FINANCIAL+MANG.-W/ACCESS PRACTICE SET

13th Edition

ISBN: 9781337575614

Author: WARREN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 20, Problem 20.4APR

Salespersons' report and analysis

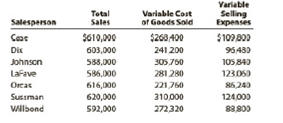

Walthman Industries Inc. employs seven salespersons to sell and distribute- its product throughout the state. Data taken from reports received from the .salespersons during the year ended December 31 are as follows:

Instructions

- 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. (Round whole percent to one digit after decimal point.)

- 2. Which salesperson generated the highest contribution margin ratio for the year and why?

- 3. Briefly list factors other than contribution margin that should be considered in evaluating the performance of salespersons.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

our firm has been the auditor of Caribild Products, a listed company, for a number of years. The

engagement partner has asked you to describe the matters you would consider when planning the audit for

the year ended 31January 2022.

During recent visit to the company you obtained the following information:

(a) The management accounts for the 10 months to 30 November 2021 show a revenue of $260 million and

profit before tax of $8 million. Assume sales and profits accrue evenly throughout the year. In the year

ended 31 January 2021 Caribild Products had sales of $220 million and profit before tax of $16 million.

(b) The company installed a new computerised inventory control system which has operated from 1 June

2021. As the inventory control system records inventory movements and current inventory quantities, the

company is proposing:

(i) To use the inventory quantities on the computer to value the inventory at the year-end

(ii) Not to carry out an inventory count at the year-end

(c) You…

Calculate the free cash flow for this question

Accurate answer

Chapter 20 Solutions

FINANCIAL+MANG.-W/ACCESS PRACTICE SET

Ch. 20 - What types of costs are customarily included in...Ch. 20 - Which type of manufacturing cost (direct...Ch. 20 - Which of the following costs would be included in...Ch. 20 - In the variable costing income statement, how are...Ch. 20 - Since all costs of operating a business are...Ch. 20 - Discuss how financial data prepared on the basis...Ch. 20 - Why might management analyze product...Ch. 20 - Explain why rewarding sales personnel on the basis...Ch. 20 - Discuss the two factors affecting both sales and...Ch. 20 - How is the quantity factor for an increase or a...

Ch. 20 - Explain why service companies use different...Ch. 20 - Prob. 20.1APECh. 20 - Variable costing Marley Company has the following...Ch. 20 - Variable costingproduction exceeds sales Fixed...Ch. 20 - Variable costingproduction exceeds sales Fixed...Ch. 20 - Variable costingsales exceed production The...Ch. 20 - Variable costing sales exceed production The...Ch. 20 - Analyzing income under absorption and variable...Ch. 20 - Analyzing income under absorption and variable...Ch. 20 - Contribution margin by segment The following...Ch. 20 - Contribution margin by segment The following...Ch. 20 - Contribution margin analysis The actual price for...Ch. 20 - Contribution margin analysis The actual variable...Ch. 20 - Inventory valuation under absorption costing and...Ch. 20 - Income statements under absorption costing and...Ch. 20 - Income statements under absorption costing and...Ch. 20 - Cost of goods manufactured, using variable costing...Ch. 20 - Variable costing income statement On June 50, the...Ch. 20 - Absorption costing income statement On July 31,...Ch. 20 - Variable costing income statement The following...Ch. 20 - Estimated income statements, using absorption and...Ch. 20 - Variable and absorption costing Ansara Company had...Ch. 20 - Variable and absorption costingthree products...Ch. 20 - Prob. 20.11EXCh. 20 - Product profitability analysis Power Train Sports...Ch. 20 - Territory and product profitability analysis Coast...Ch. 20 - Prob. 20.14EXCh. 20 - Segment profitability analysis The marketing...Ch. 20 - Prob. 20.16EXCh. 20 - Prob. 20.17EXCh. 20 - Prob. 20.18EXCh. 20 - Contribution margin analysis variable costs Based...Ch. 20 - Variable costing income statement for a service...Ch. 20 - Contribution margin reporting and analysis for a...Ch. 20 - Variable costing income statement and contribution...Ch. 20 - Prob. 20.1APRCh. 20 - Income statements under absorption costing and...Ch. 20 - Absorption and variable costing income statements...Ch. 20 - Salespersons' report and analysis Walthman...Ch. 20 - Prob. 20.5APRCh. 20 - Contribution margin analysis Dozier Industries...Ch. 20 - Absorption and variable costing income statements...Ch. 20 - Income statements under absorption costing and...Ch. 20 - Absorption and variable costing income statements...Ch. 20 - Salespersons' report and analysis Pachec Inc....Ch. 20 - Prob. 20.5BPRCh. 20 - Contribution margin analysis Mathews Company...Ch. 20 - Prob. 20.1CPCh. 20 - Prob. 20.3CPCh. 20 - Prob. 20.4CPCh. 20 - Prob. 20.5CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- SwiftTech Inc.'s stock is currently selling for $95.20 pershare at year-end. This year, the company paid shareholders a $7.50 per share. cash dividend. It also reported earnings per share of $12.40 and had 820,000common shares outstanding at year-end. Calculate the company's dividend yield.arrow_forwardMona Manufacturing applies manufacturing overhead to its cost objects on the basis of 65% of direct material cost. If Job 24B had $84,500 of manufacturing overhead applied to it during June, the direct materials assigned to Job 24B was:arrow_forwardsubject : General accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License