FUND.ACCT.PRIN.-CONNECT ACCESS

25th Edition

ISBN: 9781260780185

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 20, Problem 26E

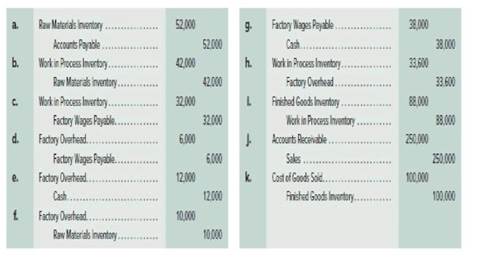

Exercise 20-26

Interpretation of journal entries in

The following journal entries are recorded in Kiesha Co.s process costing system. Kiesha produces apparel and accessories.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Choice correct answer

Please explain the solution to this general accounting problem with accurate explanations.

Please provide the solution to this general accounting question using proper accounting principles.

Chapter 20 Solutions

FUND.ACCT.PRIN.-CONNECT ACCESS

Ch. 20 - Prob. 1QSCh. 20 - Prob. 2QSCh. 20 - Process vs. job order operations C1 For each of...Ch. 20 - Physical flow reconciliation C2 Prepare a physical...Ch. 20 - Prob. 5QSCh. 20 - A FIFO: Computing equivalent units C4 Refer to QS...Ch. 20 - Prob. 7QSCh. 20 - Prob. 8QSCh. 20 - Prob. 9QSCh. 20 - Prob. 10QS

Ch. 20 - Prob. 11QSCh. 20 - Prob. 12QSCh. 20 - Prob. 13QSCh. 20 - Prob. 14QSCh. 20 - Prob. 15QSCh. 20 - Prob. 16QSCh. 20 - A FIFO: Journal entry to transfer costs P4 Refer...Ch. 20 - Prob. 18QSCh. 20 - Weighted average: Assigning costs to output C3...Ch. 20 - Prob. 20QSCh. 20 - Prob. 21QSCh. 20 - Prob. 22QSCh. 20 - Recording costs of materials P1 Hotwax mates...Ch. 20 - Prob. 24QSCh. 20 - Recording costs of factory overhead P1 P3 Prepare...Ch. 20 - Recording transfer of costs to finished goods P4...Ch. 20 - Prob. 27QSCh. 20 - Prob. 28QSCh. 20 - Prob. 29QSCh. 20 - Exercise 20-1 Process vs. job order operations C1...Ch. 20 - Exercise 20-2 Comparing process and job order...Ch. 20 - Prob. 3ECh. 20 - Prob. 4ECh. 20 - Prob. 5ECh. 20 - Prob. 6ECh. 20 - Prob. 7ECh. 20 - Exercise 20-8 Weighted average: Computing...Ch. 20 - Prob. 9ECh. 20 - Prob. 10ECh. 20 - Prob. 11ECh. 20 - Prob. 12ECh. 20 - Exercise 20-13A

FIFO: Completing a process cost...Ch. 20 - Exercise 20-14 Production cost flow and...Ch. 20 - Exercise 20-15 Recording product costs P1 P2 P3...Ch. 20 - Prob. 16ECh. 20 - Prob. 17ECh. 20 - Prob. 18ECh. 20 - Prob. 19ECh. 20 - Prob. 20ECh. 20 - Prob. 21ECh. 20 - Exercise 20-22 Recording costs of labor P2 Prepare...Ch. 20 - Prob. 23ECh. 20 - Prob. 24ECh. 20 - Exercise 20-25 Recording cost flows in a process...Ch. 20 - Exercise 20-26 Interpretation of journal entries...Ch. 20 - Prob. 27ECh. 20 - Prob. 28ECh. 20 - Prob. 29ECh. 20 - Prob. 30ECh. 20 - Prob. 1PSACh. 20 - Prob. 2PSACh. 20 - Prob. 3PSACh. 20 - Problem 20-4A Weighted average: Process cost...Ch. 20 - Problem 20-5AA FIFO: Process cost summary:...Ch. 20 - Prob. 6PSACh. 20 - Prob. 7PSACh. 20 - Prob. 1PSBCh. 20 - Prob. 2PSBCh. 20 - Prob. 3PSBCh. 20 - Prob. 4PSBCh. 20 - Problem 20-5BA FIFO: Process cost summary;...Ch. 20 - Problem 20-6BAFIFO: Costs per equivalent unit;...Ch. 20 - Problem 20-7BA FIFO: Process cost summary,...Ch. 20 - Prob. 20SPCh. 20 - Prob. 20CPCh. 20 - Prob. 1GLPCh. 20 - Apple has entered into contracts that require the...Ch. 20 - Apple and Google work to maintain high-quality and...Ch. 20 - Prob. 3AACh. 20 - Prob. 1DQCh. 20 - Prob. 2DQCh. 20 - Prob. 3DQCh. 20 - Prob. 4DQCh. 20 - Prob. 5DQCh. 20 - Explain in simple terms the notion of equivalent...Ch. 20 - Prob. 7DQCh. 20 - Prob. 8DQCh. 20 - Direct labor costs flow through what accounts in a...Ch. 20 - Prob. 10DQCh. 20 - Prob. 11DQCh. 20 - Prob. 12DQCh. 20 - Prob. 13DQCh. 20 - Companies such as Apple commonly prepare a process...Ch. 20 - Prob. 15DQCh. 20 - Prob. 16DQCh. 20 - Prob. 17DQCh. 20 - How could a company manager use a process cost...Ch. 20 - Explain a hybrid costing system. Identify' a...Ch. 20 - Prob. 1BTNCh. 20 - Prob. 2BTNCh. 20 - Many companies use technology to help them improve...Ch. 20 - Prob. 4BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject = general accountingarrow_forwardOn January 1, Damon Manufacturing's Work-in-Process Inventory account had a balance of $34,800. During the year, $78,200 of direct materials was placed into production. Manufacturing wages incurred amounted to $96,400, of which $71,500 were for direct labor. Manufacturing overhead is allocated on the basis of 140% of direct labor cost. Actual manufacturing overhead was $108,300. Jobs costing $268,500 were completed during the year. What is the December 31 balance of Work-in-Process Inventory?arrow_forwardI want the correct answer with accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY