Concept explainers

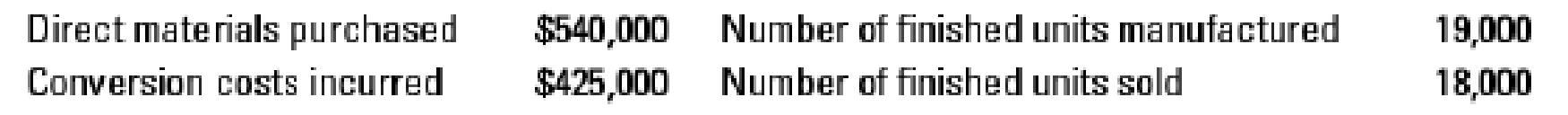

Backflush, two trigger points, materials purchase and sale (continuation of 20-37). Assume the same facts for Acton Corporation as in Problem 20-37, except that now assume Acton uses a JIT production system and backflush costing with two trigger points for making entries in the accounting system:

- Purchase of direct materials

- Sale of finished goods

The inventory account is confined solely to direct materials, whether these materials are in a storeroom, in work in process, or in finished goods. No conversion costs are inventoried. They are allocated to the units sold at standard costs. Any under- or overallocated conversion costs are written off monthly to Cost of Goods Sold.

- 1. Prepare summary

journal entries for August, including the disposition of under- or overallocated conversion costs. Acton has no direct materials variances.

Required

- 2.

Post the entries in requirement 1 to T-accounts for Inventory Control, Conversion Costs Control, Conversion Costs Allocated, and Cost of Goods Sold.

20-37 Backflush costing and JIT production. The Acton Corporation manufactures electrical meters. For August, there were no beginning inventories of direct materials and no beginning or ending work in process. Acton uses a JIT production system and backflush costing with three trigger points for making entries in the accounting system:

- Purchase of direct materials

- Completion of good finished units of product

- Sale of finished goods

Acton’s August

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

COST ACCOUNTING

- choose best answerarrow_forwardAbbey Co. sold merchandise to Gomez Co. on account, $35,000, terms 2/15, net 45. The cost of the merchandise sold was $24,500. Abbey Co. issued a credit memo for $3,600 of undiscounted merchandise returned which originally cost $1,700. Gomez Co. paid the invoice within the discount period. What is the amount of gross profit earned by Abbey Co. on the above transactions? A. $10,500 B. $30,772 C. $7,972 D. $31,400arrow_forwardans plzarrow_forward

- Nonearrow_forwardFast Answer @ general Accountarrow_forwardThe 2019 annual report for Anglo-American PLC, the world's leading global mining company, shows that the firm had $41.065 billion in non-current assets and $11.670 billion in current assets. It reported $13.120 billion in current liabilities and $9.442 billion in non-current liabilities. How much was the equity of Anglo-American PLC worth? Tutor, please provide step by step correct solution to this financial accounting problem. ?!arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning