Concept explainers

1.

To prepare:

The sales budget of N manufacturing.

1.

Explanation of Solution

Prepare the sales budget as shown below.

| Sales Budget | ||||

|---|---|---|---|---|

| Particulars | July ($) |

August ($) | September ($) |

Total ($) |

| Sales unit (A) | 21,000 | 19,000 | 20,000 | 60,000 |

| Selling price per unit (B) | 17 | 17 | 17 | 17 |

| Total sales |

357,000 | 323,000 | 340,000 | 1,020,000 |

Table - 1

2.

To prepare:

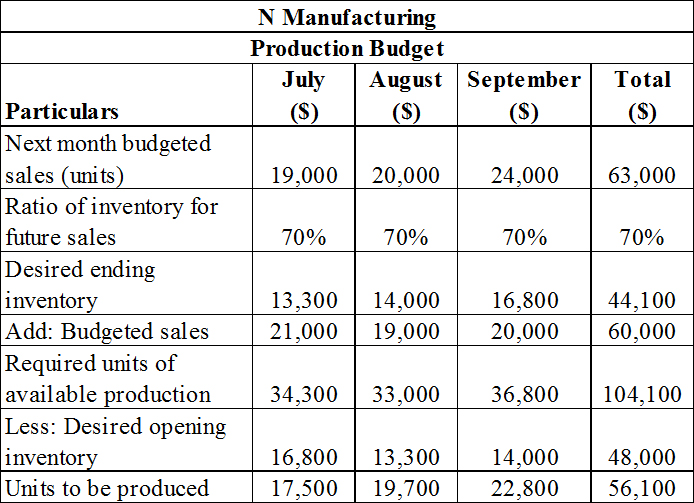

The production budget of N Manufacturing.

2.

Explanation of Solution

Prepare the production budget as shown below.

Table - 2

3.

To prepare:

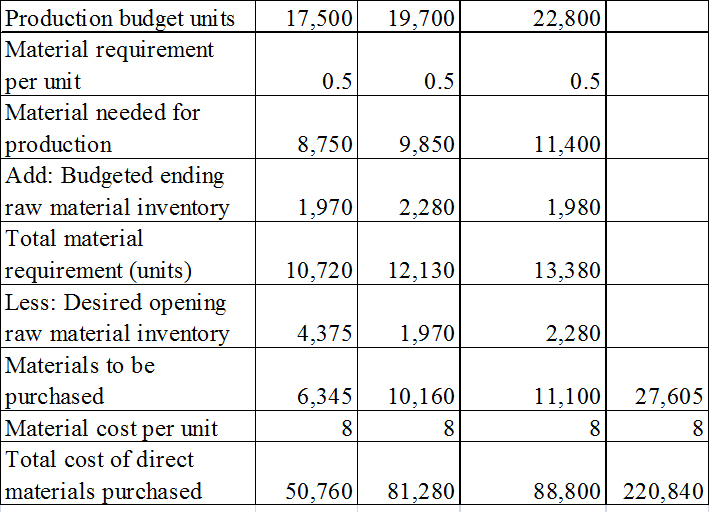

The raw materials budget of N Manufacturing.

3.

Explanation of Solution

Prepare the raw materials budget of N Manufacturing as shown below.

Table - 3

4.

To prepare:

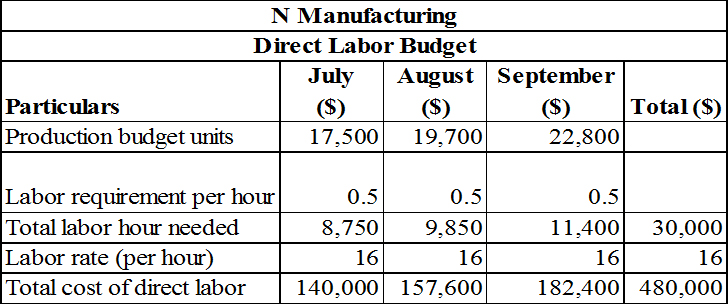

The direct labor budget of N Manufacturing.

4.

Explanation of Solution

Prepare the direct labor budget of N Manufacturing as shown below.

Table - 4

5.

To prepare:

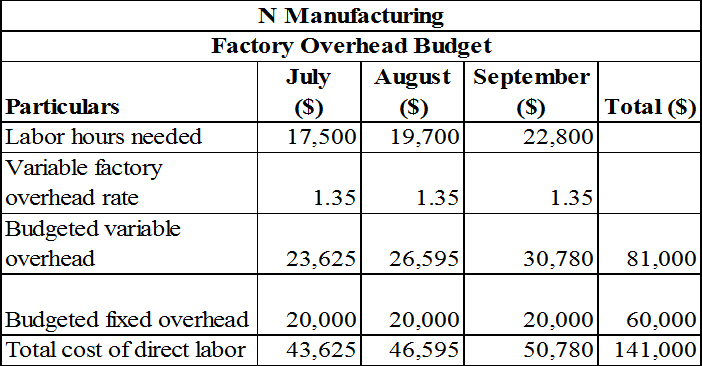

The factory

5.

Explanation of Solution

Prepare the factory overhead budget of N Manufacturing as shown below.

Table - 5

6.

To prepare:

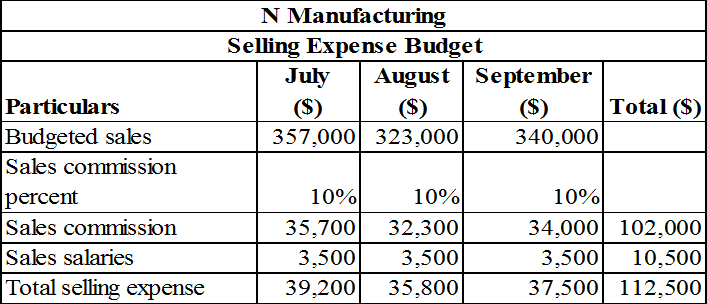

The selling expense budget of N Manufacturing.

6.

Explanation of Solution

Prepare the selling expense budget of N Manufacturing as shown below.

Table - 6

7.

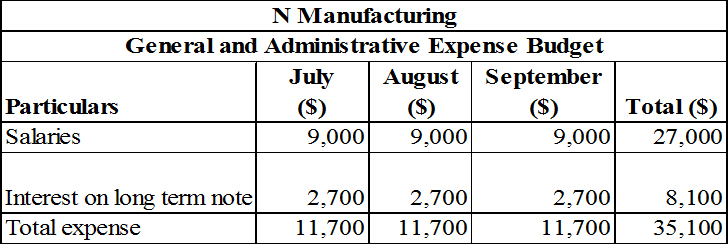

To prepare:

The general and administrative expense budget of N Manufacturing.

7.

Explanation of Solution

Prepare the general and administrative expense budget of N Manufacturing as shown below.

Table - 7

8.

To prepare:

The

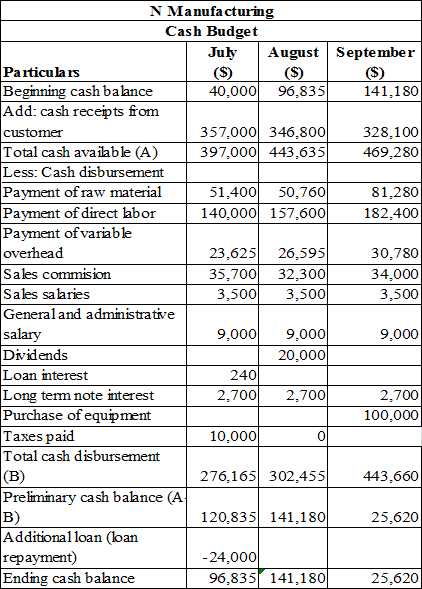

8.

Explanation of Solution

Prepare the cash budget as shown below.

Table - 8

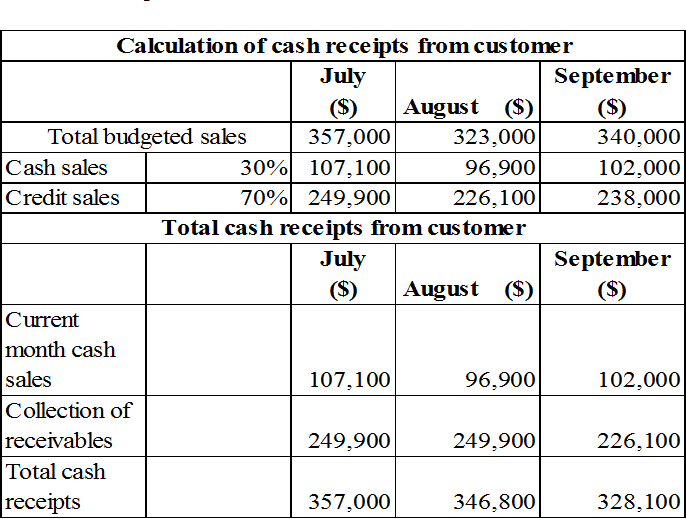

Working note:

Calculate the cash receipts.

Table (9)

9.

To prepare:

The

9.

Explanation of Solution

Prepare the budgeted income statement as shown below.

| Income Statement | ||

|---|---|---|

| For three months ended September 30, 2015 | ||

| Particulars | Amount ($) | Amount ($) |

| Sales | 1,020,000 | |

| Less: Cost of goods sold | 861,000 | |

| Gross profit | 159,000 | |

| Less: Operating expenses | ||

| Sales commission | 102,000 | |

| Sales salaries | 10,500 | |

| General administrative salary | 27,000 | |

| Total operating expense | 139,500 | |

| Earnings before interest and taxes | 19500 | |

| Less: Interest on long term notes | 8100 | |

| Interest on short term note | 240 | |

| Earnings before taxes (A) | 11,160 | |

| Less: Income tax | 3,906 | |

| Net income | 7,254 | |

Table - 10

Thus, the budgeted net income of N Manufacturing is $7,254.

10.

To prepare:

The budgeted

10.

Explanation of Solution

Prepare the balance sheet as shown below.

| Balance sheet | ||

|---|---|---|

| For three months ended September 30, 2015 | ||

| Particulars | Amount ($) | Amount ($) |

| Assets | ||

| Cash | 40,000 | |

| 238,000 | ||

| Raw material inventory | 15,840 | |

| Finished goods inventory | 241,080 | |

| Total current assets | 534,920 | |

| Equipment | 820,000 | |

| Less: |

300,000 | |

| Net equipment | 520,000 | |

| Total assets | 1,054,920 | |

| Liabilities and |

||

| Liabilities | ||

| Accounts payable | 88,800 | |

| Bank loan payable | 14,380 | |

| Income tax payable | 3,906 | |

| Total current liability | 107,086 | |

| Long term note payables | 300,000 | |

| Total liabilities | 407,086 | |

| Stockholder’s equity | ||

| Common stock | 600,000 | |

| 47,834 | ||

| Total stockholders’ equity | 647,834 | |

| Total liabilities and stockholder’s equity | 1,054,920 | |

Table - 11

Working note:

1. Calculate the retained earnings.

Hence, the total amount appearing in the balance sheet of N Manufacturing as on September 30, 2015 is $1,054,920.

Want to see more full solutions like this?

Chapter 20 Solutions

Financial and Managerial Accounting: Information for Decisions

- Computer the increase in net income Baldwin will realize by accepting the special order ,assuming the company has sufficient excess operating capity.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forward

- I need assistance with this financial accounting problem using valid financial procedures.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forward

- I am looking for the most effective method for solving this financial accounting problem.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education