FISH & CHIPS INC, PART I

LEASE ANALYSIS Martha Millon,

If the computer is purchased, a maintenance contract must be obtained at a cost of $25,000, payable at the beginning of each year. After 4 years, the computer will be sold. Millon′s best estimate of its residual value at that time is $125,000. Because technology is changing rapidly however, the residual value is uncertain.

As an alternative. National Leasing is willing to write a 4-year lease on the computer, including maintenance, for payments of $340,000 at the beginning of each year. Fish 4c Chips′s marginal federal-plus-state tax rate is 40%. Help Millon conduct her analysis by answering the following questions.

a. 1. Why is leasing sometimes referred to as "off-balance-sheet" financing?

2. What is the difference between a capital lease and an operating lease?

3. What effect does leasing have on a firm′s capital structure?

b. 1. What is Fish & Chips's

2. Explain the rationale for the discount rate you used to find the PV.

c. 1. What is Fish & Chips′s present value cost of leasing the computer? (Hint: Again, construct a time line.)

2. What is the net advantage to leasing? Does your analysis indicate that the firm should buy or lease the computer? Explain.

d. Now assume that Millon believes that the computer′s residual value could be as low as $0 or as high as $250,000, but she stands by $125,000 as her expected value. She concludes that the residual value is riskier than the other cash flows in the analysis, and she wants to incorporate this differential risk into her analysis. Describe how this can be accomplished. What effect will it have on the lease decision?

e. Millon knows that her firm has been considering moving its headquarters to a new location, and she is concerned that these plans may come to fruition prior to the expiration of the lease. If the move occurs, the company would obtain new computers; hence, Millon would like to include a cancellation clause in the lease contract. What effect would a cancellation clause have on the risk of the lease?

a.1.

To discuss: The reason why leasing is referred as an off-balance-sheet financing.

Introduction:

Off-balance sheet financing is a type of financing where the firm does not include a liability on its balance sheet. This is an accounting term and has impact on firm’s debt level and liabilities.

Explanation of Solution

The reason why leasing is referred as an off-balance-sheet financing is as follows:

At the time when an asset is purchased, this asset will be exhibited on the left-hand side balance sheet’s left hand side and has to offset equity or debt on the balance sheet’s right-hand side. However, when an asset is leased and the lease is not segregated into a capital lease, then it will not be exhibited straightly on the balance sheet. This will only be reported in the footnotes of the financial statement of the company. Therefore, this is the main reason for a leasing, which is being termed as off-balance sheet financing.

a.2

To discuss: The difference between the operating and capital lease.

Introduction:

Capital lease is termed as contract wherein lesser agrees to transfer ownership right to leasee once the completion of lease time. It is a long term lease contracts. There are also termed as finance lease.

Operating lease is a lease on assets, which is not fully amortized in the non-cancelable period. It is considered as a short term lease.

Explanation of Solution

Capital leases are distinguished from operating leases in three factors which are as follows:

- Capital lease does not gives maintenance services.

- Capital lease are not cancelable

- It is fully amortized

a.3.

To discuss: The effect that leasing has on the capital structure of the firm.

Explanation of Solution

The effect that leasing has on the capital structure of the firm is as follows:

Leasing is one substitute for debt financing. The lease payments are considered as a contractual obligation between the corresponding parties. The firm would face bankruptcy when the lease payment is not paid time. As a result the leasing uses up a firm’s debt capacity.

For instance, the F Company’s optimal capital structure comprise of 50 percent of equity and 50 percent debt. At the time when the company leases half of its assets, then the reaming half of asset will be financed by the common equity.

b.1.

To determine: The present value cost of owing the computer.

Explanation of Solution

Given information:

F Company has decided to purchase a new computer system on lease. The cost of computer is $1,200,000 and company can provide a term loan for the total amount of 10%. This loan is amortized over the 4-years life of the computer. The MACRS rates are 30 percent, 45 percent, 15 percent, and 7 percent. The maintenance cost of the computer will be $25,000 which is payable in the beginning of every year.

The computer will be sold after 4-years period and its residual value is $125,000. The national leasing is willing to offer 4-years lease on the computer including maintenance for payment of $340,000 and tax rate is 40 percent.

Construct a depreciation schedule in order to determine the cost of owing:

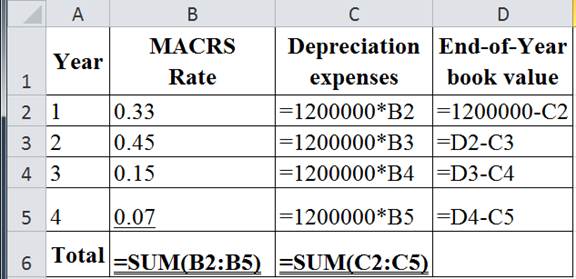

The below table show the Excel formula to compute the depreciation expenses and end-of-year book value:

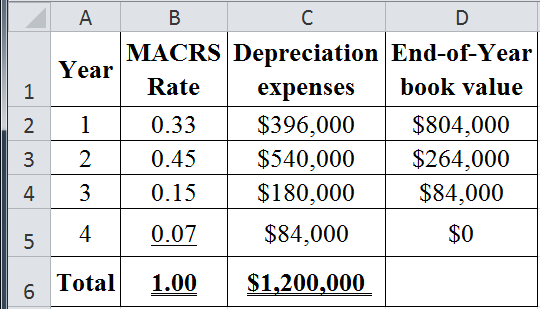

The table below shows the calculated value of depreciation expenses and end-of-year book value:

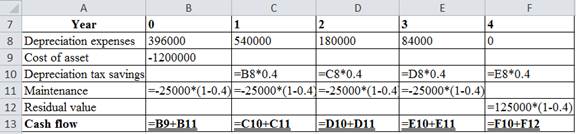

The table below shows the Excel formula to compute the cash flow:

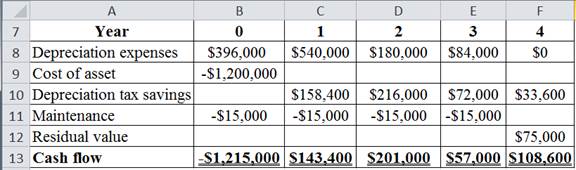

The table below shows the calculated value of cash flows:

Compute the after-tax interest rate:

Hence, the after-tax interest rate is 0.06.

Compute the present value of the cost of owing:

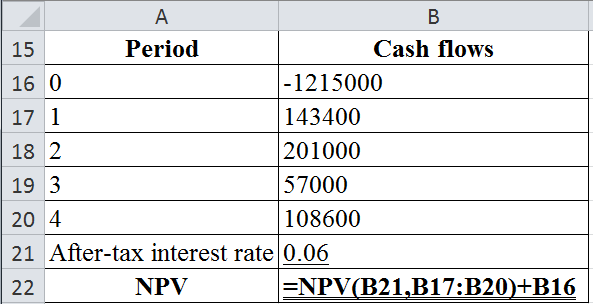

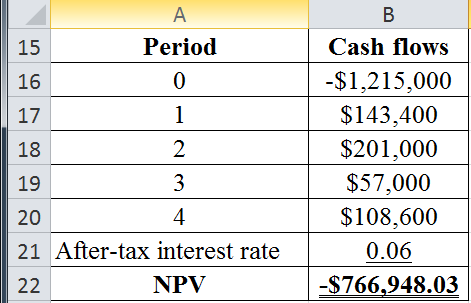

The table below shows the Excel Formula to compute the present value of the cost of owing:

The table below shows the calculated value of present value of the cost of owing:

The present value of the cost of owing is −$766,948.03.

b.2.

To discuss: The rationale for the discount rate that is utilised to determine the present value.

Explanation of Solution

The rationale for the discount rate that is used to determine the present value is as follows:

The discount rate used to find the present value depends on the riskless of the cash flows stream and even the level of interest rate. The cost of owing cash flows without including the residual value is fixed by means of the contract. As a result, it is not very risky. However, they have almost the similar risk as the company’s debt flows that are also contractual in nature.

The leasing process use debt capacity, so the similar impact on the financial risk such as debt financing. Therefore, the appropriate interest rate is the cost of debt of the F Company since the flows are after-tax flows. In this case, the F Company’s before-tax debt cost is 10 percent and tax rate is 40 percent. Therefore, the after-tax cost of debt will be 6 percent

c.1.

To determine: The present value cost of leasing the computer.

Explanation of Solution

Given information:

F Company has decided to purchase a new computer system on lease. The cost of computer is $1,200,000 and company can give a term loan for the total amount of 10%. This loan is amortized for the 4-years life of the computer. The MACRS rates are 30 percent, 45 percent, 15 percent, and 7 percent. The maintenance cost of the computer will be $25,000 which is payable in the beginning of every year.

The computer will be sold after 4-years period and its residual value is $125,000. The national leasing is wishing to offer 4-years lease on the computer including maintenance for payment of $340,000 and tax rate is 40 percent.

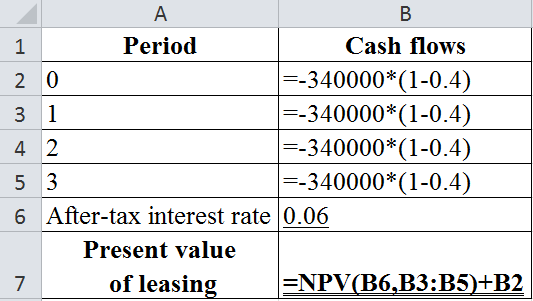

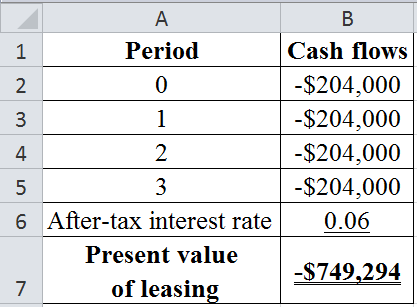

Compute the present value of leasing:

The table below shows the Excel formula to compute the present value of leasing:

The table below shows the calculated value of present value of leasing:

Hence, the present value of leasing is −$749,294.

c.2.

To determine: The net advantage to leasing and whether the analysis indicates that the firm must purchase or lease the computer.

Explanation of Solution

Given information:

F Company has decided to purchase a new computer system on lease. The cost of computer is $1,200,000 and company can give a term loan for the total amount of 10 %. This loan is amortized for the 4-years life of the computer. The MACRS rates are 30 percent, 45 percent, 15 percent, and 7 percent. The maintenance cost of the computer will be $25,000 which is payable in the starting of every year.

The computer will be sold after 4-years period and its residual value is $125,000. The national leasing is ready to offer 4-years lease on the computer including maintenance for payment of $340,000 and tax rate is 40 percent.

The formula to calculate the net advantage to leasing is as follows:

Calculate the net advantage to leasing:

Hence the net advantage to leasing is $17,654.03. Here, the net advantage to leasing has a positive value. The cost of owing outweighs the cost of leasing. Therefore, the F Company can lease the computer system than buying it.

d.

To discuss: The way for accomplishing the task and effect that will have on the leasing decision.

Explanation of Solution

The way for accomplishing the task and effect that will have on the leasing decision is as follow:

The rate utilized to discount the residual value cash flow must be raised in order to account for an increased risk. This can result to a lower present value. As a result, the lower present value can leads to a greater cost of owing because the residual value is an inflow. Therefore, the higher risk of the residual value can result in the greater cost of owing and even the leasing becomes much attractive in this stage.

The asset owner bears the residual value risk, so the leasing passes the risk to the lessor. Here, the lessor identifies this risk factor, so the assets with highly uncertain residual value can carry maximum lease payments as compared to the assets with relatively certain residual values.

e.

To discuss: The effect of a cancellation clause has on the risk of the lease.

Explanation of Solution

The effect of a cancellation clause has on the risk of the lease is as follows:

The cancelation clause will lower the risk of the lease for the F Company (lessee). It is because the company is not being obligated to make the payments on lease in all terms. Here, the company can terminate the lease when it does not need a computer or wants to change into a more technological advanced system. On the other hand, a cancellation clause can make the contract more risky for the lessor. As a result, the lessor will not only bear the residual value risk but also the uncertainty of when the contract would be cancelled.

The lessor must increase the annual lease payment to account for extra risks. Moreover, the lessor must include clauses that will prohibit cancellation for some period or impose a penalty charges for cancellation, which might reduce on the cancellation of the lease over time.

Want to see more full solutions like this?

Chapter 20 Solutions

Mindtap Finance, 1 Term (6 Months) Printed Access Card For Brigham/houston's Fundamentals Of Financial Management, 15th

- Light Sweet Petroleum, Inc., is trying to evaluate a generation project with the following cash flows. If the company requires a return of 12 percent on its investments, what is the project's NPV? What are the IRRS for the project? Year 0 $ (45,000,000) Year 1 $ 71,000,000 Year 2 $ (15,000,000) Required return 12% Complete the following analysis. Do not hard code values in your calculations. Use a "Guess" of .99 to calculate the higher IRR and -.99 to calculate the lower IRR. You must use the built-in Excel functions to answer this question. NPV Higher IRR Lower IRRarrow_forwardBethesda Mining Company reports the following balance sheet information for 2021 and 2022: Assets Current assets 2021 BETHESDA MINING COMPANY Balance Sheets as of December 31, 2021 and 2022 Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable 2021 $ 190,422 85,520 2022 Cash Accounts receivable Inventory $ 47,858 61,781 124,912 $ 60,783 82,139 190,747 Total $ 275,942 Total $ 234,551 $ 333,669 Long-term debt $ 238,000 Owners' equity Fixed assets Common stock and paid-in surplus Accumulated retained earnings $ 217,000 161,656 Net plant and equipment Total assets $ 658,047 $ 589,628 $ 378,656 $ 892,598 $ 923,297 Total liabilities and owners' equity $ 892,598 Total 2022 $ 198,111 137,088 $ 335,199 $ 174,750 $ 217,000 196,348 $ 413,348 $ 923,297 Based on the balance sheets given, calculate the following financial ratios for each year: Calculate the following financial ratios for each year: a. Current ratio. Note: Do not round intermediate calculations and round…arrow_forwardMary decides to buy a Treasury note futures contract for delivery of $100,000 face amount in September, at a price of 120′24.0. At the same time, Eric decides to sell a Treasury note futures contract if he can get a price of 120′24.0 or higher. The exchange, in turn, agrees to sell one Treasury note contract to Mary at 120′24.0 and to buy one contract from Eric at 120′24.0. The price of the Treasury note decreases to 120′10.5. Calculate Eric's balance on margin account. Assume that initial margin is $1,890. Please note that loss should be entered with minus sign. Round the answer to two decimal places.arrow_forward

- Don't used hand raiting and don't used Ai solutionarrow_forward(2x76m A = + S) Waterfront Inc. wishes to borrow on a short-term basis without reducing its current ratio below 1.25. At present its current assets and current liabilities are $1,600 and $1,000 respectively. How much can Waterfront Inc. borrow?arrow_forwardExpected Standard Stock Return Beta Deviation A B 12% 16 0.75 1.25 28% 37 The market index has a standard deviation of 22% and the risk-free rate is 9%. Required: a. What are the standard deviations of stocks A and B? b. Suppose that we were to construct a portfolio with proportions: Stock A Stock B T-bills 0.25 0.50 0.25 Compute the expected return, beta, nonsystematic standard deviation, and standard deviation of the portfolio. Complete this question by entering your answers in the tabs below. Required A Required B What are the standard deviations of stocks A and B? Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Stock A 0.33 % Stock B 0.46 %arrow_forward

- Don't used hand raiting and don't used Ai solutionarrow_forwardCould you explain what are the Biblical principles researchers that can follow to mitigate researcher bias? How to use of Biblical ethics to synthesize the literature to avoid misrepresentation of the literature? How researchers can demonstrate Biblical ethics when collecting and analyzing data?arrow_forwardThe manager of company A is thinking about adding an air conditioner to the office. The AC will cost $1630 to buy and install. The manager plans to use the AC for 5 years and each year's depreciation rate is 18% of the purchase price. The manager expects to sell the AC in 5 years for $880.The tax rate is 15% and the company's WACC is 15%. If the manager considers this purchase of AC as an investment, what is the NPV (keep two decimal places and assume that the AC will not affect the operations of the company)?arrow_forward

- Problem 5-5 Calculating IRR A firm has a project with the following cash flows: Year Cash Flow 0 -$27,700 1 23 11,700 14,700 10,700 The appropriate discount rate is 18 percent. What is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) IRR %arrow_forwardCould you help to explain: How researchers can demonstrate Biblical ethics when conducting a literature review? How researchers can demonstrate Biblical ethics when communicating with a research team or university committee? How researchers can demonstrate Biblical ethics when recruiting participants. Provide Biblical and/or scholarly support for all assertions?arrow_forwardCould you please help explain what is the Biblical ethics in research? How do they establish a firm ethical foundation based on Biblical principles? What should they do to reduce the researcher bias as well as misrepresenting the literature and study findings? How Christians would like to ensure of being obedient to God in the research and study conduct?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning