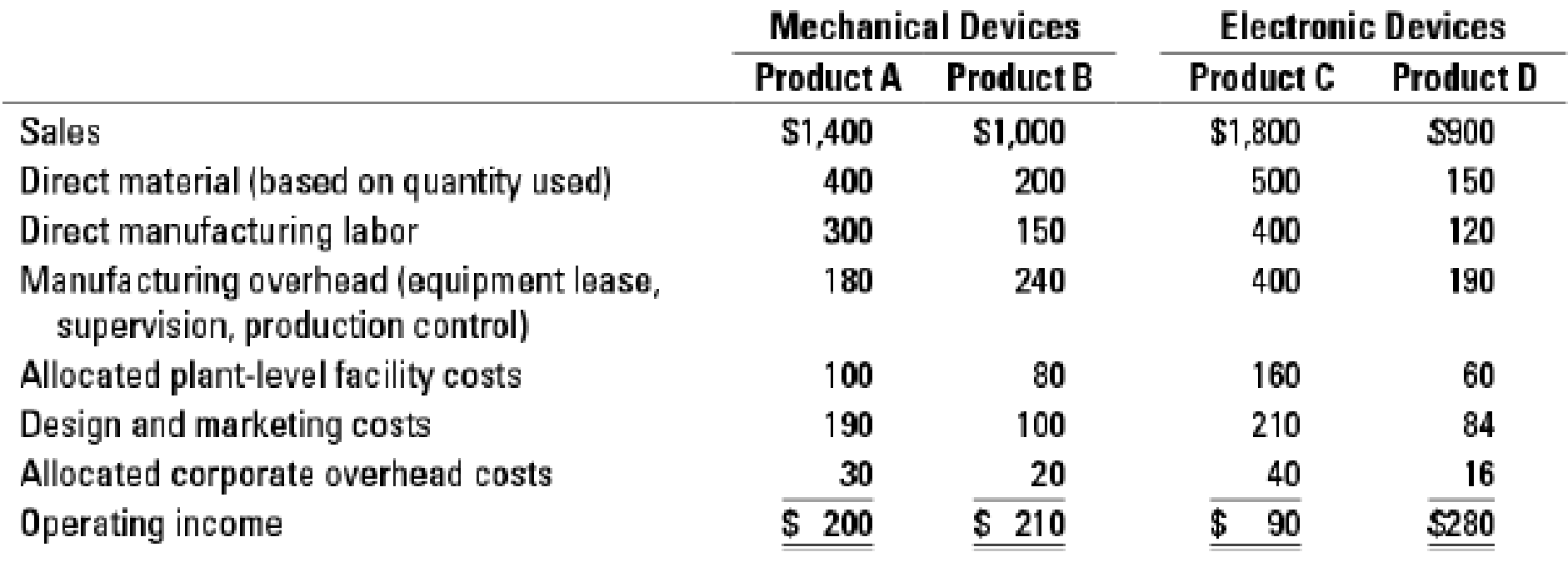

Lean accounting. Reliable Security Devices (RSD) has introduced a just-in-time production process and is considering the adoption of lean accounting principles to support its new production philosophy. The company has two product lines: Mechanical Devices and Electronic Devices. Two individual products are made in each line. Product-line

RSD has determined that each of the two product lines represents a distinct value stream. It has also determined that out of the $400,000 ($100,000 + $80,000 + $160,000 + $60,000) plant-level facility costs, product A occupies 22% of the plant’s square footage, product B occupies 18%, product C occupies 36%, and product D occupies 14%. The remaining 10% of square footage is not being used. Finally, RSD has decided that in order to identify inefficiencies, direct material should be expensed in the period it is purchased, rather than when the material is used. According to purchasing records, direct material purchase costs during the period were as follows:

- 1. What are the cost objects in RSD’s lean accounting system?

Required

- 2. Compute operating income for the cost objects identified in requirement 1 using lean accounting principles. What would you compare this operating income against? Comment on your results.

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

EBK HORNGREN'S COST ACCOUNTING

- Cost Accountingarrow_forwardThe increase in sales?arrow_forwardManzer Enterprises produces premier raspberry jam. Output is measured in pints. Manzer uses the weighted average method. During January, Manzer had the following production data: Units in process, January 1, 60% complete - 36,000 pints Units completed and transferred out - 243,000 pints Units in process, January 31, 40% complete - 65,000 pints Costs: Work in process, January 1 - $54,000 Costs added during January - 344,000 Calculate the unit cost for January. Round your answer to the nearest cent.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub