Intermediate Financial Management

14th Edition

ISBN: 9780357516782

Author: Brigham, Eugene F., Daves, Phillip R.

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 6P

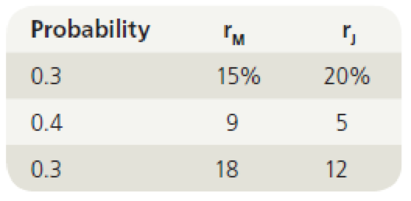

The market and Stock J have the following probability distributions:

- a. Calculate the expected

rates of return for the market and Stock J. - b. Calculate the standard deviations for the market and Stock J.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Beta is which of the following:

A) standard deviation.

B) total risk.

C) Beta is the relationship which is between an investment's return, and the market return.

D) unsystematic risk.

Which of the following measures the total risk of a portfolio?

A. Standard Deviation

B. Correlation Coefficient

C. Beta

D. Alpha

Using the data in the following table,, estimate the:

a. Average return and volatility for each stock.

b. Covariance between the stocks.

c. Correlation between these two stocks.

Chapter 2 Solutions

Intermediate Financial Management

Ch. 2 - Prob. 2QCh. 2 - Security A has an expected return of 7%, a...Ch. 2 - Prob. 4QCh. 2 - Prob. 5QCh. 2 - Your investment club has only two stocks in its...Ch. 2 - AA Corporations stock has a beta of 0.8. The...Ch. 2 - Suppose that the risk-free rate is 5% and that the...Ch. 2 - Prob. 5PCh. 2 - The market and Stock J have the following...Ch. 2 - Prob. 7P

Ch. 2 - Prob. 8PCh. 2 - Prob. 9PCh. 2 - Prob. 10PCh. 2 - Prob. 11PCh. 2 - Stock R has a beta of 1.5, Stock S has a beta of...Ch. 2 - Prob. 1MCCh. 2 - Prob. 2MCCh. 2 - Prob. 3MCCh. 2 - What is the stand-alone risk? Use the scenario...Ch. 2 - Prob. 5MCCh. 2 - Prob. 6MCCh. 2 - Prob. 7MCCh. 2 - Prob. 8MCCh. 2 - Prob. 9MCCh. 2 - Prob. 10MCCh. 2 - Prob. 11MCCh. 2 - Prob. 12MCCh. 2 - Prob. 13MCCh. 2 - Prob. 14MCCh. 2 - Prob. 15MCCh. 2 - Prob. 16MCCh. 2 - Prob. 17MCCh. 2 - Prob. 18MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- When working with the CAPM, which of the following factors can be determined with the most precision? a. The beta coefficient of "the market," which is the same as the beta of an average stock. b. The beta coefficient, bi, of a relatively safe stock. c. The market risk premium (RPM). d. The most appropriate risk-free rate, rRF. e. The expected rate of return on the market, rM.arrow_forwardA plot/graph of the positive relation between systematic risk and expected return is called: O security market line standard deviation and width of the normal distribution O covariance graph O capital asset pricing modelarrow_forwardHow are the following used on a stand-alone and a portfolio basis? 1. Standard Deviation 2. Variance 3. Covariancearrow_forward

- The expected rate of return of an investment ________. a. equals one of the possible rates of return for that investment b. equals the required rate of return for the investment c. is the mean value of the probability distribution of possible returns d. is the median value of the probability distribution of possible returns e. is the mode value of the probability distribution of possible returnsarrow_forwardA price-weighted index such as the DJIA is a geometric mean of current stock prices. a. True b. Falsearrow_forwardThe Black-Scholes OPM is dependent on which five parameters? Select one: a. Stock price, exercise price, risk free rate, beta, and time to maturity b. Stock price, risk free rate, beta, time to maturity, and variance c. Stock price, exercise price, risk free rate, standard deviation and time to maturity d. Stock price, risk free rate, probability, standard deviation and exercise pricearrow_forward

- The metric that is used to show the extent to which a given stock’s return move up and down with the stock market? a. Correlation b. Beta c. Standard deviation d. Expected returnarrow_forwardThe appropriate measure of risk used in Sharpe's measure of portfolio evaluation is a. Range b. Variance c. Beta d. Standard deviationarrow_forwardAttached imagearrow_forward

- Consider two assets. Suppose that the return on asset 1 has expected value 0.05 and standard deviation 0.1 and suppose that the return on asset 2 has expected value 0.02 and standard deviation 0.05. Suppose that the asset returns have correlation 0.4.Consider a portfolio placing weight w on asset 1 and weight 1-w on asset 2; let Rp denote the return on the portfolio. Find the mean and variance of Rp as a function of w.arrow_forwardA stock's beta coefficient can be calculated using the following equation: B₁ = Oi, m σε m a. Write a user-defined function that can calculate the beta coefficient. The argu- ments to the function should be the covariance between the stock and market returns, and the variance of the market's returns. For example, BETA (COVAR AS SINGLE, MARKET VAR AS SINGLE). b. Rewrite your function so that it accepts ranges of returns and then calcu- lates the beta directly from the returns. It should be defined as: BETA(STOCK- RETURNS AS RANGE, MARKETRETURNS AS RANGE). Your function should make use of Application. WorksheetFunction to calculate the covariance and variance (use Excel's COVAR.S and VAR.S functions). In the code, be sure to check to see if the number of stock returns is equal to the number of market returns. The function should return an error if the count of returns is not equal.arrow_forwardThe probability distribution of returns for the two stocks X and Y are as follows: Probability 0.1 0.3 0.05 0.25 0.15 0.15 For each of the two stocks, calculate: a. The expected return. b. Variance of returns c. Volatility of returns. Stock X 0.05 -0.1 0.08 -0.08 0.20 0.12 Return Stock Y 0.13 0,04 -0.12 0.21 0.1 -0.05arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Portfolio return, variance, standard deviation; Author: MyFinanceTeacher;https://www.youtube.com/watch?v=RWT0kx36vZE;License: Standard YouTube License, CC-BY