotes the risk-free investment or initial investment in the portfolio

Su – Denotes the probability of increase in stock price (the price to go up)

Sd – Denotes the probability of decrease in stock price next period (the price to go down)

rf – Denotes the risk-free rate

Cu – Denotes the price of the call option if the stock price increases (the price to go up)

Cd – Denotes the price of the call option if the stock price decreases (the price to go down)

Δ – Denotes the shares of stock in the portfolio or the sensitivity of option price to stock price

Determine the option payoff:

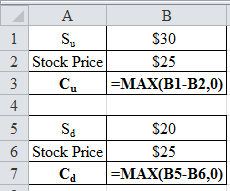

Using Excel function =MAX, the option payoff is determined as follows:

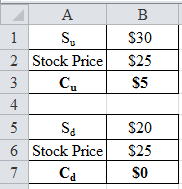

Excel spreadsheet:

Excel workings:

Therefore, the option payoff either increases to $5 or decreases to $0.

Determine the shares of stock in the replicating portfolio:

Therefore, the share of stock in the replicating portfolio is 0.5.

Determine the risk-free investment or initial investment in the portfolio:

Therefore, the risk-free investment or initial investment in the portfolio is -9.4340.

Determine the price of a one year call option on ET stock:

Therefore, the price of a one year call option on ET stock is $3.07.

Want to see more full solutions like this?

Chapter 21 Solutions

EBK CORPORATE FINANCE

Additional Business Textbook Solutions

Financial Accounting: Tools for Business Decision Making, 8th Edition

Engineering Economy (17th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Horngren's Accounting (12th Edition)

- You want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Silver Leisure would let you make quarterly payments of $3,530 for 7 years at an interest rate of 2.14 percent per quarter. Your first payment to Silver Leisure would be today. Pond Leisure would let you make X monthly payments of $18,631 at an interest rate of 1.19 percent per month. Your first payment to Pond Leisure would be in 1 month. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forwardYou plan to retire in 4 years with $659,371. You plan to withdraw $100,000 per year for 12 years. The expected return is X percent per year and the first regular withdrawal is expected in 4 years. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Gray Media would let you make quarterly payments of $1,430 for 7 years at an interest rate of 1.59 percent per quarter. Your first payment to Gray Media would be today. River Media would let you make monthly payments of $X for 8 years at an interest rate of 1.46 percent per month. Your first payment to River Media would be in 1 month. What is X? Input instructions: Round your answer to the nearest dollar.arrow_forward

- You plan to retire in 8 years with $X. You plan to withdraw $114,200 per year for 21 years. The expected return is 17.92 percent per year and the first regular withdrawal is expected in 9 years. What is X? Input instructions: Round your answer to the nearest dollar. SAarrow_forward69 You plan to retire in 3 years with $911,880. You plan to withdraw $X per year for 18 years. The expected return is 18.56 percent per year and the first regular withdrawal is expected in 3 years. What is X? Input instructions: Round your answer to the nearest dollar.arrow_forwardYou plan to retire in 7 years with $X. You plan to withdraw $54,100 per year for 15 years. The expected return is 13.19 percent per year and the first regular withdrawal is expected in 7 years. What is X? Input instructions: Round your answer to the nearest dollar.arrow_forward

- You want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Orange Furniture would let you make quarterly payments of $12,540 for 6 years at an interest rate of 1.26 percent per quarter. Your first payment to Orange Furniture would be in 3 months. River Furniture would let you make X monthly payments of $41,035 at an interest rate of 0.73 percent per month. Your first payment to River Furniture would be today. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forwardLet y(t) represent your retirement account balance, in dollars, after t years. Each year the account earns 7% interest, and you deposit 8% of your annual income. Your current annual income is $34000, but it is growing at a continuous rate of 2% per year. Write the differential equation modeling this situation. dy dtarrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Silver Research would let you make quarterly payments of $9,130 for 3 years at an interest rate of 3.27 percent per quarter. Your first payment to Silver Research would be today. Island Research would let you make monthly payments of $3,068 for 3 years at an interest rate of X percent per month. Your first payment to Island Research would be in 1 month. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forward

- You want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Orange Technology would let you make quarterly payments of $13,650 for 8 years at an interest rate of 1.93 percent per quarter. Your first payment to Orange Technology would be in 3 months. Island Technology would let you make monthly payments of $7,976 for 4 years at an interest rate of X percent per month. Your first payment to Island Technology would be today. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forwardSays my answer is wrongarrow_forwardEquipment is worth $339,976. It is expected to produce regular cash flows of $50,424 per year for 18 years and a special cash flow of $75,500 in 18 years. The cost of capital is X percent per year and the first regular cash flow will be produced today. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT