Fundamental Accounting Principles -Hardcover

22nd Edition

ISBN: 9780077862275

Author: John J Wild, Ken Shaw Accounting Professor, Barbara Chiappetta Fundamental Accounting Principles

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

thumb_up100%

Chapter 20, Problem 19E

Exercise 20-19

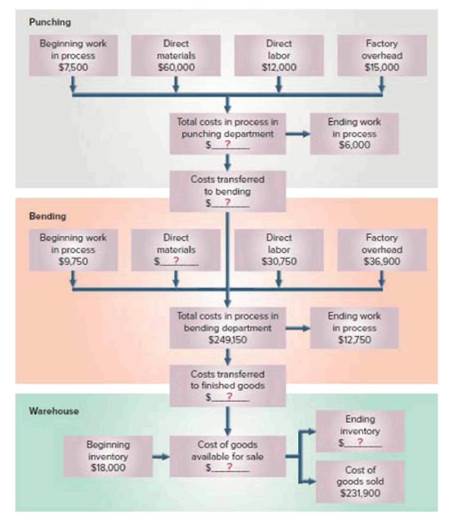

Production cost flows P1 P2 P3 P4

The flowchart below shows the August production activity of the punching and bending departments of Wire Bos Company. Use the amounts shown on the flowchart to compute the missing numbers identified by question marts.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Ans plz

What are annual credit sales ? General accounting

The next dividend payment by Skippy Inc. will be $3.45. The dividends are anticipated to maintain a growth rate of 4.2% forever. If the stock currently sells for $37.95 per share, what is the required rate of return?

Comprehensive Holdings just paid a dividend of $2.95 per share on its stock. The dividends are expected to grow at a constant rate of 4.8% forever. If investors require a return of 12% on the stock, what is the current price? What will be the price in 3 years? In 7 years?

Citibank expects to pay a dividend of $2 per share on its common stock at the end of this year. The growth rate of the dividend is 8% for the next 2 years. After that, the dividends are expected to grow at a constant growth rate of 5% per year forever. The required rate of return on the company’s stock is 11%. What is the price of Citibank stock today?

A firm pays a current dividend of $3, which is expected to grow at a rate of 4% indefinitely. If the current value of the firm’s shares is $53,…

Chapter 20 Solutions

Fundamental Accounting Principles -Hardcover

Ch. 20 - Prob. 1DQCh. 20 - Prob. 2DQCh. 20 - Prob. 3DQCh. 20 - Prob. 4DQCh. 20 - Prob. 5DQCh. 20 - Prob. 6DQCh. 20 - Prob. 7DQCh. 20 - Prob. 8DQCh. 20 - Prob. 9DQCh. 20 - Prob. 10DQ

Ch. 20 - Prob. 11DQCh. 20 - Prob. 12DQCh. 20 - Prob. 13DQCh. 20 - Prob. 14DQCh. 20 - Prob. 15DQCh. 20 - Prob. 16DQCh. 20 - Prob. 1QSCh. 20 - Prob. 2QSCh. 20 - Prob. 3QSCh. 20 - Prob. 4QSCh. 20 - Prob. 5QSCh. 20 - Prob. 6QSCh. 20 - Prob. 7QSCh. 20 - Prob. 8QSCh. 20 - Prob. 9QSCh. 20 - Prob. 10QSCh. 20 - Prob. 11QSCh. 20 - Prob. 12QSCh. 20 - Prob. 13QSCh. 20 - Prob. 14QSCh. 20 - Prob. 15QSCh. 20 - Prob. 16QSCh. 20 - Prob. 17QSCh. 20 - Prob. 18QSCh. 20 - Prob. 19QSCh. 20 - Prob. 20QSCh. 20 - Prob. 21QSCh. 20 - Prob. 22QSCh. 20 - Prob. 23QSCh. 20 - Recording costs of labor P2 Prepare journal...Ch. 20 - Prob. 25QSCh. 20 - Prob. 26QSCh. 20 - Prob. 27QSCh. 20 - Prob. 1ECh. 20 - Prob. 2ECh. 20 - Prob. 3ECh. 20 - Prob. 4ECh. 20 - Prob. 5ECh. 20 - Prob. 6ECh. 20 - Prob. 7ECh. 20 - Prob. 8ECh. 20 - Prob. 9ECh. 20 - Prob. 10ECh. 20 - Prob. 11ECh. 20 - Prob. 12ECh. 20 - Prob. 13ECh. 20 - Prob. 14ECh. 20 - Prob. 15ECh. 20 - Prob. 16ECh. 20 - Prob. 17ECh. 20 - Prob. 18ECh. 20 - Exercise 20-19 Production cost flows P1 P2 P3 P4...Ch. 20 - Exercise 20-20

Weighted average: Process cost...Ch. 20 - Exercise 20-21

Recording costs of...Ch. 20 - Prob. 22ECh. 20 - Prob. 23ECh. 20 - Exercise 20-24

Recording cost of completed...Ch. 20 - Prob. 25ECh. 20 - Prob. 26ECh. 20 - Prob. 27ECh. 20 - Prob. 1APSACh. 20 - Prob. 2APSACh. 20 - Prob. 3APSACh. 20 - Prob. 4APSACh. 20 - Prob. 5APSACh. 20 - Prob. 6APSACh. 20 - Prob. 7APSACh. 20 - Prob. 1BPSBCh. 20 - Prob. 2BPSBCh. 20 - Prob. 3BPSBCh. 20 - Prob. 4BPSBCh. 20 - Prob. 5BPSBCh. 20 - Prob. 6BPSBCh. 20 - Prob. 7BPSBCh. 20 - Prob. 20SPCh. 20 - Prob. 20CPCh. 20 - Prob. 1GLPCh. 20 - Prob. 1BTNCh. 20 - Prob. 2BTNCh. 20 - Prob. 3BTNCh. 20 - Prob. 4BTNCh. 20 - Prob. 5BTNCh. 20 - Prob. 6BTNCh. 20 - Prob. 7BTNCh. 20 - Prob. 8BTNCh. 20 - Prob. 9BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hyundai Company had beginning raw materials inventory of $29,000. During the period, the company purchased $115,000 of raw materials on account. If the ending balance in raw materials was $18,500, the amount of raw materials transferred to work in process inventory is?arrow_forwardComputing the gross profit percentage Edible Art earned net sales revenue of $75,050,000 in 2019. The cost of goods sold was $55,650,000, and net income reached $13,000,000, the company s highest ever. Compute the company s gross profit percentage for 2019.arrow_forwardcorrect answer pleasearrow_forward

- Computing the gross profit percentage Edible Art earned net sales revenue of $75,050,000 in 2019. The cost of goods sold was $55,650,000, and net income reached $13,000,000, the company s highest ever. Compute the company s gross profit percentage for 2019. Answerarrow_forwardNeed help this questionarrow_forwardAverage leval of receivables?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Inspection and Quality control in Manufacturing. What is quality inspection?; Author: Educationleaves;https://www.youtube.com/watch?v=Ey4MqC7Kp7g;License: Standard youtube license