Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 9EB

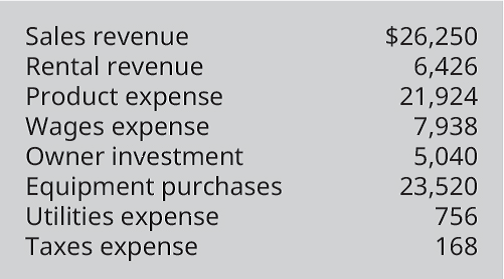

Prepare an income statement using the following information for CK Company for the month of February 2019.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

On January 1, 2017, Chintan Corp., a 75% owned subsidiary of Victor Inc., transferred equipment with a 10-year useful life to Victor Inc. in exchange for $95,000 cash. At the date of transfer, Chintan’s records carried the equipment at a cost of $140,000 with accumulated depreciation of $60,000. Straight-line depreciation is used. Chintan reported net income of $50,000 and $42,000 for 2017 and 2018, respectively. All net income effects of the intra-entity transfer are attributed to the seller for consolidation purposes. Compute the gain recognized by Chintan Corp. relating to the equipment for 2017.help

What amount is reported for net income?

Net income?

Chapter 2 Solutions

Principles of Accounting Volume 1

Ch. 2 - Which of these statements is not one of the...Ch. 2 - Stakeholders are less likely to include which of...Ch. 2 - Identify the correct components of the income...Ch. 2 - The balance sheet lists which of the following? A....Ch. 2 - Assume a company has a $350 credit (not cash)...Ch. 2 - Which of the following statements is true? A....Ch. 2 - Owners have no personal liability under which...Ch. 2 - The accounting equation is expressed as ________....Ch. 2 - Which of the following decreases owners equity? A....Ch. 2 - Exchanges of assets for assets have what effect on...

Ch. 2 - All of the following increase owners equity except...Ch. 2 - Which of the following is not an element of the...Ch. 2 - Which of the following is the correct order of...Ch. 2 - The three heading lines of financial statements...Ch. 2 - Which financial statement shows the financial...Ch. 2 - Which financial statement shows the financial...Ch. 2 - Working capital is an indication of the firms...Ch. 2 - Identify the four financial statements and...Ch. 2 - Define the term stakeholders. Identify two...Ch. 2 - Identify one similarity and one difference between...Ch. 2 - Identify one similarity and one difference between...Ch. 2 - Explain the concept of equity, and identify some...Ch. 2 - Explain the difference between current and...Ch. 2 - Identify/discuss one similarity and one difference...Ch. 2 - Name the three types of legal business structure....Ch. 2 - What is the accounting equation? List two examples...Ch. 2 - Identify the order in which the four financial...Ch. 2 - Explain how the following items affect equity:...Ch. 2 - Explain the purpose of the statement of cash flows...Ch. 2 - For each independent situation below, calculate...Ch. 2 - For each independent situation below, calculate...Ch. 2 - For each independent situation below, calculate...Ch. 2 - For each independent situation below, place an (X)...Ch. 2 - For each of the following items, identify whether...Ch. 2 - For the items listed below, indicate how the item...Ch. 2 - Forest Company had the following transactions...Ch. 2 - Here are facts for the Hudson Roofing Company for...Ch. 2 - Prepare an income statement using the following...Ch. 2 - Prepare a statement of owners equity using the...Ch. 2 - Prepare a balance sheet using the following...Ch. 2 - For each independent situation below, calculate...Ch. 2 - For each independent situation below, calculate...Ch. 2 - For each independent situation below, calculate...Ch. 2 - For each of the following independent situations,...Ch. 2 - For each of the following items, identify whether...Ch. 2 - For the items listed below, indicate how the item...Ch. 2 - Gumbo Company had the following transactions...Ch. 2 - Here are facts for Haileys Collision Service for...Ch. 2 - Prepare an income statement using the following...Ch. 2 - Prepare a statement of owners equity using the...Ch. 2 - Prepare a balance sheet using the following...Ch. 2 - The following information is taken from the...Ch. 2 - Each situation below relates to an independent...Ch. 2 - The following information is from a new business....Ch. 2 - Each of the following situations relates to a...Ch. 2 - For each of the following independent...Ch. 2 - Olivias Apple Orchard had the following...Ch. 2 - Using the information in PA6, determine the amount...Ch. 2 - The following ten transactions occurred during the...Ch. 2 - The following information is taken from the...Ch. 2 - Each situation below relates to an independent...Ch. 2 - The following information is from a new business....Ch. 2 - Each of the following situations relates to a...Ch. 2 - For each of the following independent...Ch. 2 - Mateos Maple Syrup had the following transactions...Ch. 2 - Using the information in PB6, determine the amount...Ch. 2 - Choose three stakeholders (or stakeholder groups)...Ch. 2 - Assume you purchased ten shares of Roku during the...Ch. 2 - A trademark is an intangible asset that has value...Ch. 2 - For each of the following ten independent...Ch. 2 - The following historical information is from...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Basic accounting equation (Learning Objective 5) 10-15 min. Hanson Corp. ? 44,900 + 10,300 Tiny Tots Daycare In...

Financial Accounting, Student Value Edition (5th Edition)

Preference for current ratio and quick ratio. Introduction: Current ratio explains the liquidity position of a ...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

A company has the opportunity to take over a redevelopment project in an industrial area of a city. No immediat...

Engineering Economy (17th Edition)

Discussion Questions 1. What characteristics of the product or manufacturing process would lead a company to us...

Managerial Accounting (5th Edition)

(Capital asset pricing model) Using the CAPM, estimate the appropriate required rate of return for the three st...

Foundations Of Finance

1-13. Identify a product, either a good or a service, that will take advantage of this opportunity. Although yo...

Business Essentials (12th Edition) (What's New in Intro to Business)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Consolidated financial statements; Author: The Finance Storyteller;https://www.youtube.com/watch?v=DTFD912ZJQg;License: Standard Youtube License