Concept explainers

Problem 20-7BA

FIFO: Process cost summary, equivalent units, cost estimates

C2 C3 C4 P4

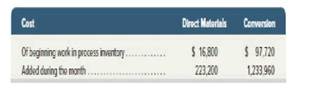

Belda Co. mates organic juice in two departments: cutting and blending. Direct materials are added at the beginning of each process, and conversion costs are added evenly throughout each process. The company uses the FIFO method of

Required

- Prepare the cutting departments process cost summary for March using the FIFO method.

- Prepare the

journal entry dated March 31 to transfer the cost of completed units to the blending department, - The company provides incentives to department managers by paying monthly bonuses based on their success in controlling costs per equivalent unit of production, Assume that the production department overestimates the percentage of completion for units in ending inventory with the result that its

equivalent units of production for March are overstated, What impact does this error have on bonuses paid to the managers of the production department? What impact, if any, does this error have on these managers' April bonuses?

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Connect Access Card For Fundamental Accounting Principles

- I need assistance with this general accounting question using appropriate principles.arrow_forwardCan you explain this financial accounting question using accurate calculation methods?arrow_forwardCan you help me solve this financial accounting question using valid financial accounting techniques?arrow_forward

- Please provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forward

- Determine the price of a $1.3 million bond issue under each of the following independent assumptions: Maturity 10 years, interest paid annually, stated rate 8%, effective (market) rate 10%. Maturity 10 years, interest paid semiannually, stated rate 8%, effective (market) rate 10%. Maturity 10 years, interest paid semiannually, stated rate 10%, effective (market) rate 8%. Maturity 20 years, interest paid semiannually, stated rate 10%, effective (market) rate 8%. Maturity 20 years, interest paid semiannually, stated rate 10%, effective (market) rate 10%.arrow_forwardIf total assets increase while liabilities remain unchanged, equity must: A) IncreaseB) DecreaseC) Remain the sameD) Be negativearrow_forwardNo chatgpt!! Which of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivablearrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub