College Accounting (Book Only): A Career Approach

12th Edition

ISBN: 9781305084087

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 7E

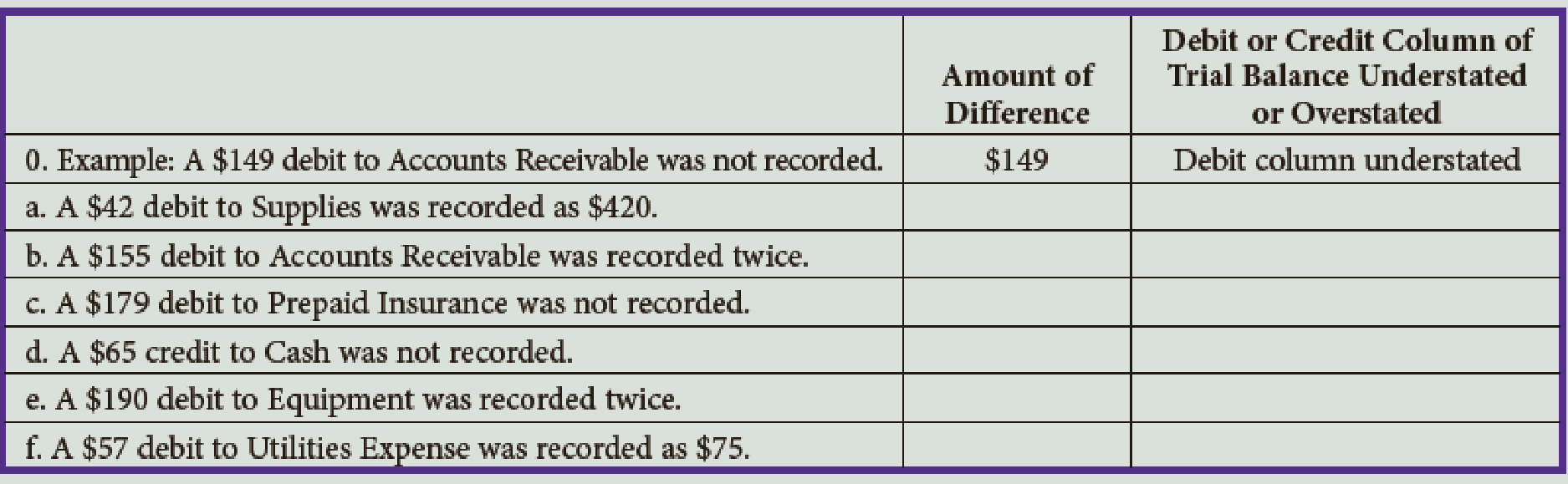

The following errors were made in journalizing transactions. In each case, calculate the amount of the error and indicate whether the debit or the credit column of the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you please solve this questions

How much are equivalent units for conversion costs if the weighted average method in used ? General accounting

The amount and nature of the gain/loss from the sale

Chapter 2 Solutions

College Accounting (Book Only): A Career Approach

Ch. 2 - Determine the balance of the following T account:

...Ch. 2 - Which of the following statements is correct? a....Ch. 2 - Prob. 3QYCh. 2 - R. Nelson invests his personal computer, with a...Ch. 2 - When preparing a trial balance, which of the...Ch. 2 - What would be the net income for Floress Catering?...Ch. 2 - On which financial statement(s) would R. Flores,...Ch. 2 - What is the amount of ending capital shown on the...Ch. 2 - Floress Catering purchased equipment that cost...Ch. 2 - Prob. 1DQ

Ch. 2 - Explain why the term debit doesnt always mean...Ch. 2 - Prob. 3DQCh. 2 - How are the three financial statements shown in...Ch. 2 - Prob. 5DQCh. 2 - List two reasons why the debits and credits in the...Ch. 2 - Prob. 7DQCh. 2 - What do we mean when we say that capital, drawing,...Ch. 2 - Prob. 1ECh. 2 - List the classification of each of the following...Ch. 2 - R. Dalberg operates Dalbergs Tours. The company...Ch. 2 - During the first month of operation, Graham...Ch. 2 - Speedy Sewing Services, owned by T. Nguyen, hired...Ch. 2 - During the first month of operations, Landish...Ch. 2 - The following errors were made in journalizing...Ch. 2 - Would the following errors cause the trial balance...Ch. 2 - During December of this year, G. Elden established...Ch. 2 - B. Kelso established Computer Wizards during...Ch. 2 - S. Myers, a speech therapist, opened a clinic in...Ch. 2 - On May 1, B. Bangle opened Self-Wash Laundry. His...Ch. 2 - The financial statements for Daniels Custom...Ch. 2 - During February of this year, H. Rose established...Ch. 2 - J. Carrie established Carries Photo Tours during...Ch. 2 - D. Johnston, a physical therapist, opened...Ch. 2 - On July 1, K. Resser opened Ressers Business...Ch. 2 - The financial statements for Baker Custom Catering...Ch. 2 - Prob. 1ACh. 2 - What Would You Say? A fellow accounting student...Ch. 2 - Prob. 3A

Additional Business Textbook Solutions

Find more solutions based on key concepts

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (13th Edition)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY