Financial & Managerial Accounting, Loose-Leaf Version

14th Edition

ISBN: 9781337270700

Author: Carl S. Warren, James M. Reeve, Jonathan Duchac

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 20, Problem 4ADM

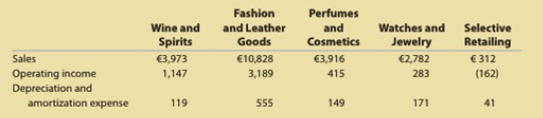

LVMH: Group segment sales and EBITDA analysis

LVMH Group is a French domiciled company known for Dior, Givenchy, Louis Vuitton, and many other fashion brands. LVMH's operating segment revenues, operating income, and

- A. Prepare a vertical analysis of the segment sales to total sales. (Round to nearest whole percent.)

- B. Interpret the vertical analysis in (A).

- C. Compute (1) EBITDA and (2) EBITDA as a percent of sales (EBITDA margin) for each segment. (Round to nearest whole percent.)

- D. Prepare a column bar chart of the EBITDA as a percent of sales for the segments in descending order.

- E. Interpret the chart in (D).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please give me true answer this financial accounting question

Can you please give me correct solution this general accounting question?

Michael McDowell Co. establishes a $108 million liability at the end of 2025 for the estimated site-cleanup costs at two of its manufacturing facilities. All related closing costs will be paid and deducted on the tax return in 2026. Also, at the end of 2025, the company has $54 million of temporary differences due to excess depreciation for tax purposes, $7.56 million of which will reverse in 2026.

The enacted tax rate for all years is 20%, and the company pays taxes of $34.56 million on $172.80 million of taxable income in 2025. McDowell expects to have taxable income in 2026.

Assuming that the only deferred tax account at the beginning of 2025 was a deferred tax liability of $5,400,000, draft the income tax expense portion of the income statement for 2025, beginning with the line "Income before income taxes." (Hint: You must first compute (1) the amount of temporary difference underlying the beginning $5,400,000 deferred tax liability, then (2) the amount of temporary differences…

Chapter 20 Solutions

Financial & Managerial Accounting, Loose-Leaf Version

Ch. 20 - What types of costs are customarily included in...Ch. 20 - Which type of manufacturing cost (direct...Ch. 20 - Which of the following costs would be included in...Ch. 20 - In the variable costing income statement, how are...Ch. 20 - Since all costs of operating a business are...Ch. 20 - Discuss how financial data prepared on the basis...Ch. 20 - Why might management analyze product...Ch. 20 - Explain why rewarding sales personnel on the basis...Ch. 20 - Discuss the two factors affecting both sales and...Ch. 20 - How is the quantity factor for an increase or a...

Ch. 20 - Explain why service companies use different...Ch. 20 - Variable costing Marley Company has the following...Ch. 20 - Variable costingproduction exceeds sales Fixed...Ch. 20 - Variable costing sales exceed production The...Ch. 20 - Analyzing income under absorption and variable...Ch. 20 - Contribution margin by segment The following...Ch. 20 - Contribution margin analysis The actual variable...Ch. 20 - Inventory valuation under absorption costing and...Ch. 20 - Income statements under absorption costing and...Ch. 20 - Income statements under absorption costing and...Ch. 20 - Cost of goods manufactured, using variable costing...Ch. 20 - Variable costing income statement On November 30,...Ch. 20 - Absorption costing income statement On March 31....Ch. 20 - Variable costing income statement The following...Ch. 20 - Estimated income statements, using absorption and...Ch. 20 - Variable and absorption costing Ansara Company had...Ch. 20 - Prob. 20.10EXCh. 20 - Prob. 20.11EXCh. 20 - Product profitability analysis Power Train Sports...Ch. 20 - Territory and product profitability analysis Coast...Ch. 20 - Sales territory and salesperson profitability...Ch. 20 - Segment profitability analysis The marketing...Ch. 20 - Prob. 20.16EXCh. 20 - Contribution margin analysis sales Select Audio...Ch. 20 - Prob. 20.18EXCh. 20 - Contribution margin analysis variable costs Based...Ch. 20 - Variable costing income statement for a service...Ch. 20 - Contribution margin reporting and analysis for a...Ch. 20 - Variable costing income statement and contribution...Ch. 20 - Absorption and variable costing income statements...Ch. 20 - Income statements under absorption costing and...Ch. 20 - Absorption and variable costing income statements...Ch. 20 - Salespersons' report and analysis Walthman...Ch. 20 - Segment variable costing income statement and...Ch. 20 - Contribution margin analysis Farr Industries Inc....Ch. 20 - Prob. 20.1BPRCh. 20 - Income statements under absorption costing and...Ch. 20 - Absorption and variable costing income statements...Ch. 20 - Salespersons' report and analysis Pachec Inc....Ch. 20 - Variable costing income statement and effect on...Ch. 20 - Contribution margin analysis Mathews Company...Ch. 20 - Prob. 1ADMCh. 20 - Prob. 2ADMCh. 20 - Apple Inc.: Segment revenue analysis Segment...Ch. 20 - LVMH: Group segment sales and EBITDA analysis LVMH...Ch. 20 - Prob. 20.1TIFCh. 20 - Communication Bon Jager Inc. manufactures and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please answer the following requirements a and b on these general accounting questionarrow_forwardGeneral Accountingarrow_forwardHarper, Incorporated, acquires 40 percent of the outstanding voting stock of Kinman Company on January 1, 2023, for $210,000 in cash. The book value of Kinman's net assets on that date was $400,000, although one of the company's buildings, with a $60,000 carrying amount, was actually worth $100,000. This building had a 10-year remaining life. Kinman owned a royalty agreement with a 20-year remaining life that was undervalued by $85,000. Kinman sold Inventory with an original cost of $60,000 to Harper during 2023 at a price of $90,000. Harper still held $15,000 (transfer price) of this amount in Inventory as of December 31, 2023. These goods are to be sold to outside parties during 2024. Kinman reported a $40,000 net loss and a $20,000 other comprehensive loss for 2023. The company still manages to declare and pay a $10,000 cash dividend during the year. During 2024, Kinman reported a $40,000 net income and declared and paid a cash dividend of $12,000. It made additional inventory sales…arrow_forward

- Solve this general accounting question not use aiarrow_forwardPlease provide solution this general accounting questionarrow_forwardMichael McDowell Co. establishes a $108 million liability at the end of 2025 for the estimated site-cleanup costs at two of its manufacturing facilities. All related closing costs will be paid and deducted on the tax return in 2026. Also, at the end of 2025, the company has $54 million of temporary differences due to excess depreciation for tax purposes, $7.56 million of which will reverse in 2026. The enacted tax rate for all years is 20%, and the company pays taxes of $34.56 million on $172.80 million of taxable income in 2025. McDowell expects to have taxable income in 2026. Assuming that the only deferred tax account at the beginning of 2025 was a deferred tax liability of $5,400,000, draft the income tax expense portion of the income statement for 2025, beginning with the line "Income before income taxes." (Hint: You must first compute (1) the amount of temporary difference underlying the beginning $5,400,000 deferred tax liability, then (2) the amount of temporary differences…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Foreign Exchange Risks; Author: Kaplan UK;https://www.youtube.com/watch?v=ne1dYl3WifM;License: Standard Youtube License