The current price of Estelle Corporation stock is $25. In each of the next two years, this stock price will either go up by 20% or go down by 20%. The stock pays no dividends. The one-year risk-free interest rate is 6% and will remain constant. Using the Binomial Model, calculate the price of a one-year call option on Estelle stock with a strike price of $25.

To determine: The price of a one year call option on ET stock.

Introduction: A binomial model portrays the development of irregular variables over a progression of time steps, relegating specified probabilities to increase or decrease in the variable. The binomial option pricing model makes the improving supposition that, toward the finish of every period, the price of stocks has just two conceivable values.

Answer to Problem 1P

Explanation of Solution

Determine the increase or decrease in the stock price.

Therefore, the stock price either increases to $30 or decreases to $20

Here

S – Denotes the current stock price

K – Denotes the strike price

C – Denotes the call price

B – Denotes the risk-free investment or initial investment in the portfolio

Su – Denotes the probability of increase in stock price (the price to go up)

Sd – Denotes the probability of decrease in stock price next period (the price to go down)

rf – Denotes the risk-free rate

Cu – Denotes the price of the call option if the stock price increases (the price to go up)

Cd – Denotes the price of the call option if the stock price decreases (the price to go down)

Δ – Denotes the shares of stock in the portfolio or the sensitivity of option price to stock price

Determine the option payoff:

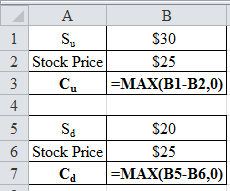

Using Excel function =MAX, the option payoff is determined as follows:

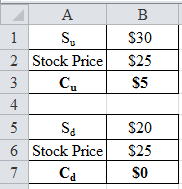

Excel spreadsheet:

Excel workings:

Therefore, the option payoff either increases to $5 or decreases to $0.

Determine the shares of stock in the replicating portfolio:

Therefore, the share of stock in the replicating portfolio is 0.5.

Determine the risk-free investment or initial investment in the portfolio:

Therefore, the risk-free investment or initial investment in the portfolio is -9.4340.

Determine the price of a one year call option on ET stock:

Therefore, the price of a one year call option on ET stock is $3.07.

Want to see more full solutions like this?

Chapter 21 Solutions

Corporate Finance

Additional Business Textbook Solutions

Financial Accounting: Tools for Business Decision Making, 8th Edition

Engineering Economy (17th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Horngren's Accounting (12th Edition)

- You take a loan of $10,000 at 8% annual interest to be repaid in 4 equal annual installments. What is the annual payment?arrow_forwardNeed help!! A stock pays a constant dividend of $2.50 per year. If the required rate of return is 10%, what is the value of the stock? A) $20.00B) $22.50C) $25.00D) $27.50arrow_forwardA stock pays a constant dividend of $2.50 per year. If the required rate of return is 10%, what is the value of the stock? A) $20.00B) $22.50C) $25.00D) $27.50arrow_forward

- Don't use chatgpt i will give unhelpful! The beta of a stock is 1.2, the risk-free rate is 3%, and the expected market return is 9%. What is the expected return of the stock using the CAPM?arrow_forwardNo ai A project requires an initial investment of $5,000 and returns $2,000 per year for 3 years. What is the Net Present Value (NPV) at a discount rate of 10%? A) $375.66B) $420.50C) $487.23D) $512.67arrow_forwardWhat is the effective annual rate (EAR) for a nominal interest rate of 12% compounded monthly? A) 12.00%B) 12.36%C) 12.68%D) 13.00%arrow_forward

- Don't use chatgpt. The beta of a stock is 1.2, the risk-free rate is 3%, and the expected market return is 9%. What is the expected return of the stock using the CAPM?arrow_forwardA company's stock is expected to grow at 5% annually. The next dividend is $3, and the required rate of return is 10%. What is the stock’s value using the Gordon Growth Model?arrow_forwardDon't use ai . The beta of a stock is 1.2, the risk-free rate is 3%, and the expected market return is 9%. What is the expected return of the stock using the CAPM?arrow_forward

- The beta of a stock is 1.2, the risk-free rate is 3%, and the expected market return is 9%. What is the expected return of the stock using the CAPM?arrow_forwardIf you invest $1,000 at an annual interest rate of 5% compounded annually, how much will you have after 3 years?need help!!arrow_forwarddon't use chatgpt. If you invest $1,000 at an annual interest rate of 5% compounded annually, how much will you have after 3 years?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT