Preparing a production cost report, second department with beginning W1P; decision making

Lake Bound uses three processes to manufacture lifts for personal watercrafts: forming a lift’s parts from galvanized steel, assembling the lift, and testing the completed lift. The lifts are transferred to finished goods before shipment to materials across the country.

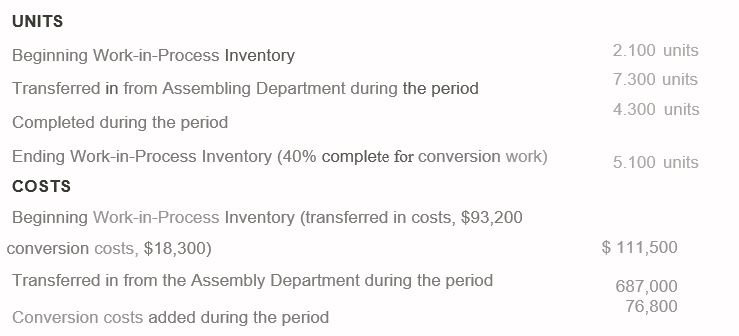

Lake Bound’s Testing Department requires no direct materials. Conversion costs are incurred evenly throughout the testing process. Other information follows for October 2016:

The cost transferred into Finished Goods Inventory is the cost of the lifts transferred

out of the Testing Department. Lake Bound uses weighted-average

Requirements

- Prepare a production cost report for the Testing Department.

- What is the cost per unit for lifts completed and transferred out to Finished Goods Inventory? Why would management he interested in this cost'

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Horngren's Accounting, Student Value Edition Plus MyAccountingLab with Pearson eText, Access Card Package

- Need correct answer general Accountingarrow_forwardYear 0123 Cash Flow -$ 19,000 11,300 10,200 6,700 a. What is the profitability index for the set of cash flows if the relevant discount rate is 11 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. b. What is the profitability index for the set of cash flows if the relevant discount rate is 16 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. c. What is the profitability index for the set of cash flows if the relevant discount rate is 23 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. a. Profitability index b. Profitability index c. Profitability indexarrow_forwardSol This question answerarrow_forward

- Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What is the impact on Abercrombie & Fitch's financial statements from the write-down of its logo-adorned merchandise…arrow_forwardTherefore the final answerarrow_forwardAns ? General Accounting questionarrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,