EBK HORNGREN'S ACCOUNTING

12th Edition

ISBN: 9780134487212

Author: MILLER-NOBLES

Publisher: PEARSON CO

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

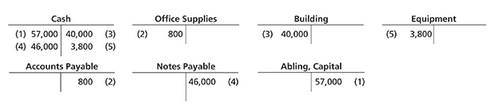

Chapter 2, Problem E2.21E

Journalizing transactions from T-accounts

Learning Objective 3

In December 2018, the first five transactions of Abling’s Lawn Care Company have been posted to the T−accounts. Prepare the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The monthly cost (in dollars) of a data plan for Mercury Communications is a linear function of the total data usage (in gigabytes). The monthly cost for 25 gigabytes of data is $45.50 and the monthly cost for 40 gigabytes is $58.00. What is the monthly cost for 28 gigabytes of data?

Refer to the information given below:

a. The June 30 cash balance in the general ledger is $1,940.

b. The June 30 balance shown on the bank statement is $1,168.

c. Checks issued but not returned with the bank statement were Number 712 for $33 and Number 723 for $160.

d. A deposit made late on June 30 for $800 is included in the general ledger balance but not in the bank statement balance.

e. Returned with the bank statement was a notice that a customer's check for $120 that was deposited on June 24 had been returned

because the customer's account was overdrawn.

f. During a review of the checks that were returned with the bank statement, it was noted that the amount of Check Number 728 was

$72 but that in the company's records supporting the general ledger balance, the check had been erroneously recorded as a

payment of an account payable in the amount of $27.

Required:

Prepare a bank reconciliation as of June 30 from the above information.

Note: Total the entries of the same account…

What Is the equity at the end of the year?

Chapter 2 Solutions

EBK HORNGREN'S ACCOUNTING

Ch. 2 - The detailed record of the changes in a particular...Ch. 2 - Which of the following accounts is a liability?...Ch. 2 - The left side of an account is used to record...Ch. 2 - Which of the following statements is correct?...Ch. 2 - Your business purchased office supplies of $2,500...Ch. 2 - Sedlor Properties puchased office supplies on...Ch. 2 - Posting a $2,500 purchase of office supplies on...Ch. 2 - Pixel Copies recorded a cash collection on account...Ch. 2 - Which sequence correctly summarizes the accounting...Ch. 2 - Nathvile Laundry reported assets of $800 and...

Ch. 2 - Identify the three categones of the accounting...Ch. 2 - What is the purpose of the chart of accounts?...Ch. 2 - What does a ledger show? What’s the difference...Ch. 2 - Accounng uses a double-entry system. Explain what...Ch. 2 - What is T-account? On which side is the debit? On...Ch. 2 - Prob. 6RQCh. 2 - Prob. 7RQCh. 2 - Identify which types of accounts have a normal...Ch. 2 - What are source documents? Provide examples of...Ch. 2 - Prob. 10RQCh. 2 - Explain the five steps in journalizing and posting...Ch. 2 - What are the four parts of a journal entry?Ch. 2 - What is involved in the posting process?Ch. 2 - What is the purpose of the trial balance?Ch. 2 - What is the differnce between the trial balance...Ch. 2 - If total debits equal total credits on the trial...Ch. 2 - What is the calculation for the debt ratio?...Ch. 2 - Identifying accounts Learning Objective 1 Consider...Ch. 2 - Identifying increases and decreases in accounts...Ch. 2 - Identifying normal balances Learning Objective 2...Ch. 2 - Prob. S2.4SECh. 2 - Journalizing transactions Learning Objective 3...Ch. 2 - S2-6 Journalizing transactions

Learning...Ch. 2 - Journalizing transactions and posting to...Ch. 2 - Prob. S2.8SECh. 2 - Prob. S2.9SECh. 2 - Using accounting vocabulary Learning Objectives 1,...Ch. 2 - Creating a chart of accounts Learning Objective 1...Ch. 2 - Identifying accounts, increases in accounts, and...Ch. 2 - Identifying increases and decreases in accounts...Ch. 2 - Identifying source documents Learning Objective 3...Ch. 2 - Analyzing and journalizing transactions Learing...Ch. 2 - Analyzing and journalizing transactions Leaning...Ch. 2 - Posting journal entries to T-accounts Learning...Ch. 2 - Analyzing and journalizing transactions Learning...Ch. 2 - Posting journal entries to four-column accounts...Ch. 2 - Analyzing transactions from T-accounts Learning...Ch. 2 - Journalizing transactions from T-accounts Learning...Ch. 2 - Preparing a trial balance Learning Objective 4...Ch. 2 - Preparing a trial balance from T-accounts Learning...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Analyzing accounting errors Learning Ojective 4...Ch. 2 - Prob. E2.26ECh. 2 - E2-27 Correcting errors in a trial...Ch. 2 - Prob. E2.28ECh. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Correcting errors in a trial balance Learning...Ch. 2 - Prob. P2.34APGACh. 2 - Prob. P2.35BPGBCh. 2 - Prob. P2.36BPGBCh. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Prob. P2.38BPGBCh. 2 - Correcting errors in a trial balance Learning...Ch. 2 - Prob. P2.40BPGBCh. 2 - Prob. P2.41CTCh. 2 - P2-42 Journalizing transactions, posting to...Ch. 2 - Journalizing transactions, posting to T-accounts,...Ch. 2 - Before you begin this assignment, renew the Tymg...Ch. 2 - Prob. 2.1DCCh. 2 - Prob. 2.1EICh. 2 - Prob. 2.1FCCh. 2 - Prob. 2.1FSC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What was mark jons beginning capital balance?arrow_forwardFor questions 6 and 7, refer to the following information from the balance sheets and income statement of Pink Corp. From the balance sheets 12/31/2024 12/31/2023 Accounts receivable Prepaid insurance Machines Acc. depreciation $90,000 8,000 $80,000 From the income statement 12/31/2024 Sales $750,000 12,000 Cost of sales 65,000 95,000 Operating Expenses -600,000 -75,000 -30,000 -20,000 Gain on sale of machine 4,000 Additional information: Operating expenses includes depreciation expense Machines costing $30,000 were sold for $22,000 at a gain. 6) How much would net income be adjusted under the indirect method? A B $(12,000) $12,000 с D $0 $20,000 7) What were the cash payments for operating expenses under the direct method? A $74,000 C $61,000 B $49,000 D $53,000arrow_forwardNeed step by step answerarrow_forward

- The owner's equity at the beginning of the period for Vivo Enterprises was $52,000. At the end of the period, assets totaled $110,000, and liabilities were $28,000. If the owner made an additional investment of $12,000 and withdrew $9,000 during the period, what is the net income or (net loss) for the period?arrow_forwardAnswer me these problemsarrow_forwardAll answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY