Concept explainers

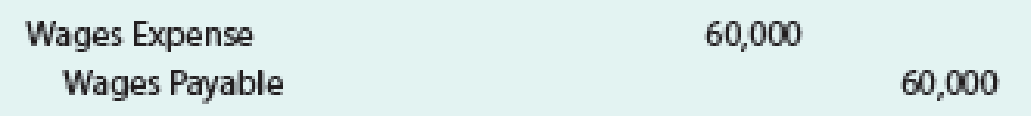

Todd Lay just began working as a cost accountant for Enteron Industries Inc., which manufactures gift items. Todd is preparing to record summary

Then the factory

Todd’s supervisor, Jeff Fastow, walks by and notices the entries. The following conversation takes place:

Jeff: That’s a very unusual way to record our factory wages and depreciation for the month.

Todd: What do you mean? This is the way I was taught in school to record wages and depreciation.

You know, debit an expense and credit Cash or payables or, in the case of depreciation, credit

Jeff: Well, it’s not the credits I’m concerned about. It’s the debits—I don’t think you’ve recorded the debits correctly. I wouldn’t mind if you were recording the administrative wages or office equipment depreciation this way, but I’ve got real questions about recording factory wages and factory machinery depreciation this way.

Todd: Now I’m really confused. You mean this is correct for administrative costs but not for

- a.

Play the role of Jeff and answer Todd’s questions.

Play the role of Jeff and answer Todd’s questions. - b.

Why would Jeff accept the journal entries if they were for administrative costs?

Why would Jeff accept the journal entries if they were for administrative costs?

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Bundle: Managerial Accounting, 15th + Cengagenowv2, 1 Term Printed Access Card

- I need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning