FUNDAMENTAL ACCOUNTING PRINCIPLES

24th Edition

ISBN: 9781264044375

Author: Wild

Publisher: McGraw-Hil

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 5BPSB

Problem 2-5B Computing net income from equity analysis, preparing a

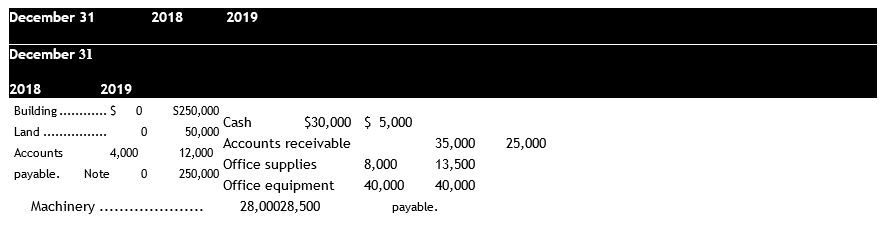

The accounting records of Tama Co. show the following assets and liabilities as of December 31. 2018 and 2019.

Required

- Prepare balance sheets for the business as of December 31, 2018 and 2019. Hint: Report only total equity on the balance sheet and remember that total equity equals the difference between assets and liabilities.

- Compute net income for 2019 by comparing total equity amounts for these two years and using the following information: During 2019, the owner invested $5,000 additional cash in the business and withdrew $3,000 cash for personal use. Check (2) Net income, $11,000

- Compute the December 31, 2019, debt ratio (in percent and rounded to one decimal). (3) Debt ratio, 63.6%

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

If a company has current assets of $80,000 and current liabilities of $50,000, what is its working capital? Need

If a company has current assets of $80,000 and current liabilities of $50,000, what is its working capital?

Can you explain the correct methodology to solve this general accounting problem?

Chapter 2 Solutions

FUNDAMENTAL ACCOUNTING PRINCIPLES

Ch. 2 - Prob. 1DQCh. 2 - What is the difference between a note payable and...Ch. 2 - Prob. 3DQCh. 2 - What kinds of transactions can be recorded in a...Ch. 2 - Are debits or credits typically listed first in...Ch. 2 - Should a transaction be recorded first in a...Ch. 2 - If assets are valuable resources asset accounts...Ch. 2 - Prob. 8DQCh. 2 - Prob. 9DQCh. 2 - Identify the four financial statements of a...

Ch. 2 - Prob. 11DQCh. 2 - Prob. 12DQCh. 2 - Prob. 13DQCh. 2 - Prob. 14DQCh. 2 - Prob. 15DQCh. 2 - Prob. 16DQCh. 2 - Prob. 17DQCh. 2 - Prob. 18DQCh. 2 - Identifying source documents C1 Identify the items...Ch. 2 - Identifying financial statement accounts C2...Ch. 2 - Reading a chart of accounts C3 A chart of accounts...Ch. 2 - Identifying normal balance C4 Identify the normal...Ch. 2 - QS 2–5

Linking debit or credit with normal...Ch. 2 - Prob. 6QSCh. 2 - Analyzing debit or credit by account A1 Identify...Ch. 2 - Prob. 8QSCh. 2 - Prob. 9QSCh. 2 - Prob. 10QSCh. 2 - Preparing journal entries P1 Prepare general...Ch. 2 - Preparing an income statement P3 Liu Zhang...Ch. 2 - Preparing a statement of owner's equity P3 Use the...Ch. 2 - Prob. 14QSCh. 2 - Prob. 15QSCh. 2 - Exercise 21 Steps in analyzing and recording...Ch. 2 - Prob. 2ECh. 2 - Exercise 2-3 Identifying a ledger and chart of...Ch. 2 - Prob. 4ECh. 2 - Prob. 5ECh. 2 - Prob. 6ECh. 2 - Prob. 7ECh. 2 - Exercise 28 Preparing Taccounts (ledger) and a...Ch. 2 - Prob. 9ECh. 2 - Exercise 2-10 Preparing a trial balance P2 After...Ch. 2 - Prob. 11ECh. 2 - Prob. 12ECh. 2 - Exercise 2-13 Entering transactions into...Ch. 2 - Exercise 2-14 Preparing general journal entries P1...Ch. 2 - Prob. 15ECh. 2 - Prob. 16ECh. 2 - Prob. 17ECh. 2 - Prob. 18ECh. 2 - Prob. 19ECh. 2 - Prob. 20ECh. 2 - Prob. 21ECh. 2 - Exercise 2-22 Calculating and interpreting the...Ch. 2 - Exercise 2-23 Preparing journal entries P1 Prepare...Ch. 2 - Prob. 1APSACh. 2 - Prob. 2APSACh. 2 - Prob. 3APSACh. 2 - Prob. 4APSACh. 2 - Prob. 6APSACh. 2 - Prob. 7APSACh. 2 - Prob. 1BPSBCh. 2 - Prob. 2BPSBCh. 2 - Prob. 3BPSBCh. 2 - Prob. 4BPSBCh. 2 - Problem 2-5B Computing net income from equity...Ch. 2 - Prob. 6BPSBCh. 2 - Problem 2-7B Preparing an income statement,...Ch. 2 - SP 2 On October 1, 2019, Santana Rey launched a...Ch. 2 - Using transactions from the following assignments...Ch. 2 - Prob. 2GLPCh. 2 - Prob. 3GLPCh. 2 - Prob. 4GLPCh. 2 - Prob. 5GLPCh. 2 - Prob. 6GLPCh. 2 - Prob. 7GLPCh. 2 - Prob. 8GLPCh. 2 - Refer to Apple's financial statements in Appendix...Ch. 2 - Prob. 2AACh. 2 - Key comparative figures for Apple, Google, and...Ch. 2 - Prob. 1BTNCh. 2 - Prob. 2BTNCh. 2 - Prob. 3BTNCh. 2 - Prob. 4BTNCh. 2 - Prob. 5BTNCh. 2 - Prob. 6BTNCh. 2 - Prob. 7BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, XYZ Corp. purchases inventory for $5,000 on credit. What is the journal entry for this transaction?arrow_forwardWhat is general accounting? give correct answer . need help in thisarrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanationarrow_forward

- Please provide the answer to this general accounting question with proper steps.arrow_forwardI am looking for the correct answer to this financial accounting question with appropriate explanations.arrow_forwardGive correct answer Global Fitness LLC reported a debt-to-equity ratio of 1.5 times at the end of 2024. If the firm's total assets at year-end were $36.8 million, how much of their assets are financed with equity?arrow_forward

- Please explain the correct approach for solving this general accounting question.arrow_forwardGlobal Fitness LLC reported a debt-to-equity ratio of 1.5 times at the end of 2024. If the firm's total assets at year-end were $36.8 million, how much of their assets are financed with equity?a. $14.72 millionb. $22.08 millionc. $9.2 milliond. $55.2 million i need helparrow_forwardPlease provide the accurate answer to this financial accounting problem using valid techniques.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License