Concept explainers

The Main consideration while deciding on the method to be followed for assigning and recording the cost incurred in the products is based on the criterion of homogenous products and custom based products.

The Products which are homogenous in nature and is produced in large batches and passes through various processes before its completion to final products need to be recorded under Process costing system.

However, the products which are produced on a special request and is customized product as per customer request and is having unique feature and unique cost from the other product shall be recorded as per Job costing method.

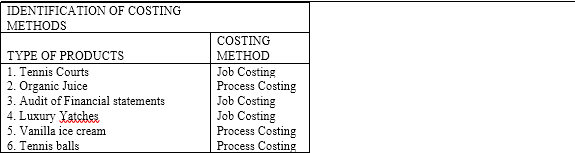

The determination of products to be recorded under Process costing or Job costing.

Answer to Problem 1QS

Solution:

TheProducts shall be recorded under costing methods as follows:

Explanation of Solution

The products which are produced in the batches of large quantities (as these are homogenous products) and passes through various processes before its completion to final product shall be treated under Process costing. Like, Organic Juice, vanilla ice cream and Tennis balls shall be recorded under Process costing.

The products which are customized products and has been made as per customer's specific request shall be recorded under Job costing. Like, Tennis court, Audit of financial statement, Luxury Yatches, etc are made on specific customer request and as per their specific requirement. These products shall be treated under Job costing.

To conclude, it must be said that the products are recorded in the different method of costing based on nature of product.

Want to see more full solutions like this?

Chapter 20 Solutions

FUND.ACCT.PRIN.-CONNECT ACCESS

- See an attachment for details General accounting question not need ai solutionarrow_forwardDon't use ai given answer accountingarrow_forwardCollins Corporation reported $120,000 of income for the year by using variable costing. The company had no beginning inventory, planned and actual production of 60,000 units, and sales of 55,000 units. Standard variable manufacturing costs were $18 per unit, and total budgeted fixed manufacturing overhead was $180,000. If there were no variances, income under absorption costing would be__.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education