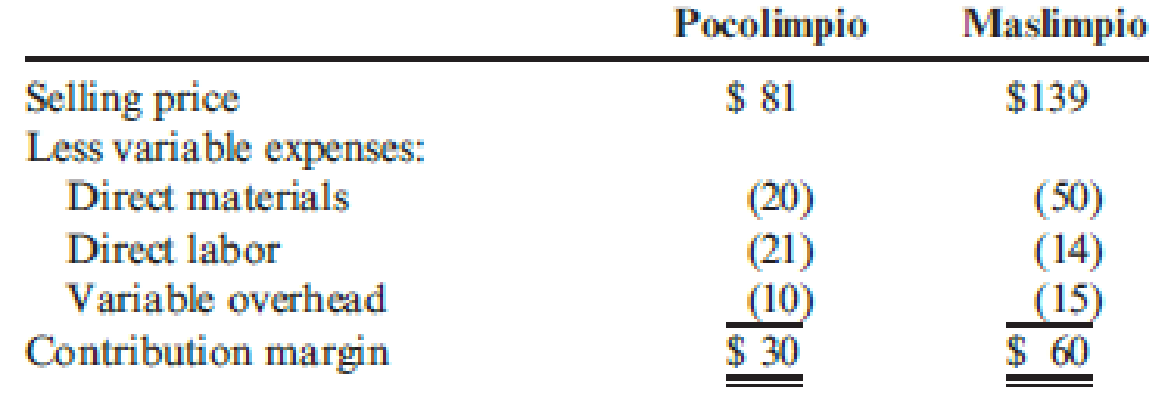

Taylor Company produces two industrial cleansers that use the same liquid chemical input: Pocolimpio and Maslimpio. Pocolimpio uses two quarts of the chemical for every unit produced, and Maslimpio uses five quarts. Currently, Taylor has 6,000 quarts of the material in inventory. All of the material is imported. For the coming year, Taylor plans to import 6,000 quarts to produce 1,000 units of Pocolimpio and 2,000 units of Maslimpio. The detail of each product’s unit contribution margin is as follows:

Taylor Company has received word that the source of the material has been shut down by embargo. Consequently, the company will not be able to import the 6,000 quarts it planned to use in the coming year’s production. There is no other source of the material.

Required:

- 1. Compute the total contribution margin that the company would earn if it could import the 6,000 quarts of the material.

- 2. Determine the optimal usage of the company’s inventory of 6,000 quarts of the material. Compute the total contribution margin for the product mix that you recommend.

- 3. Assume that Pocolimpio uses three direct labor hours for every unit produced and that Maslimpio uses two hours. A total of 6,000 direct labor hours is available for the coming year.

- a. Formulate the linear programming problem faced by Taylor Company. To do so, you must derive mathematical expressions for the objective function and for the materials and labor constraints.

- b. Solve the linear programming problem using the graphical approach.

- c. Compute the total contribution margin produced by the optimal mix.

Trending nowThis is a popular solution!

Chapter 20 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- You invest $1,500 today to purchase a new machine that is expected to generate the following revenues over the next 4 years: Year 0 1 2 3 4 Cash flow -1500 300 475 680 490 Find the internal rate of return (IRR) from this investment. What would be the net present value (NPV) if the interest rate is 10%? An investment project provides cash inflows of $560 per year for 10 years. What is the project’s payback period if the initial cost is $2,500? What if the initial cost is $3,250?arrow_forwardPlease help me with this question general Accountingarrow_forwardAnswer? ? Financial accountingarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning