Concept explainers

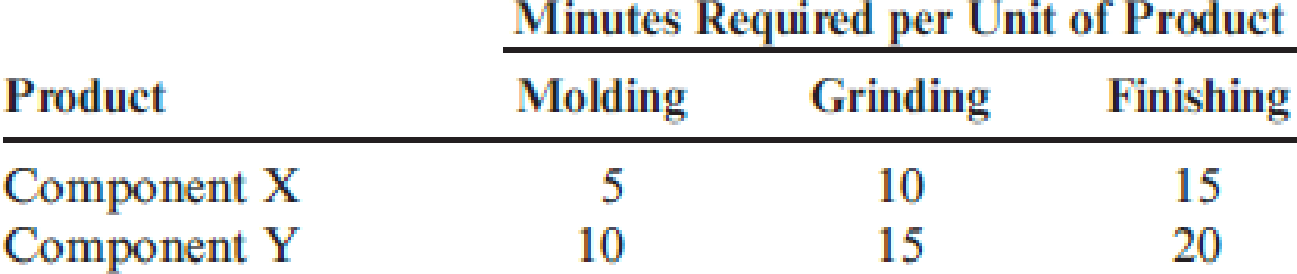

Confer Company produces two different metal components used in medical equipment (Component X and Component Y). The company has three processes: molding, grinding, and finishing. In molding, molds are created, and molten metal is poured into the shell. Grinding removes the gates that allowed the molten metal to flow into the mold’s cavities. In finishing, rough edges caused by the grinders are removed by small, handheld pneumatic tools. In molding, the setup time is one hour. The other two processes have no setup time required. The demand for Component X is 600 units per day, and the demand for Component Y is 1,000 units per day. The minutes required per unit for each product are as follows:

The company operates one eight-hour shift. The molding process employs 24 workers (who each work eight hours). Two hours of their time, however, are used for setups (assuming both products are produced). The grinding process has sufficient equipment and workers to provide 400 grinding hours per shift.

The Finishing Department is labor intensive and employs 70 workers, who each work eight hours per day. The only significant unit-level variable costs are materials and power. For Component X, the variable cost per unit is $40, and for Component Y, it is $50. Selling prices for X and Y are $90 and $110, respectively. Confer’s policy is to use two setups per day: an initial setup to produce all that is scheduled for Component X and a second setup (changeover) to produce all that is scheduled for Component Y. The amount scheduled does not necessarily correspond to each product’s daily demand.

Required:

- 1. Calculate the time (in minutes) needed each day to meet the daily market demand for Component X and Component Y. What is the major internal constraint facing Confer Company?

- 2. Describe how Confer should exploit its major binding constraint. Specifically, identify the product mix that will maximize daily throughput.

- 3. Assume that manufacturing engineering has found a way to reduce the molding setup time from one hour to 10 minutes. Explain how this affects the product mix and daily throughput.

1.

Ascertain the net time required by each processes to meet the daily market demand for Component X and Y and describe the major internal constraint that is faced by Company C.

Explanation of Solution

Theory of constraint: Making money in the future by managing constraints is the main goal of the theory of constraints. The theory of constraints (TOC) recognizes the performance of origination with constraints volume and it develops a specific approach to focus the system level effects of the continuous improvement.

Ascertain the net time required by each processes to meet the daily market demand for Component X and Y and describe the major internal constraint that is faced by Company C:

| Particulars | Molding | Grinding | Finishing |

| Component X: | |||

| Labor hours per unit (A) | 5 | 10 | 15 |

| Demand per day (in units) (B) | 600 units | 600 units | 600 units |

| 3,000 | 6,000 | 9,000 | |

| Component Y: | |||

| Labor hours per unit (D) | 10 | 15 | 20 |

| Demand per day (in units) Demand per day (in units) (E) | 1,000 units | 1,000 units | 1,000 units |

| 10,000 | 15,000 | 20,000 | |

| Totals | 13,000 | 21,000 | 29,000 |

Table (1)

| Particulars | Molding | Grinding | Finishing |

| Component X: | |||

| Number of workers (A) | 24 | - | 70 |

| Supplied minutes per day (B) | |||

| Available time | 11,520 | 21,000 | 33,600 |

| Less: Setup time | 2,880 | - | - |

| Net time available (D) | 8,640 | 24,000 | 33,600 |

Table (2)

From the above calculation it is clear that molding process is the major internal constraint faced by Company C.

2.

Describe the manner in which the company should exploit its major binding constraint and identify the quantity of product mix that will maximize daily.

Explanation of Solution

Compute the contribution per unit:

For component X:

For component Y:

The contribution margin per unit of scarce resource for Component X is $10 per minute

The company would require 3,000 molding minutes, if all 600 units of component X are produced. On the other hand, the available minutes by using two setups are 8,640 minutes and as a result component X leaves 5,640 minutes

Therefore the total contribution margin per day would be $63,840.

Compute the total contribution margin per day:

3.

Explain the manner in which the given effect would affects the product mix and daily throughput.

Explanation of Solution

Setup costs: Setup cost is the costs which are useful in preparing equipment and facilities, so that these costs could be used for producing a product or component. Examples: Lost income wages of idled production workers, and the costs of test runs.

In this case, the setup time of molding department has been reduced from 1 hour to 10 minutes. Thus, a setup time of 10 minutes would tie up to the 24 workers and this would result in a production time loss of 240 minutes

Want to see more full solutions like this?

Chapter 20 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning