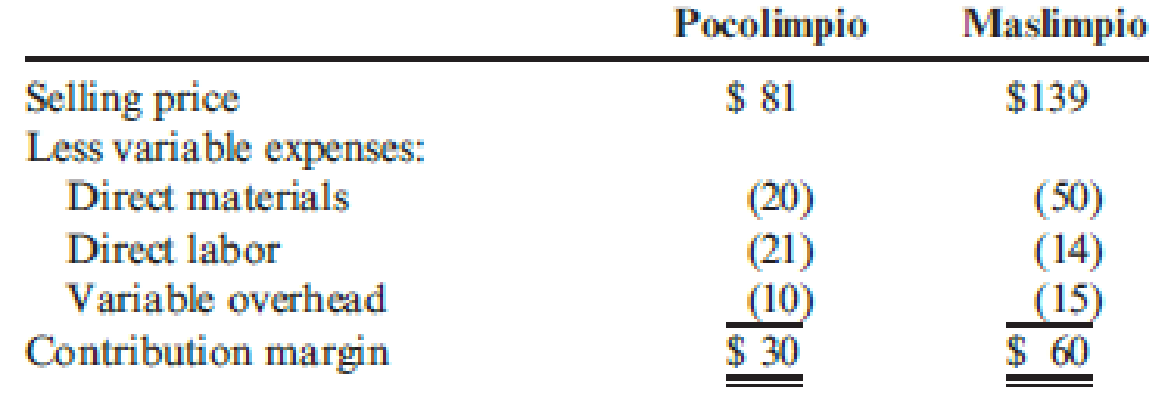

Taylor Company produces two industrial cleansers that use the same liquid chemical input: Pocolimpio and Maslimpio. Pocolimpio uses two quarts of the chemical for every unit produced, and Maslimpio uses five quarts. Currently, Taylor has 6,000 quarts of the material in inventory. All of the material is imported. For the coming year, Taylor plans to import 6,000 quarts to produce 1,000 units of Pocolimpio and 2,000 units of Maslimpio. The detail of each product’s unit contribution margin is as follows:

Taylor Company has received word that the source of the material has been shut down by embargo. Consequently, the company will not be able to import the 6,000 quarts it planned to use in the coming year’s production. There is no other source of the material.

Required:

- 1. Compute the total contribution margin that the company would earn if it could import the 6,000 quarts of the material.

- 2. Determine the optimal usage of the company’s inventory of 6,000 quarts of the material. Compute the total contribution margin for the product mix that you recommend.

- 3. Assume that Pocolimpio uses three direct labor hours for every unit produced and that Maslimpio uses two hours. A total of 6,000 direct labor hours is available for the coming year.

- a. Formulate the linear programming problem faced by Taylor Company. To do so, you must derive mathematical expressions for the objective function and for the materials and labor constraints.

- b. Solve the linear programming problem using the graphical approach.

- c. Compute the total contribution margin produced by the optimal mix.

Trending nowThis is a popular solution!

Chapter 20 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

- @ Accountarrow_forwardIn a fully integrated standard costing system standards costs eventually flow into the: a. cost of goods sold account b. standard cost account c. selling and administrative expenses account d. sales accountarrow_forwardNet sales total $438,000. Beginning and ending accounts receivable are $35,000 and $37,000, respectively. Calculate days' sales in receivables. A.27 days B.30 days C.36 days D.31 daysarrow_forward

- Provide correct answerarrow_forwardFor the system shown in figure below, the per unit values of different quantities are E-1.2, V 1, X X2-0.4. Xa-0.2 Determine whether the system is stable for a sustained fault. The fault is cleared at 8-60°. Is the system stable? If so find the maximum rotor swing. Find the critical clearing angle. E25 G X'd 08 CB X2 F CB V28 Infinite busarrow_forwardGeisner Inc. has total assets of $1,000,000 and total liabilities of $600,000. The industry average debt-to-equity ratio is 1.20. Calculate Geisner's debt-to-equity ratio and indicate whether the company's default risk is higher or lower than the average of other companies in the industry.arrow_forward

- Hy expert give me solution this questionarrow_forwardBaker's Market began the current month with inventory costing $35,250, then purchased additional inventory at a cost of $78,400. The perpetual inventory system indicates that inventory costing $82,500 was sold during the month for $88,250. An inventory count at month-end shows that inventory costing $29,000 is actually on hand. What amount of shrinkage occurred during the month? a) $350 b) $1,150 c) $1,750 d) $2,150arrow_forwardA pet store sells a pet waste disposal system for $60 each. The cost per unit, including the system and enzyme digester, is $42.50. What is the contribution margin per unit? A. $15.00 B. $17.50 C. $12.25 D. $19.00arrow_forward

- Narchie sells a single product for $40. Variable costs are 80% of the selling price, and the company has fixed costs that amount to $152,000. Current sales total 16,000 units. What is the break-even point in units?arrow_forwardA company sells 32,000 units at $25 per unit. The variable cost per unit is $20.50, and fixed costs are $52,000. (a) Determine the contribution margin ratio. (b) Determine the unit contribution margin. (c) Determine the income from operations.arrow_forwardhello tutor provide solutionarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning