Concept explainers

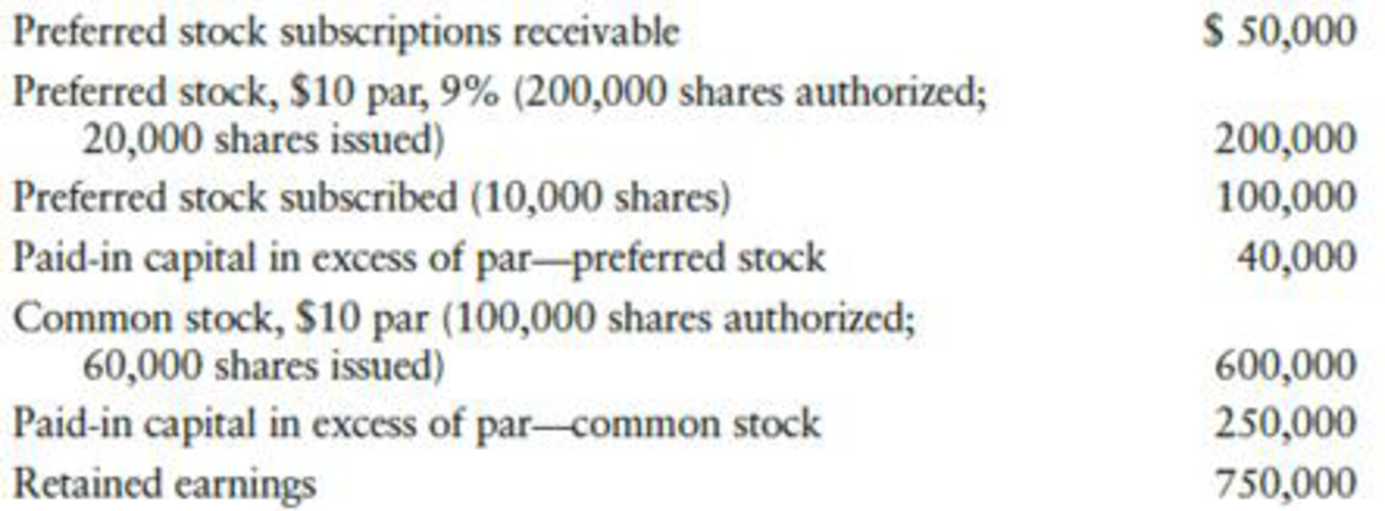

Stockholders’ equity accounts and other related accounts of Gonzales Company as of January 1, 20--, the beginning of its fiscal year, are shown below.

(a) Received $20,000 for the balance due on subscriptions for

(b) Purchased 10,000 shares of common

(c) Received subscriptions for 10,000 shares of common stock at $19 per share, collecting down payments of $45,000.

(d) Issued 15,000 shares of common stock in exchange for land with a fair market value of $290,000.

(e) Sold 5,000 shares of common treasury stock for Si00,000.

(f) Issued 10,000 shares of preferred stock at $11.50 per share, receiving cash.

(g) Sold 3,000 shares of common treasury stock for $17 per share.

REQUIRED

- 1. Prepare general

journal entries for the transactions, identifying each transaction by letter. - 2.

Post the journal entries to appropriate T accounts. The cash account has a beginning balance of $300,000. - 3. Prepare the stockholders’ equity section of the

balance sheet as of December 31, 20--. Net income for the year was $825,000 and dividends of $400,000 were paid.

Trending nowThis is a popular solution!

Chapter 20 Solutions

College Accounting, Chapters 1-9 (New in Accounting from Heintz and Parry)

- Variable manufacturing overhead:2.80, fixed manufacturing overhead:5arrow_forwardCan you help me with accounting questionsarrow_forwardYejun works for New & Old Apparel, which pays employees on a semimonthly basis. Yejun's annual salary is $194,800. Required: Calculate the following: Note: Round your final answers to 2 decimal places.arrow_forward

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,