College Accounting: A Career Approach (with Quickbooks Accountant 2015 Cd-rom)

12th Edition

ISBN: 9781305863385

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 4PB

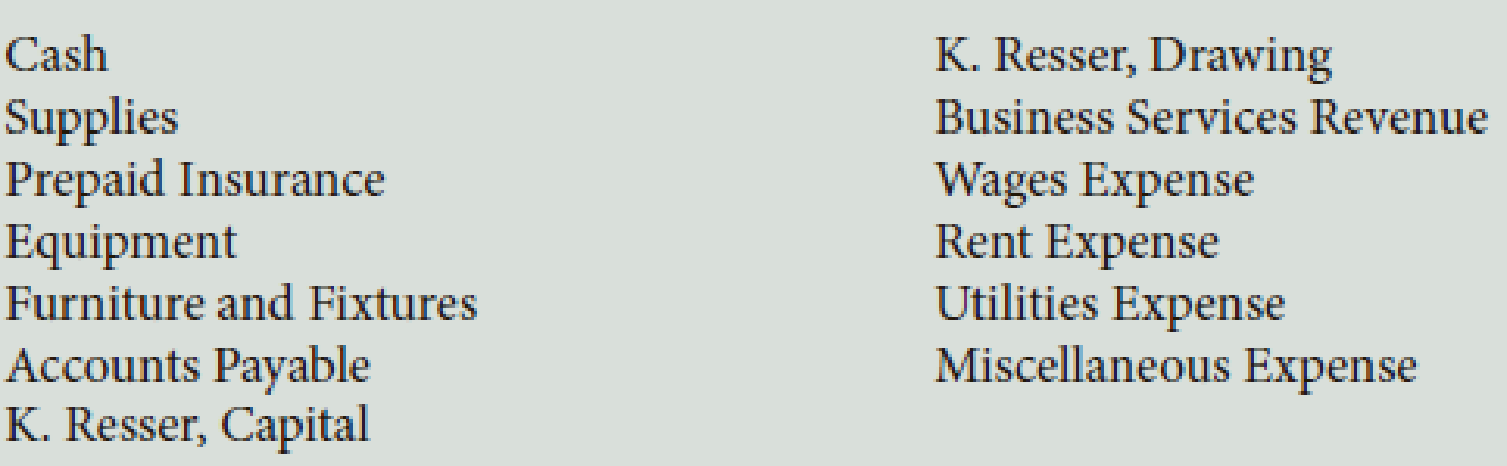

On July 1, K. Resser opened Resser’s Business Services. Resser’s accountant listed the following chart of accounts:

The following transactions were completed during July:

- a. Resser deposited $25,000 in a bank account in the name of the business.

- b. Bought tables and chairs for cash, $725, Ck. No. 1200.

- c. Paid the rent for the current month, $1,750, Ck. No. 1201.

- d. Bought computers and copy machines from Ferber Equipment, $15,700, paying $4,000 in cash and placing the balance on account, Ck. No. 1202.

- e. Bought supplies on account from Wiggins’s Distributors, $535.

- f. Sold services for cash, $1,742.

- g. Bought insurance for one year, $1,375, Ck. No. 1203.

- h. Paid on account to Ferber Equipment, $700, Ck. No. 1204.

- i. Received and paid the electric bill, $438, Ck. No. 1205.

- j. Paid on account to Wiggins’s Distributors, $315, Ck. No. 1206.

- k. Sold services to customers for cash for the second half of the month, $820.

- l. Received and paid the bill for the business license, $75, Ck. No. 1207.

- m. Paid wages to an employee, $1,200, Ck. No. 1208.

- n. Resser withdrew cash for personal use, $700, Ck. No. 1209.

Required

- 1. Record the owner’s name in the Capital and Drawing T accounts.

- 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts.

- 3. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction.

- 4. Foot the T accounts and show the balances.

- 5. Prepare a

trial balance as of July 31, 20--. - 6. Prepare an income statement for July 31, 20--.

- 7. Prepare a statement of owner’s equity for July 31, 20--.

- 8. Prepare a

balance sheet as of July 31, 20--. LO 1, 2, 3, 4, 5, 6

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Bonnie and Clyde are the only two shareholders in Getaway Corporation. Bonnie owns 60 shares with a basis of $3,000, and Clyde owns the remaining 40 shares with a basis of $12,000. At year-end, Getaway is considering different alternatives for redeeming some shares of stock. Evaluate whether each of these stock redemption transactions qualify for sale or exchange treatment.

Getaway redeems 29 of Bonnie’s shares for $10,000. Getaway has $26,000 of E&P at year-end and Bonnie is unrelated to Clyde.

Novak supply company a newly formed corporation , incurred the following expenditures related to the land , to buildings, and to machinery and equipment.

abstract company's fee for title search $1,170

architect's fee $7,133

cash paid for land and dilapidated building thereon $195,750

removal of old building $45,000

LESS: salvage $12,375 $32,625

Interest on short term loans during construction…

Year

Cash Flow

0

-$ 27,000

1

11,000

2

3

14,000

10,000

What is the NPV for the project if the required return is 10 percent?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

NPV

$ 1,873.28

At a required return of 10 percent, should the firm accept this project?

No

Yes

What is the NPV for the project if the required return is 26 percent?

Chapter 2 Solutions

College Accounting: A Career Approach (with Quickbooks Accountant 2015 Cd-rom)

Ch. 2 - Determine the balance of the following T account:

...Ch. 2 - Which of the following statements is correct? a....Ch. 2 - Prob. 3QYCh. 2 - R. Nelson invests his personal computer, with a...Ch. 2 - When preparing a trial balance, which of the...Ch. 2 - What would be the net income for Floress Catering?...Ch. 2 - On which financial statement(s) would R. Flores,...Ch. 2 - What is the amount of ending capital shown on the...Ch. 2 - Floress Catering purchased equipment that cost...Ch. 2 - Prob. 1DQ

Ch. 2 - Explain why the term debit doesnt always mean...Ch. 2 - Prob. 3DQCh. 2 - How are the three financial statements shown in...Ch. 2 - Prob. 5DQCh. 2 - List two reasons why the debits and credits in the...Ch. 2 - Prob. 7DQCh. 2 - What do we mean when we say that capital, drawing,...Ch. 2 - Prob. 1ECh. 2 - List the classification of each of the following...Ch. 2 - R. Dalberg operates Dalbergs Tours. The company...Ch. 2 - During the first month of operation, Graham...Ch. 2 - Speedy Sewing Services, owned by T. Nguyen, hired...Ch. 2 - During the first month of operations, Landish...Ch. 2 - The following errors were made in journalizing...Ch. 2 - Would the following errors cause the trial balance...Ch. 2 - During December of this year, G. Elden established...Ch. 2 - B. Kelso established Computer Wizards during...Ch. 2 - S. Myers, a speech therapist, opened a clinic in...Ch. 2 - On May 1, B. Bangle opened Self-Wash Laundry. His...Ch. 2 - The financial statements for Daniels Custom...Ch. 2 - During February of this year, H. Rose established...Ch. 2 - J. Carrie established Carries Photo Tours during...Ch. 2 - D. Johnston, a physical therapist, opened...Ch. 2 - On July 1, K. Resser opened Ressers Business...Ch. 2 - The financial statements for Baker Custom Catering...Ch. 2 - Prob. 1ACh. 2 - What Would You Say? A fellow accounting student...Ch. 2 - Prob. 3A

Additional Business Textbook Solutions

Find more solutions based on key concepts

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

Whether callable bonds have a higher or lower yield than otherwise identical bonds without a call feature. Intr...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

2. Identify four people who have contributed to the theory and techniques of operations management.

Operations Management

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following were selected from among the transactions completed by Babcock Company during November of the current year: Nov. 3 Purchased merchandise on account from Moonlight Co., list price $85,000, trade discount 25%, terms FOB destination, 2/10, n/30. 4 Sold merchandise for cash, $37,680. The cost of the goods sold was $22,600. 5 Purchased merchandise on account from Papoose Creek Co., $47,500, terms FOB shipping point, 2/10, n/30, with prepaid freight of $810 added to the invoice. 6 Returned merchandise with an invoice amount of $13,500 ($18,000 list price less trade discount of 25%) purchased on November 3 from Moonlight Co. 8 Sold merchandise on account to Quinn Co., $15,600 with terms n/15. The cost of the goods sold was $9,400. 13 Paid Moonlight Co. on account for purchase of November 3, less return of November 6. 14 Sold merchandise with a list price of $236,000 to customers who used VISA and who redeemed $8,000 of pointof- sale coupons. The cost…arrow_forwardHello teacher please solve this questionsarrow_forwardHelp me to solve this questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning - Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY