Concept explainers

Cost Allocation with Cost Flow Diagram

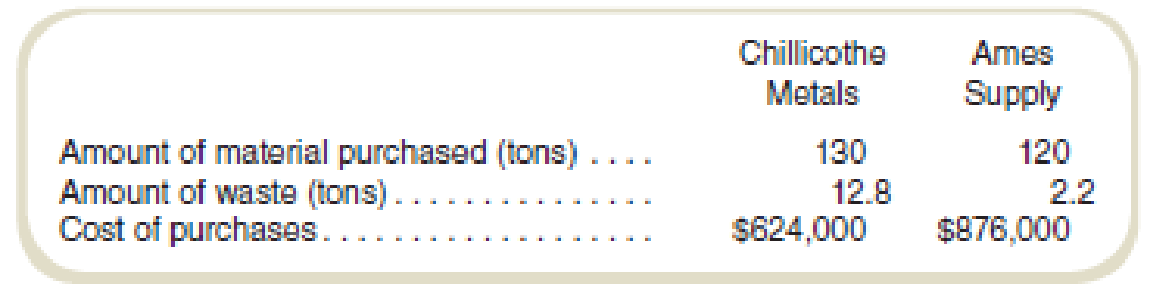

Wayne Casting, Inc., produces a product made from a metal alloy. Wayne buys the alloy from two different suppliers, Chillicothe Metals and Ames Supply, in approximately equal amounts because of supply constraints at both vendors. The material from Chillicothe is less expensive to buy, but more difficult to use, resulting in greater waste. The metal alloy is highly toxic and any waste requires costly handling to avoid environmental accidents. Last year the cost of handling the waste totaled $300,000. Additional data from last year’s operations are shown below.

Required

- a. Allocate the cost of the waste handling to the two suppliers based on:

- 1. Amount of material purchased.

- 2. Amount of waste.

- 3. Cost of material purchased.

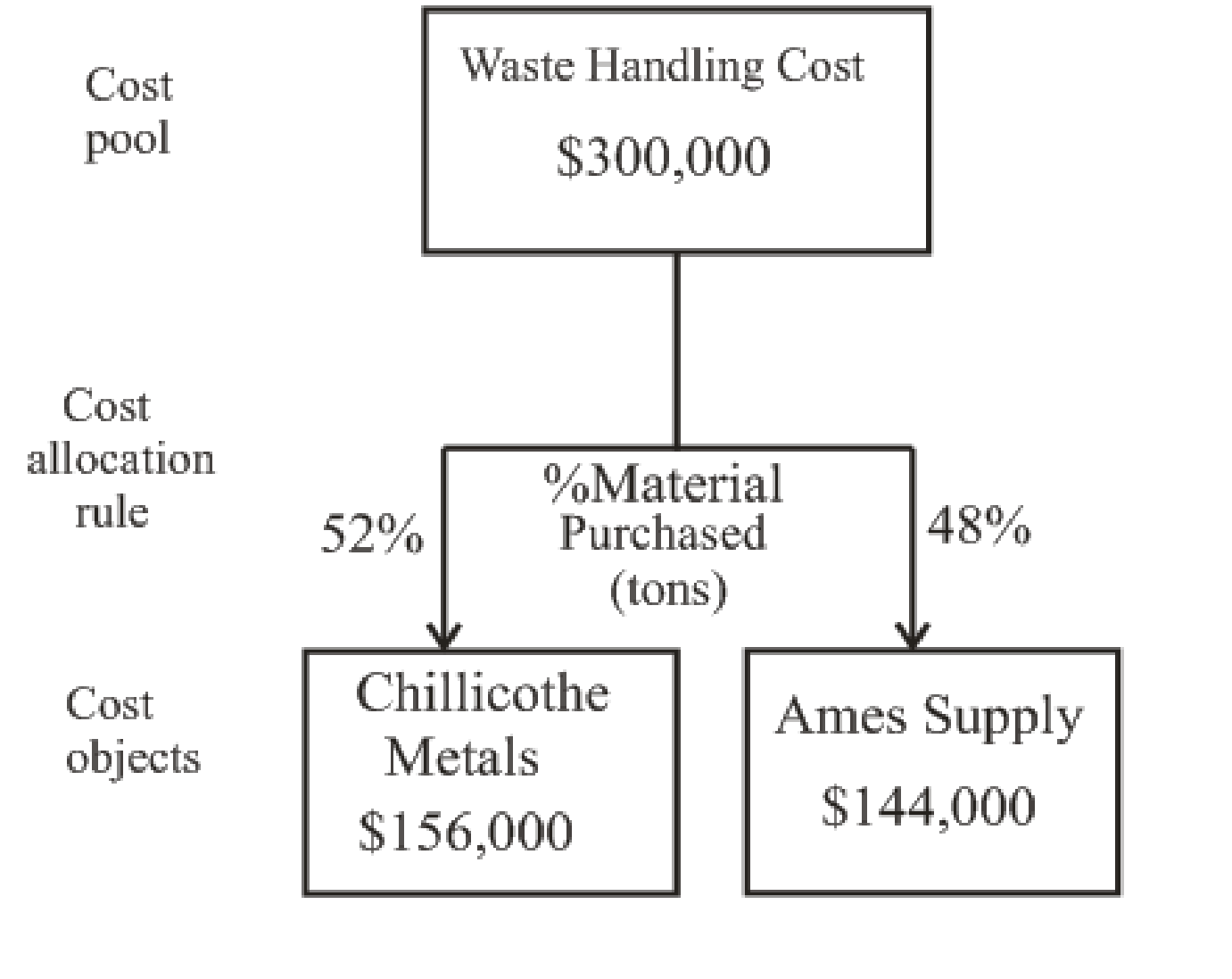

- b. Draw a cost flow diagram to illustrate your answer to requirement (a), part (1).

a.

Allocate the cost of the waste handling to the two suppliers based on:

1. Amount of material purchased.

2. Amount of waste.

3. Cost of material purchased.

Explanation of Solution

Calculate the allocation of the cost of handling the waste on the basis of given variables:

| Chillicothe Ames | Ames Supply |

Total Cost | |||

| Particulars | % | Amount | % | Amount | |

| 1. Based on amount of material purchased: | |||||

| Cost of handling the waste |

52% (1) | $156,000 (3) |

48% (2) | $144,000 (4) | $300,000 |

| 2. Based on amount waste: | |||||

| Cost of handling the waste |

85.33% (5) | $256,000 (7) |

14.67% (6) | $44,000 (8) | $300,000 |

| 3. Based on the cost of material purchased | |||||

| Cost of handling the waste |

41.6% (9) | $124,000 (11) |

58.4% (10) |

$175,200 (12) | $300,000 |

Table: (1)

Calculate the allocation of cost of handling the waste on the basis of the amount of material purchased:

Working note 1:

Allocation for Chillicothe Ames:

Working note 2:

Allocation for Ames Supply:

Working note 3:

Calculate the cost of Chillicothe Ames:

Working note 4:

Calculate the cost of Ames Supply:

Calculate the allocation of cost of handling the waste on the basis of the amount of waste:

Working note 5:

Allocation for Chillicothe Ames:

Working note 6:

Allocation for Ames Supply:

Working note 7:

Calculate the cost of Chillicothe Ames:

Working note 8:

Calculate the cost of Ames Supply:

Calculate the allocation of cost of handling the waste on the basis of cost purchases:

Working note 9:

Allocation for Chillicothe Ames:

Working note 10:

Allocation for Ames Supply:

Working note 11:

Calculate the cost of Chillicothe Ames:

Working note 12:

Calculate the cost of Ames Supply:

b.

Draw a cost flow diagram to illustrate your answer to requirement (a), part (1).

Explanation of Solution

The cost flow diagram to illustrate your answer to requirement (a), part (1):

Figure (1)

Want to see more full solutions like this?

Chapter 2 Solutions

FUNDAMENTALS OF COST ACCT.-CONNECT CARD

- Provide correct solution and accountingarrow_forwardCompute the company's degree of opereting leverage?arrow_forwardWhich feature distinguishes nominal accounts from real accounts in closing entries? Options: (i) Temporary nature requiring closure (ii) Balance sheet presentation (iii) Permanent balances carried forward (iv) Contra account status financial Accounting problemarrow_forward

- Which feature distinguishes nominal accounts from real accounts in closing entries? Options: (i) Temporary nature requiring closure (ii) Balance sheet presentation (iii) Permanent balances carried forward (iv) Contra account statusarrow_forwardNeed help this questionarrow_forwardOrganization/Industry Rank Employer Survey Student Survey Career Service Director Survey Average Pay Deloitte & Touche/accounting 1 1 8 1 55 Ernst & Young/accounting 2 6 3 6 50 PricewaterhouseCoopers/accounting 3 22 5 2 50 KPMG/accounting 4 17 11 5 50 U.S. State Department/government 5 12 2 24 60 Goldman Sachs/investment banking 6 3 13 16 60 Teach for America/non-profit; government 7 24 6 7 35 Target/retail 8 19 18 3 45 JPMorgan/investment banking 9 13 12 17 60 IBM/technology 10 11 17 13 60 Accenture/consulting 11 5 38 15 60 General Mills/consumer products 12 3 33 28 60 Abbott Laboratories/health 13 2 44 36 55 Walt Disney/hospitality 14 60 1 8 40 Enterprise Rent-A-Car/transportation 15 28 51 4 35 General Electric/manufacturing 16 19 16 9 55 Phillip Morris/consumer products 17 8 50 19 55 Microsoft/technology 18 28 9 34 75 Prudential/insurance 19 9 55 37 50 Intel/technology 20 14 23 63 60 Aflac/insurance 21 9 55 62 50 Verizon…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub