Break-even sales under present and proposed conditions

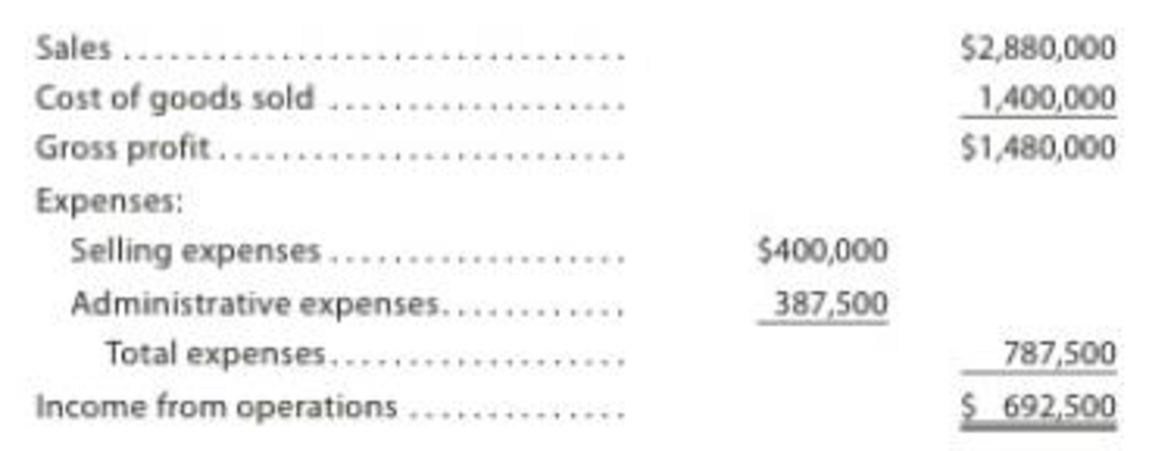

Howard Industries Inc., operating at full capacity, sold 64,000 units at a price of $45 per unit during the current year. Its income statement is as follows:

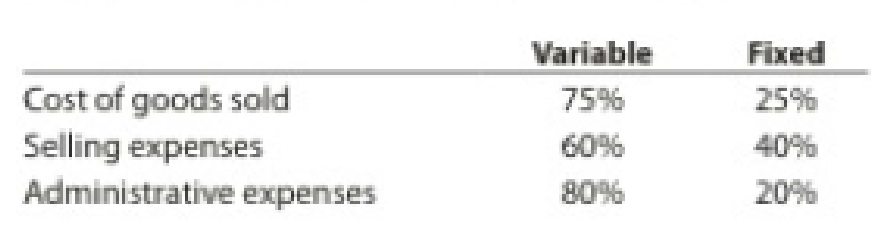

The division of costs between variable and fixed is as follows:

Management is considering a plant expansion program for the following year that will permit an increase of $900,000 in yearly sales. The expansion will increase fixed costs by $212,500 but will not affect the relationship between sales and variable costs.

Instructions

Determine the total fixed costs and the total variable costs for the current year.

Determine (A) the unit variable cost and (B) the unit contribution margin for the current year.

Compute the break-even sales (units) for the current year.

Compute the break-even sales (units) under the proposed program for the following year.

Determine the amount of sales (units) that would be necessary under the proposed program to realize the $692,500 of operating income that was earned in the current year.

Determine the maximum operating income possible with the expanded plant.

If the proposal is accepted and sales remain at the current level, what will the operating income or loss be for the following year?

Based on the data given, would you recommend accepting the proposal? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Financial and Managerial Accounting - CengageNow

- Please provide the answer to this general accounting question using the right approach.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardBon Corporation has the following transactions: $820,000 operating income; $640,000 operating expenses; $55,000 municipal bond interest; $150,000 long-term capital gain; and $70,000 short-term capital loss. Compute Bon Corporation's taxable income for the year.arrow_forward

- Expert need your helparrow_forwardJuniper Retail plans to open a new store location. The company analysis indicates that fixed costs would be $225,000 annually, while variable costs would be 60% of sales revenue. If Juniper requires a minimum profit of $75,000 before tax from this location, what amount of annual sales revenue must the store generate to meet this target?arrow_forwardHii teacher please provide for general accounting question answer do fastarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT