Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 6EB

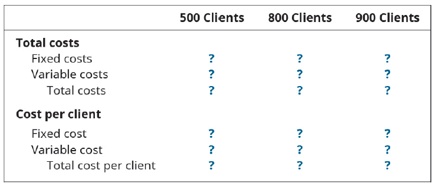

Sanchez & Vukmin, LLP, is a full-service accounting firm located near Chicago, Illinois. Last year, Sanchez provided tax preparation services to 500 clients. Total fixed costs were $265,000 with total variable costs of $180,000. Based on this information, complete this chart.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Can you solve this general accounting problem with appropriate steps and explanations?

I am searching for the most suitable approach to this financial accounting problem with valid standards.

Willow Industries is evaluating its cost structure and pricing strategy. The company produces a single product that sells for $42 per unit. Variable manufacturing costs are $25 per unit, and variable selling expenses are 5% of the selling price. Annual fixed manufacturing overhead is $315,000, and fixed selling and administrative expenses are $248,000. If Willow desires a target net income of $180,000, how many units must be produced and sold? What would be the company's margin of safety in both units and dollars if it actually sold 30,000 units? Answer

Chapter 2 Solutions

Principles of Accounting Volume 2

Ch. 2 - Which of the following is the primary source of...Ch. 2 - Which of the following is the primary source of...Ch. 2 - Which of the following is the primary source of...Ch. 2 - Which of the following represents the components...Ch. 2 - Which of the following represents the components...Ch. 2 - Which of the following represents the components...Ch. 2 - Conversion costs include all of the following...Ch. 2 - Which of the following is not considered a product...Ch. 2 - Fixed costs are expenses that...Ch. 2 - Variable costs are expenses that...

Ch. 2 - Total costs for ABC Distributing are $250,000 when...Ch. 2 - Which of the following would not be classified as...Ch. 2 - Which of the following are prime costs? A....Ch. 2 - Which of the following statements is true...Ch. 2 - The high-low method and least-squares regression...Ch. 2 - Which of the following methods of cost estimation...Ch. 2 - In the cost equation Y=a+bx, Y represents which of...Ch. 2 - A scatter graph is used to test the assumption...Ch. 2 - Identify the three primary classifications of...Ch. 2 - Explain how the income statement of a...Ch. 2 - Walsh & Coggins, a professional accounting firm,...Ch. 2 - Lizzys is a retail clothing store, specializing in...Ch. 2 - Identify and describe the three types of product...Ch. 2 - Explain the difference between a period cost and a...Ch. 2 - Explain the concept of relevant range and how it...Ch. 2 - Explain the differences among fixed costs,...Ch. 2 - Explain the difference between prime costs and...Ch. 2 - Explain how a scatter graph is used to identify...Ch. 2 - Explain the components of the total cost equation...Ch. 2 - Explain how the high-low method is used for cost...Ch. 2 - Magio Company manufactures kitchen equipment used...Ch. 2 - Park and West, LLC, provides consulting services...Ch. 2 - Canine Couture is a specialty dog clothing...Ch. 2 - Hicks Contracting collects and analyzes cost data...Ch. 2 - Rose Company has a relevant range of production...Ch. 2 - Carr Company provides human resource consulting...Ch. 2 - Western Trucking operates a fleet of delivery...Ch. 2 - Suppose that a company has fixed costs of $18 per...Ch. 2 - The cost data for Evencoat Paint for the year 2019...Ch. 2 - This cost data from Hickory Furniture is for the...Ch. 2 - Markson and Sons leases a copy machine with terms...Ch. 2 - Markson and Sons leases a copy machine with terms...Ch. 2 - Winterfell Products manufactures electrical...Ch. 2 - CPK ** Associates is a mid-size legal firm,...Ch. 2 - Flip or Flop is a retail shop selling a wide...Ch. 2 - Roper Furniture manufactures office furniture and...Ch. 2 - Baxter Company has a relevant range of production...Ch. 2 - Sanchez & Vukmin, LLP, is a full-service...Ch. 2 - Case Airlines provides charter airline services....Ch. 2 - Suppose that a company has fixed costs of $11 per...Ch. 2 - The cost data for BC Billing Solutions for the...Ch. 2 - This cost data from Hickory Furniture is for the...Ch. 2 - Able Transport operates a tour bus that they lease...Ch. 2 - Able Transport operates a tour bus that they lease...Ch. 2 - Ballentine Manufacturing produces and sells...Ch. 2 - Tom West is a land surveyor who operates a small...Ch. 2 - Just Beachy is a retail business located on the...Ch. 2 - Listed as follows are various costs found in...Ch. 2 - Wachowski Company reported these cost data for the...Ch. 2 - Carolina Yachts builds custom yachts in its...Ch. 2 - Hicks Products produces and sells patio furniture...Ch. 2 - Conner ** Scheer, Attorneys at Law, provide a wide...Ch. 2 - Puzzles, Pranks ** Games is a retail business...Ch. 2 - Pocket Umbrella, Inc. is considering producing a...Ch. 2 - Using the costs listed in the previous problem,...Ch. 2 - Gadell Farms produces venison sausage that is...Ch. 2 - In a team of two or three students, interview the...Ch. 2 - This list contains costs that various...

Additional Business Textbook Solutions

Find more solutions based on key concepts

(NPV calculation) Calculate the NPV given the following free cash flows if the appropriate required rate of ret...

Foundations Of Finance

11-13. Discuss how your team is going to identify the existing competitors in your chosen market. Based on the ...

Business Essentials (12th Edition) (What's New in Intro to Business)

Small Business Analysis Purpose: To help you understand the importance of cash flows in the operation of a smal...

Financial Accounting, Student Value Edition (5th Edition)

E5-18 Using accounting vocabulary

Learning Objectives 1, 2,3

Match the accounting terms with the corresponding ...

Horngren's Accounting (12th Edition)

S6-2 Determining inventory costing methods

Ward Hard ware does not expect costs to change dramatically and want...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

An experimental composite engine block for an automobile will trim 20 pounds of weight compared with a traditio...

Engineering Economy (17th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardPlease provide the correct answer to this financial accounting problem using accurate calculations.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

- I am looking for a step-by-step explanation of this financial accounting problem with correct standards.arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forwardLucas Republic is experiencing a budget deficit of $180 billion. The economy is operating $240 billion below its potential GDP, and the marginal tax rate is 30%. What are the structural deficit and the cyclical deficit?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

How Accounting Systems Work (Bookkeeping); Author: WolvesAndFinance;https://www.youtube.com/watch?v=aDtN9LEc2lM;License: Standard Youtube License