Concept explainers

Credit Policy at Howlett Industries

Sterling Wyatt, the president of Howlett Industries, has been exploring ways of improving the company’s financial performance. Howlett manufactures and sells office equipment to retailers. The company’s growth has been relatively slow in recent years, but with an expansion in the economy, it appears that sales may increase more rapidly in the future. Sterling has asked Andrew Preston, the company’s treasurer, to examine Howlett’s credit policy to see if a change can help increase profitability.

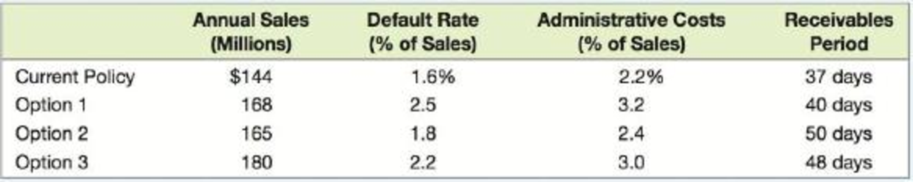

The company currently has a policy of net 30. As with any credit sales, default rates are always of concern. Because of Howlett’s screening and collection process, the default rate on credit is currently only 1.6 percent. Andrew has examined the company’s credit policy in relation to other vendors, and he has found three available options.

The first option is to relax the company’s decision on when to grant credit. The second option is to increase the credit period to net 45, and the third option is a combination of the relaxed credit policy and the extension of the credit period to net 45. On the positive side, each of the three policies under consideration would increase sales. The three policies have the drawbacks that default rates would increase, the administrative costs of managing the firm’s receivables would increase, and the receivables period would increase. The effect of the credit policy change would impact all four of these variables to different degrees. Andrew has prepared the following table outlining the effect on each of these variables:

Howlett’s variable costs of production are 45 percent of sales, and the relevant interest rate is a 6 percent effective annual rate.

1. Which credit policy should the company use?

To evaluate: The credit policy of the firm.

Introduction:

Credit policy refers to a set of procedures that include the terms and conditions for providing goods on credit and principles for making collections.

Answer to Problem 1M

Company H should select Option 1, because it has the highest net present value (NPV) of $34,226,117.98 compared to other two options.

Explanation of Solution

The formula to calculate the average daily sales under current policy:

Hence, the average sales under current policy is $394,520.55.

The formula to calculate average daily variable costs under current policy:

Hence, the variable costs under current policy is $177,534.25.

The formula to calculate the average daily default under current policy:

Hence, the average daily default under current policy is $6312.33.

The formula to calculate average daily administrative cost under current policy:

Hence, the average administrative costs under current policy is $8,679.45.

The formula to calculate the interest rate for the collection period:

Hence, the interest rate is 0.61%.

The formula to calculate the net present value (NPV) under current policy:

Hence, the NPV under current policy is $32,936,321.48.

Option 1:

The formula to calculate the average daily sales under option 1:

Hence, the average daily sales under option 1 is $460,273.97.

The formula to calculate average daily variable costs under option 1:

Hence, the average daily variable costs under option 1 is $207,123.29.

The formula to calculate average daily default under option 1:

Hence, average daily default under option 1 is $11,506.85.

The formula to calculate average daily administrative cost under option 1:

Hence, the average daily administrative costs under option 1 is $14,728.77.

The formula to calculate interest rate for the for collection period:

Hence, the interest rate is 0.659%.

The formula to calculate the net present value (NPV) under option 1:

Hence, the NPV under option 1 is $34,226,117.98.

Option 2:

The formula to calculate the average daily sales under option 2:

Hence, the average daily sales under option 2 is $452,054.79.

The formula to calculate average daily variable costs under option 2:

Hence, the average daily variable costs under option 2 is $203,424.66.

The formula to calculate average daily default under option 2:

Hence, the average daily default under option 2 is $8,136.99.

The formula to calculate average daily administrative cost under option 2:

Hence, the average daily administrative costs under option 2 is $10,849.32.

The formula to calculate interest rate for the for collection period:

Hence, the interest rate is 0.852%.

The formula to calculate NPV under option 2:

Hence, the NPV under option 2 is $27,632,189.89.

Option 3:

The formula to calculate the average daily sales under current policy:

Hence, the average daily sales under option 3 is $493,150.68.

The formula to calculate average daily variable costs under option 3:

Hence, the average daily variable costs under option 3 is $221,917.81.

The formula to calculate average daily default under option 3:

Hence, the average daily default under option 3 is $10,849.32.

The formula to calculate average daily administrative cost under option 3:

Hence, the average daily administrative costs under option 3 is $14,794.52.

The formula to calculate interest rate for collection period:

Hence, the interest rate is 0.792%.

The formula to calculate NPV under option 3:

Hence, the NPV under option 3 is $30,786,798.099.

Want to see more full solutions like this?

Chapter 20 Solutions

Fundamentals of Corporate Finance

- Equipment is worth $339,976. It is expected to produce regular cash flows of $50,424 per year for 18 years and a special cash flow of $75,500 in 18 years. The cost of capital is X percent per year and the first regular cash flow will be produced today. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forwardYou plan to retire in 8 years with $X. You plan to withdraw $114,200 per year for 21 years. The expected return is 17.92 percent per year and the first regular withdrawal is expected in 9 years. What is X? Input instructions: Round your answer to the nearest dollar. $ 523472 0arrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Orange Furniture would let you make quarterly payments of $12,540 for 6 years at an interest rate of 1.26 percent per quarter. Your first payment to Orange Furniture would be in 3 months. River Furniture would let you make X monthly payments of $41,035 at an interest rate of 0.73 percent per month. Your first payment to River Furniture would be today. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forward

- I keep getting it wrongarrow_forwardYou plan to retire in 5 years with $429,887. You plan to withdraw $67,100 per year for 12 years. The expected return is X percent per year and the first regular withdrawal is expected in 6 years. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forwardYou plan to retire in 10 years with $385,337. You plan to make X withdrawals of $59,856 per year. The expected return is 17.26 percent per year and the first regular withdrawal is expected in 10 years. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forward

- My answer keeps having an x for incorrect what is the correct answerarrow_forwardYou plan to retire in 4 years with $659,371. You plan to withdraw $100,000 per year for 12 years. The expected return is X percent per year and the first regular withdrawal is expected in 4 years. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forwardAnswers wrongarrow_forward

- You plan to retire in 6 years with $1,124,632. You plan to make X withdrawals of $148,046 per year. The expected return is 10.81 percent per year and the first regular withdrawal is expected in 7 years. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forwardEquipment is worth $206,286. It is expected to produce regular cash flows of $13,729 per year for 25 years and a special cash flow of $10,100 in 25 years. The cost of capital is X percent per year and the first regular cash flow will be produced in 1 year. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Silver Leisure would let you make quarterly payments of $3,530 for 7 years at an interest rate of 2.14 percent per quarter. Your first payment to Silver Leisure would be today. Pond Leisure would let you make X monthly payments of $18,631 at an interest rate of 1.19 percent per month. Your first payment to Pond Leisure would be in 1 month. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning