Concept explainers

Communication

Jamarcus Bradshaw, plant, manager of Georgia Paper Company's papermaking mill, was looking over the cost of production reports for July and August for the Papermaking Department. The reports revealed the following:

| July | August | |

| Pulp and chemicals | $295,600 | $304,100 |

| Conversion cost | 146,000 | 149,600 |

| Total cost | $441,600 | $453,700 |

| Number of tons | + 1,200 | + 1,130 |

| Cost per ton | $ 368 | $ 401.50 |

Jamarcus was concerned about the increased cost per ton from the output of the department. As a result, he asked the plant controller to perform a study to help explain these results. The controller, Leann Brunswick, began the analysis by performing some interviews of key plant personnel in order to understand what the problem might be. Excerpts from an interview with Len Tyson, a paper machine operator, follow:

Len: We have two papermaking machines in the department I have no data, but I think paper machine No. 1 is applying too much pulp and, thus, is wasting both conversion and materials resources. We haven't had repairs on paper machine No. 1 in a while. Maybe this is the problem.

Leann. How does too much pulp result i n wasted resources?

Len: Well, you see, if too much pulp is applied, then we will waste pulp material. The customer will not pay for the extra product we just use more material to make the product. Also, when there is too much pulp, the machine must be slowed down in order to complete the drying process. This results in additional conversion costs.

Leann: Do you have any other suspicions?

Len: Well, as you know, we have two products—green pa per and yellow pa per. They are identical except for the color. The color is added to the papermaking process in the paper machine. I think that during August these two color papers have been behaving differently. I don't have any data, but it seems as though the amount of waste associated with the green paper has increased.

Leann. Why is this?

Len: I understand that there has been a change in specifications for the green paper, starting near the beginning of August This change could be causing the machines to run poorly when making green paper. If that is the case, the cost per ton would increase for green paper.

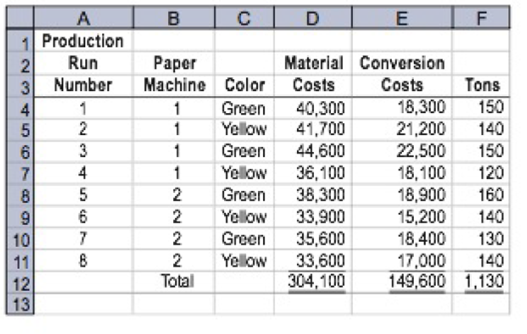

Leann also asked for a database printout providing greater detail on August's operating results. September 9 Requested by: Leann Brunswick Papermaking Department—August detail

Prior to preparing a report, Leann resigned from Georgia Paper Company to start her own business. You have been asked to lake the data that Leann collected and write a memo to Jamarcus Bradshaw with a recommendation to management. Your memo should include analysis of the August data to determine whether the paper machine or the paper color explains the increase in the unit cost from July. Include any supporting schedules that are appropriate. Round all calculations to the nearest cent.

Trending nowThis is a popular solution!

Chapter 20 Solutions

Accounting (Text Only)

- Watts Company uses a predetermined overhead rate based on direct labor hours to apply manufacturing overhead to jobs. The company estimated manufacturing overhead at $306,000 for the year and direct labor hours a 117,000. Actual manufacturing overhead costs incurred during the year totaled $285,000. Actual direct labor hours were 118,000. What was the overapplied or underapplied overhead for the year?arrow_forwardGeneral Accountingarrow_forwardPlease solve this question general Accountingarrow_forward

- Tutor please provide answerarrow_forwardCompany K had total sales of $2,800,000 during the year. The cost of goods sold and depreciation expense were $2,100,000 and $530,000, respectively. The company had a net interest expense of $250,000, and its tax rate is 30%. What is Company K’s net income?arrow_forwardWhat is the effective cost of trade credit under the credit terms of 2/15, net 40? Assume 365 days in a year for your calculations. Round your answers to two decimal places. Do not round intermediate calculations. Accounting 21arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,