Concept explainers

Journal entries and

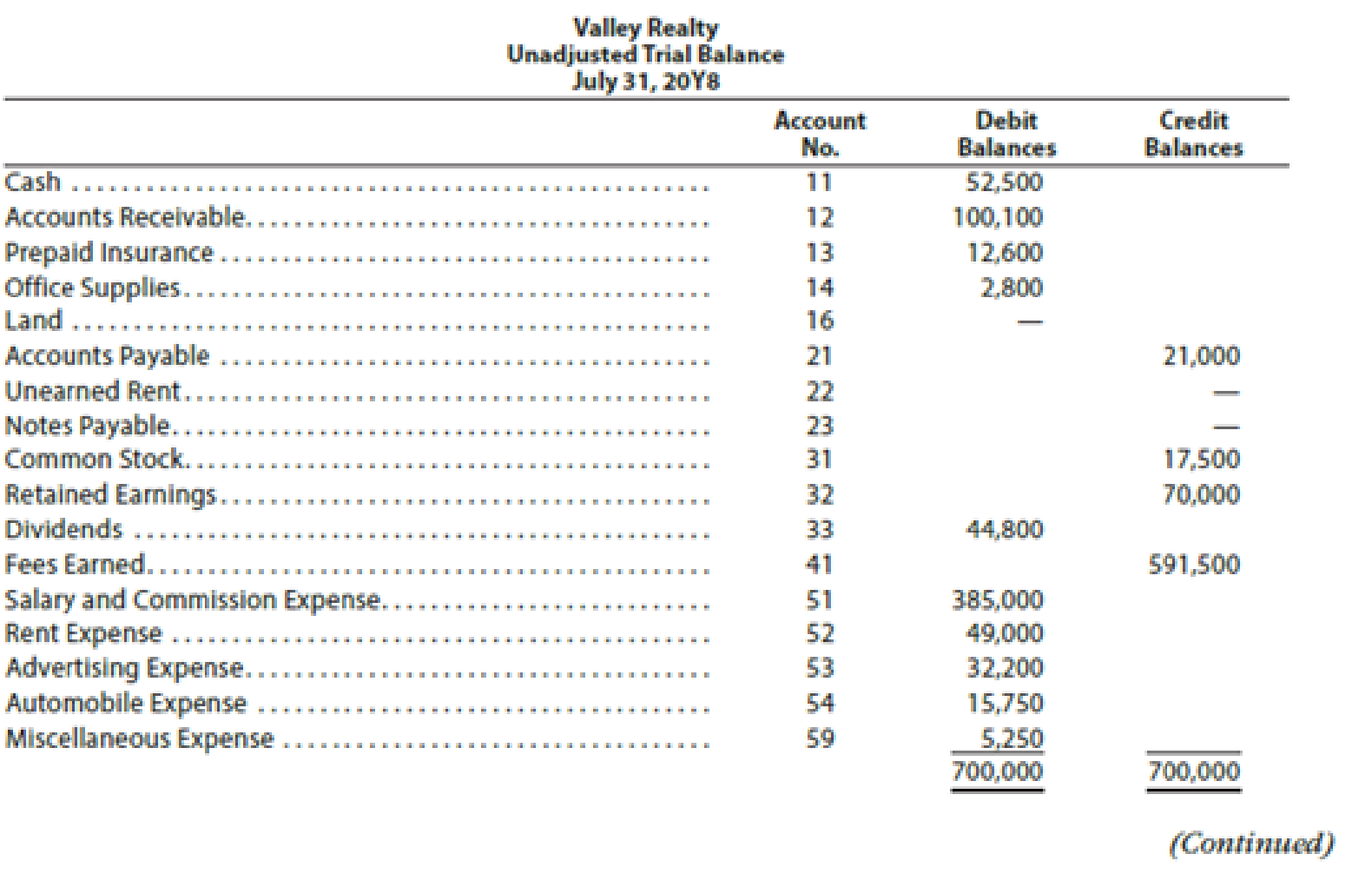

Valley Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on July 31, 20Y8, follows:

The following business transactions were completed by Valley Realty during August 20Y8:

Aug. 1. Purchased office supplies on account, $3,150.

2. Paid rent on office for month, $7,200.

3. Received cash from clients on account, $83,900.

5. Paid insurance premiums, $12,000.

9. Returned a portion of the office supplies purchased on August 1, receiving full credit for their cost, $400.

17. Paid advertising expense, $8,000.

23. Paid creditors on account, $13,750.

Enter the following transactions on Page 19 of the two-column journal:

29. Paid miscellaneous expenses, $1,700.

30. Paid automobile expense (including rental charges for an automobile), $2,500.

31. Discovered an error in computing a commission during July; received cash from the salesperson for the overpayment, $2,000.

31. Paid salaries and commissions for the month, $53,000.

31. Recorded revenue earned and billed to clients during the month, $183,500.

31. Purchased land for a future building site for $75,000, paying $7,500 in cash and giving a note payable for the remainder.

31. Paid dividends, $1,000.

31. Rented land purchased on August 31 to a local university for use as a parking lot during football season (September, October, and November); received advance payment of $5,000.

Instructions

1. Record the August 1 balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark (✓) in the Posting Reference column.

2. Journalize the transactions for August in a two-column journal beginning on Page 18.

3. Post to the ledger, extending the account balance to the appropriate balance column after each posting.

4. Prepare an unadjusted trial balance of the ledger as of August 31, 20Y8.

5. Assume that the August 31 transaction for dividends should have been $10,000. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?

(2) and (3)

Journalize the transactions of August in a two column journal beginning on page 18.

Explanation of Solution

Journal:

Journal is the book of original entry. Journal consists of the day today financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

Rules of debit and credit:

“An increase in an asset account, an increase in an expense account, a decrease in liability account, and a decrease in a revenue account should be debited.

Similarly, an increase in liability account, an increase in a revenue account and a decrease in an asset account, a decrease in an expenses account should be credited”.

Journalize the transactions of August in a two column journal beginning on page 18.

| Journal Page 18 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 20Y8 | Office supplies | 14 | 3,150 | ||

| August | 1 | Accounts payable | 21 | 3,150 | |

| (To record the purchase of supplies of account) | |||||

| 2. | Rent expense | 52 | 7,200 | ||

| Cash | 11 | 7,200 | |||

| (To record the payment of rent) | |||||

| 3 | Cash | 11 | 83,900 | ||

| Accounts receivable | 12 | 83,900 | |||

| (To record the receipt of cash from clients) | |||||

| 5 | Prepaid insurance | 13 | 12,000 | ||

| Cash | 11 | 12,000 | |||

| (To record the payment of insurance premium) | |||||

| 9 | Accounts payable | 21 | 400 | ||

| Office supplies | 14 | 400 | |||

| (To record the payment made to creditors on account) | |||||

| 17 | Advertising expense | 53 | 8,000 | ||

| Cash | 11 | 8,000 | |||

| (To record the payment of advertising expense) | |||||

| 23 | Accounts payable | 21 | 13,750 | ||

| Cash | 11 | 13,750 | |||

| (To record the payment made to creditors on account) | |||||

Table (1)

| Journal Page 19 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 20Y8 | 29 | Miscellaneous expense | 59 | 1,700 | |

| August | Cash | 11 | 1,700 | ||

| (To record the payment made for Miscellaneous expense) | |||||

| 30 | Automobile expense | 54 | 2,500 | ||

| Cash | 11 | 2,500 | |||

| (To record the payment made for automobile expense) | |||||

| 31 | Cash | 11 | 2,000 | ||

| Salary and commission expense | 51 | 2,000 | |||

| (To record the receipt of cash) | |||||

| 31 | Salary and commission expense | 51 | 53,000 | ||

| Cash | 11 | 53,000 | |||

| (To record the payment made for salary and commission expense) | |||||

| 31 | Accounts receivable | 12 | 183,500 | ||

| Fees earned | 41 | 183,500 | |||

| (To record the revenue earned and billed) | |||||

| 31 | Land | 16 | 75,000 | ||

| Cash | 11 | 7,500 | |||

| Notes payable | 23 | 67,500 | |||

| (To record the purchase of land party for cash and party on signing a note) | |||||

| 31 | Dividends | 33 | 1,000 | ||

| Cash | 11 | 1,000 | |||

| (To record the drawing made for personal use) | |||||

| 31 | Cash | 11 | 5,000 | ||

| Unearned rent | 22 | 5,000 | |||

| (To record the cash received for the service yet to be provide) | |||||

Table (2)

(1) and (3)

Record the beginning balances of each accounts in the appropriate balance column of a four-column account, and post them to the ledger extending the account balance to the appropriate balance column after each posting.

Explanation of Solution

Record the beginning balance in the general ledger:

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 52,500 | |||

| 2 | 18 | 7,200 | 45,300 | ||||

| 3 | 18 | 83,900 | 129,200 | ||||

| 5 | 18 | 12,000 | 117,200 | ||||

| 17 | 18 | 8,000 | 109,200 | ||||

| 23 | 18 | 13,750 | 95,450 | ||||

| 29 | 19 | 1,700 | 93,750 | ||||

| 30 | 19 | 2,500 | 91,250 | ||||

| 31 | 19 | 2,000 | 93,250 | ||||

| 31 | 19 | 53,000 | 40,250 | ||||

| 31 | 19 | 7,500 | 32,750 | ||||

| 31 | 19 | 1,000 | 31,750 | ||||

| 31 | 19 | 5,000 | 36,750 | ||||

Table (3)

| Account: Accounts Receivable Account no. 12 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 100,100 | |||

| 3 | 18 | 83,900 | 16,200 | ||||

| 31 | 19 | 183,500 | 199,700 | ||||

Table (4)

| Account: Prepaid Insurance Account no. 13 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 12,600 | |||

| 5 | 18 | 12,000 | 24,600 | ||||

Table (5)

| Account: Office Supplies Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 2,800 | |||

| 1 | 18 | 3,150 | 5,950 | ||||

| 9 | 18 | 400 | 5,550 | ||||

Table (6)

| Account: Land Account no. 16 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 31 | 19 | 75,000 | 75,000 | |||

Table (7)

| Account: Accounts Payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 21,000 | |||

| 1 | 18 | 3,150 | 24,150 | ||||

| 9 | 18 | 400 | 23,750 | ||||

| 23 | 18 | 13,750 | 10,000 | ||||

Table (8)

| Account: Unearned Rent Account no. 22 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 31 | 19 | 5,000 | 5,000 | |||

Table (9)

| Account: Notes Payable Account no. 23 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 31 | 19 | 67,500 | 67,500 | |||

Table (11)

| Account: Common stock Account no. 31 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 17,500 | |||

Table (12)

| Account: Retained earnings Account no. 32 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 70,000 | |||

Table (13)

| Account: Dividends Account no. 33 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 44,800 | |||

| 31 | 19 | 1,000 | 45,800 | ||||

Table (13)

| Account: Fees earned Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 591,500 | |||

| 31 | 19 | 183,500 | 775,000 | ||||

Table (14)

| Account: Salary and commission expense Account no. 51 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 385,000 | |||

| 31 | 19 | 2,000 | 383,000 | ||||

| 31 | 19 | 53,000 | 436,000 | ||||

Table (15)

| Account: Rent expense Account no. 52 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 49,000 | |||

| 2 | 18 | 7,200 | 56,200 | ||||

Table (16)

| Account: Advertising expense Account no. 53 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 32,200 | |||

| 17 | 18 | 8,000 | 40,200 | ||||

Table (17)

| Account: Automobile expense Account no. 54 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 15,750 | |||

| 30 | 19 | 2,500 | 18,250 | ||||

Table (19)

| Account: Miscellaneous expense Account no. 59 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y8 | |||||||

| August | 1 | Balance | ✓ | 5,250 | |||

| 29 | 19 | 1,700 | 6,950 | ||||

Table (20)

(4)

Prepare an unadjusted trial balance of Company V at August 31, 20Y8.

Explanation of Solution

Unadjusted trial balance:

The unadjusted trial balance is the summary of all the ledger accounts that appears on the ledger accounts before making adjusting journal entries.

Prepare an unadjusted trial balance of Company V at August 31, 20Y8 as follows:

|

Company V Unadjusted Trial Balance August 31, 20Y8 | |||

| Particulars |

Account No. |

Debit $ | Credit $ |

| Cash | 11 | 36,750 | |

| Accounts receivable | 12 | 199,700 | |

| Prepaid insurance | 13 | 24,600 | |

| Office supplies | 14 | 5,550 | |

| Land | 16 | 75,000 | |

| Accounts payable | 21 | 10,000 | |

| Unearned rent | 22 | 5,000 | |

| Notes payable | 23 | 67,500 | |

| Common stock | 31 | 17,500 | |

| Retained earnings | 32 | 70,000 | |

| Dividends | 33 | 45,800 | |

| Fees earned | 41 | 775,000 | |

| Salaries and commission expense | 51 | 436,000 | |

| Rent expense | 52 | 56,200 | |

| Advertising expense | 53 | 40,200 | |

| Automobile expense | 54 | 18,250 | |

| Miscellaneous expense | 59 | 6,950 | |

| Total | 945,000 | 945,000 | |

Table (20)

The debit column and credit column of the unadjusted trial balance are agreed, both having balance of $945,000.

(5) (a)

Explain the reason for unadjusted trial balance in (4) is balanced.

Explanation of Solution

Unadjusted trial balance:

The unadjusted trial balance is the summary of all the ledger accounts that appears on the ledger accounts before making adjusting journal entries.

The unadjusted trial balance in (4) would still balance, since the debit equalized the credit in the original journal entry.

(5) (b)

Journalize the correcting entry

Explanation of Solution

The correcting entry is as follows:

| Journal Page 19 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 20Y8 | Dividends | 33 | 9,000 | ||

| August | 31 | Cash | 11 | 9,000 | |

| (To record the correcting entry) | |||||

Table (21)

Working notes:

(5) (c)

Identify whether the error made is a slide or transposition.

Explanation of Solution

Slide error:

A slide error occurs, when the decimal point of an amount has been misplaced.

The drawings account balance recorded as $10,000 instead of $1,000 is a slide error. Since, the decimal point of the amount has been misplaced.

Want to see more full solutions like this?

Chapter 2 Solutions

Financial And Managerial Accounting

- The Armstrong Machinery Company is preparing its manufacturing overhead budget for the fourth quarter of the year. The budgeted variable factory overhead is $6.10 per direct labor-hour; the budgeted fixed factory overhead is $82,500 per month, of which $15,300 is factory depreciation. If the budgeted direct labor time for November is 8,200 hours, then what is the total budgeted factory overhead for November?arrow_forwardUse the following table of government officers travelling and mileage allowance to answer questions 1 and 2. Travel Allowance and Mileage: Government Government Post Annual Travel Allowance Mileage Genuine travelling officers $457,920 $36 per km Genuine travelling officers (no mileage) $569,635 Not applicable Supervisors $335,167 $36 per km Casual miles (mileage without travelling allowances) Not applicable $43 per km Commuted $311,040 Not applicable Marcia Bell is a project manager. She drives her vehicle to different sites and submitted a claim for 2,450 km for the month of January. Calculate her travelling allowance for January. A.$116,130 B.$423,367 C.$133,280 D.$126,360 Lisa Chapelle made 2 site visits, 750 km each, in the month of May. In between site visits, she picked up her son at the day care which amounted to 200 km. What would be her casual travelling allowance for May? A.$32,250 B.$40,850 C.$73,100 D.$64,500…arrow_forwardSubject general accountingarrow_forward

- Don't use ai solution given correct answer general accounting questionarrow_forwardUse the following table of government officers travelling and mileage allowance to answer the question Travel Allowance and Mileage: Government Government Post Annual Travel Allowance Mileage Genuine travelling officers $457,920 $36 per km Genuine travelling officers (no mileage) $569,635 Not applicable Supervisors $335,167 $36 per km Casual miles (mileage without travelling allowances) Not applicable $43 per km Commuted $311,040 Not applicable Marcia Bell is a project manager. She drives her vehicle to different sites and submitted a claim for 2,450 km for the month of January. Calculate her travelling allowance for January. A. $116,130 B. $423,367 C. $133,280 D. $126,360arrow_forwardSubject: general accountingarrow_forward

- quick answer of this accountarrow_forwardEckhart Corp. reports that at an activity level of 5,800 machine-hours in a month, its total variable inspection cost is $348,240 and its total fixed inspection cost is $128,500. What would be the total variable inspection cost at an activity level of 6,100 machine-hours in a month? Assume that this level of activity is within the relevant range. Helparrow_forwardCollins Corporation reported $120,000 of income for the year by using variable costing. The company had no beginning inventory, planned and actual production of 60,000 units, and sales of 55,000 units. Standard variable manufacturing costs were $18 per unit, and total budgeted fixed manufacturing overhead was $180,000. If there were no variances, income under absorption costing would be__.arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning