Concept explainers

The Fly Company provides advertising services for clients across the nation. The Fly Company is presently working on four projects, each for a different client. The Fly Company accumulates costs for each account (client) on the basis of both direct costs and allocated indirect costs. The direct costs include the charged time of professional personnel and media purchases (air time and ad space).

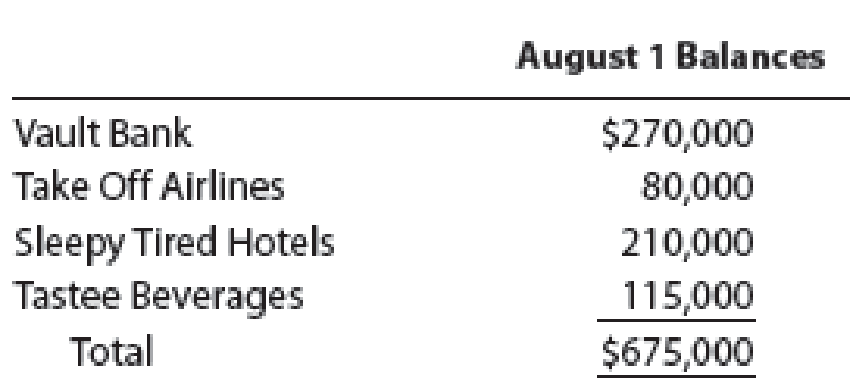

On August 1, the four advertising projects had the following accumulated costs:

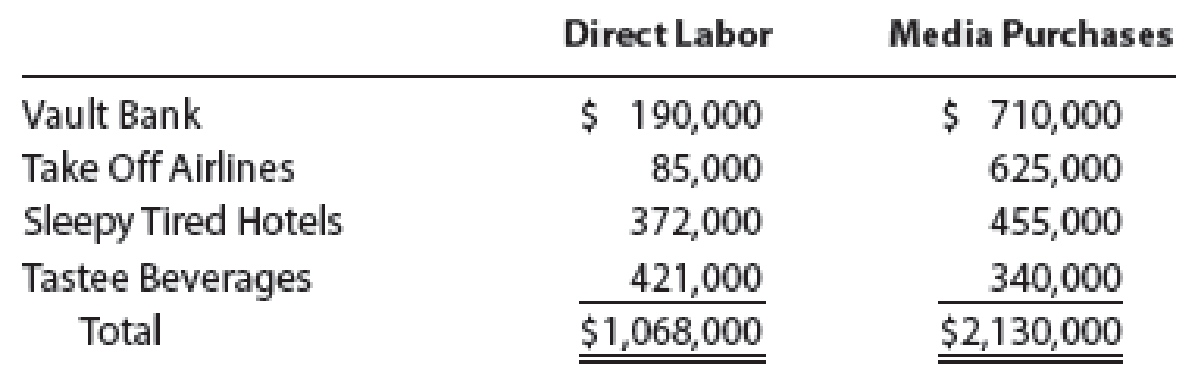

During August, The Fly Company incurred the following direct labor and media purchase costs related to preparing advertising for each of the four accounts:

At the end of August, both the Vault Bank and Take Off Airlines campaigns were completed. The costs of completed campaigns are debited to the cost of services account.

Journalize the summary entry to record each of the following for the month:

- A. Direct labor costs

- B. Media purchases

- C. Overhead applied

- D. Completion of Vault Bank and Take Off Airlines campaigns

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Bundle: Managerial Accounting, 15th + Cengagenowv2, 1 Term Printed Access Card

- A contingent liability should be recorded only when:A. It is possible and the amount is estimableB. It is probable and the amount is estimableC. It is certain to occurD. Management decides it’s important need helparrow_forwardA contingent liability should be recorded only when:A. It is possible and the amount is estimableB. It is probable and the amount is estimableC. It is certain to occurD. Management decides it’s importantarrow_forwardNo chatgpt 6. Which of the following is not an intangible asset?A. GoodwillB. PatentC. TrademarkD. Landarrow_forward

- Need help hi 6. Which of the following is not an intangible asset?A. GoodwillB. PatentC. TrademarkD. Landarrow_forward6. Which of the following is not an intangible asset?A. GoodwillB. PatentC. TrademarkD. Land i need helparrow_forward6. Which of the following is not an intangible asset?A. GoodwillB. PatentC. TrademarkD. Landneed helparrow_forward

- 6. Which of the following is not an intangible asset?A. GoodwillB. PatentC. TrademarkD. Landarrow_forwardWhich basis of accounting recognizes revenues and expenses when cash is exchanged?A. AccrualB. Modified AccrualC. Cash BasisD. Matchingneedarrow_forwardWhich basis of accounting recognizes revenues and expenses when cash is exchanged?A. AccrualB. Modified AccrualC. Cash BasisD. Matchingneed helparrow_forward

- Which basis of accounting recognizes revenues and expenses when cash is exchanged?A. AccrualB. Modified AccrualC. Cash BasisD. Matchingarrow_forward9. Which of the following best describes deferred revenue?A. Cash received before revenue is earnedB. Cash paid after expense is incurredC. Revenue earned but not yet receivedD. Expense incurred but not paidarrow_forwardNeed help. 2. What does a classified balance sheet do that an unclassified one does not?A. Uses the cash basis of accountingB. Categorizes assets and liabilities into current and long-termC. Shows only owner’s equityD. Omits depreciationarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,