Concept explainers

Backflush, two trigger points, completion of production and sale (continuation of 20-37). Assume the same facts for Acton Corporation as in Problem 20-37, except that now assume Acton uses a JIT production system and backflush costing with two trigger points for making entries in the accounting system:

- Completion of good finished units of product

- Sale of finished goods

The inventory account is confined solely to finished goods. Any under- or overallocated conversion costs are written off monthly to Cost of Goods Sold.

- 1. Prepare summary

journal entries for August, including the disposition of under- or overallocated conversion costs. Acton has no direct materials variances.

Required

- 2.

Post the entries in requirement 1 to T-accounts for Finished Goods Control, Conversion Costs Control, Conversion Costs Allocated, and Cost of Goods Sold.

20-37 Backflush costing and JIT production. The Acton Corporation manufactures electrical meters. For August, there were no beginning inventories of direct materials and no beginning or ending work in process. Acton uses a JIT production system and backflush costing with three trigger points for making entries in the accounting system:

- Purchase of direct materials

- Completion of good finished units of product

- Sale of finished goods

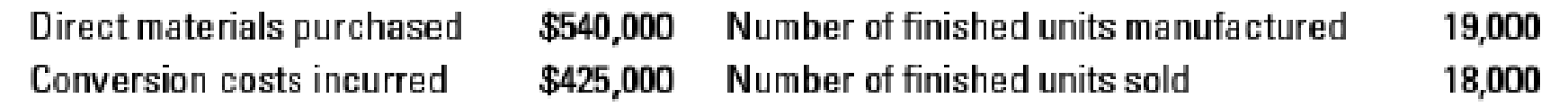

Acton’s August

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Horngren's Cost Accounting, Student Value Edition (16th Edition)

- Alderon Ltd. has 1,200 defective units of a product that cost $3.50 per unit in direct costs and $7.10 per unit in indirect costs when produced last year. The units can be sold as scrap for $4.80 per unit or reworked at an additional cost of $3.10 per unit and sold at the full price of $13.50. The incremental net income (loss) from the choice of reworking the units would be____.arrow_forwardMangesh Analytics, Inc. sells earnings forecasts for European securities. Its credit terms are 2/15, net 40. Based on experience, 60 percent of all customers will take the discount. What is the average collection period? Need answerarrow_forwardWhat would be the cost per equivalent unit ?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College