Concept explainers

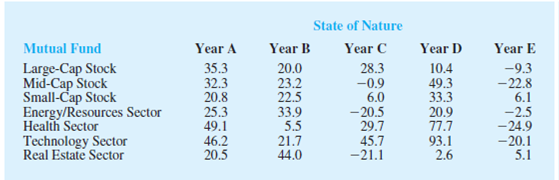

An investor wants to select one of seven mutual funds for the coming year. Data showing the percentage annual return for each fund during five typical one-year periods are shown here. The assumption is that one of these five-year periods will occur again during the coming year. Thus, years A, B, C, D, and E are the states of nature for the mutual fund decision.

- a. Suppose that an experienced financial analyst reviews the five states of nature and provides the following probabilities: .1, .3, .1, .1, and .4. Using the

expected value approach, what is the recommended mutual fund? What is the expected annual return? Using this mutual fund, what are the minimum and maximum annual returns? - b. A conservative investor notes that the Small-Cap mutual fund is the only fund that does not have the possibility of a loss. In fact, if the Small-Cap fund is chosen, the investor is guranteed a return of at least 6%. What is the expected annual return for this fund?

- c. Considering the mutual funds recommended in parts (a) and (b), which fund appears to have more risk? Why? Is the expected annual return greater for the mutual fund with more risk?

- d. What mutual fund would you recommend to the investor? Explain.

a.

Identify the recommended mutual fund. And compute the expected annual return.

Compute the minimum and maximum annual return Based on the recommended mutual fund.

Answer to Problem 18SE

The technology sector is the recommended mutual fund with expected annual return is 16.97%.

The minimum annual return for the technology sector is –20.1% and maximum annual return for the technology sector is 93.1%.

Explanation of Solution

Calculation:

There are a total of seven mutual funds. The table provides percentage annual return for each fund during five typical one-year periods. There are 5 states of nature for the mutual funds. The probabilities for states of nature are 0.1, 0.3, 0.1, 0.1, and 0.4 respectively.

Expected value approach:

The expected value (EV) of a decision rule

Where,

Since the problem deals with profit, the optimal decision is one with maximum expected value (EV).

The expected value for the Large-Cap Stock mutual fund is as follows:

Substitute the following values in the expected value approach,

Therefore,

The expected value Large-Cap Stock mutual fund is 9.68%.

Similarly the other expected values are obtained as shown in the table:

| Mutual Fund | Expected Annual Return |

| Large-Cap Stock | 9.68 |

| Mid-Cap Stock | |

| Small-Cap Stock | |

| Emergency/Resource Sector | |

| Health Sector | |

| Technology Sector | |

| Real Estate Sector |

From the expected values, it is clear that the technology sector provide maximum expected value. The annual return of technology sector is 16.97%.

From the table of percentage annual return, the minimum annual return for the technology sector is –20.1% and maximum annual return for the technology sector is 93.1%.

b.

Compute the expected annual return for Small-Cap Stock.

Answer to Problem 18SE

The expected annual return for Small-Cap Stock is 15.20%.

Explanation of Solution

The investor note that the Small-Cap mutual funds are mutual funds that does not have a chance of loss. The Small-Cap mutual funds guaranteed a return of at least 6%.

From part (a), it is clear that expected annual return for Small-Cap Stock is 15.20%. But the recommended mutual fund is technology sector with expected value 16.97%. The difference between recommended and Small-Cap Stock is 1.77%

Therefore, the expected annual return for Small-Cap Stock is 15.20%.

c.

Identify the mutual fund that explained in parts (a) and (b) is more risky. Explain the reason.

Check whether annual return greater for the mutual fund with more risk.

Answer to Problem 18SE

The technology sector is more risky. Annual return greater for the mutual fund with more risk.

Explanation of Solution

From the table of percentage annual return, the minimum annual return for the technology sector is –20.1% and maximum annual return for the technology sector is 93.1%. That is, the annual return for technology sector varies from –20.1% to 93.1%. The minimum annual return for the Small-Cap Stock is 6% and maximum annual return for the Small-Cap Stock is 33.3%. That is, the annual return for Small-Cap Stock varies from 6% to 33.3%. That is, the range of variation is high for technology sector. Therefore, technology sector is more risky. The technology sector also have a higher expected annual return but only by 1.77%. Hence Annual return greater for the mutual fund with more risk.

d.

Identify which mutual fund is recommended to the investor. Explain the reason.

Answer to Problem 18SE

The recommended mutual fund is Small-Cap Stock.

Explanation of Solution

The answer will vary. One of the possible answer is given below:

From part (c), it is clear that, risk associated with Small-Cap Stock mutual fund is less compared to technology sector. From part (b), the high risk technology sector only has a 1.77% higher expected annual return. Therefore, mutual fund that recommended to the investor is Small-Cap Stock mutual fund.

Want to see more full solutions like this?

Chapter 21 Solutions

Statistics for Business & Economics, Revised (with XLSTAT Education Edition Printed Access Card)

- 5. Probability Distributions – Continuous Random Variables A factory machine produces metal rods whose lengths (in cm) follow a continuous uniform distribution on the interval [98, 102]. Questions: a) Define the probability density function (PDF) of the rod length.b) Calculate the probability that a randomly selected rod is shorter than 99 cm.c) Determine the expected value and variance of rod lengths.d) If a sample of 25 rods is selected, what is the probability that their average length is between 99.5 cm and 100.5 cm? Justify your answer using the appropriate distribution.arrow_forward2. Hypothesis Testing - Two Sample Means A nutritionist is investigating the effect of two different diet programs, A and B, on weight loss. Two independent samples of adults were randomly assigned to each diet for 12 weeks. The weight losses (in kg) are normally distributed. Sample A: n = 35, 4.8, s = 1.2 Sample B: n=40, 4.3, 8 = 1.0 Questions: a) State the null and alternative hypotheses to test whether there is a significant difference in mean weight loss between the two diet programs. b) Perform a hypothesis test at the 5% significance level and interpret the result. c) Compute a 95% confidence interval for the difference in means and interpret it. d) Discuss assumptions of this test and explain how violations of these assumptions could impact the results.arrow_forward1. Sampling Distribution and the Central Limit Theorem A company produces batteries with a mean lifetime of 300 hours and a standard deviation of 50 hours. The lifetimes are not normally distributed—they are right-skewed due to some batteries lasting unusually long. Suppose a quality control analyst selects a random sample of 64 batteries from a large production batch. Questions: a) Explain whether the distribution of sample means will be approximately normal. Justify your answer using the Central Limit Theorem. b) Compute the mean and standard deviation of the sampling distribution of the sample mean. c) What is the probability that the sample mean lifetime of the 64 batteries exceeds 310 hours? d) Discuss how the sample size affects the shape and variability of the sampling distribution.arrow_forward

- A biologist is investigating the effect of potential plant hormones by treating 20 stem segments. At the end of the observation period he computes the following length averages: Compound X = 1.18 Compound Y = 1.17 Based on these mean values he concludes that there are no treatment differences. 1) Are you satisfied with his conclusion? Why or why not? 2) If he asked you for help in analyzing these data, what statistical method would you suggest that he use to come to a meaningful conclusion about his data and why? 3) Are there any other questions you would ask him regarding his experiment, data collection, and analysis methods?arrow_forwardBusinessarrow_forwardWhat is the solution and answer to question?arrow_forward

- To: [Boss's Name] From: Nathaniel D Sain Date: 4/5/2025 Subject: Decision Analysis for Business Scenario Introduction to the Business Scenario Our delivery services business has been experiencing steady growth, leading to an increased demand for faster and more efficient deliveries. To meet this demand, we must decide on the best strategy to expand our fleet. The three possible alternatives under consideration are purchasing new delivery vehicles, leasing vehicles, or partnering with third-party drivers. The decision must account for various external factors, including fuel price fluctuations, demand stability, and competition growth, which we categorize as the states of nature. Each alternative presents unique advantages and challenges, and our goal is to select the most viable option using a structured decision-making approach. Alternatives and States of Nature The three alternatives for fleet expansion were chosen based on their cost implications, operational efficiency, and…arrow_forwardBusinessarrow_forwardWhy researchers are interested in describing measures of the center and measures of variation of a data set?arrow_forward

- WHAT IS THE SOLUTION?arrow_forwardThe following ordered data list shows the data speeds for cell phones used by a telephone company at an airport: A. Calculate the Measures of Central Tendency from the ungrouped data list. B. Group the data in an appropriate frequency table. C. Calculate the Measures of Central Tendency using the table in point B. 0.8 1.4 1.8 1.9 3.2 3.6 4.5 4.5 4.6 6.2 6.5 7.7 7.9 9.9 10.2 10.3 10.9 11.1 11.1 11.6 11.8 12.0 13.1 13.5 13.7 14.1 14.2 14.7 15.0 15.1 15.5 15.8 16.0 17.5 18.2 20.2 21.1 21.5 22.2 22.4 23.1 24.5 25.7 28.5 34.6 38.5 43.0 55.6 71.3 77.8arrow_forwardII Consider the following data matrix X: X1 X2 0.5 0.4 0.2 0.5 0.5 0.5 10.3 10 10.1 10.4 10.1 10.5 What will the resulting clusters be when using the k-Means method with k = 2. In your own words, explain why this result is indeed expected, i.e. why this clustering minimises the ESS map.arrow_forward

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman