Contemporary Engineering Economics (6th Edition)

6th Edition

ISBN: 9780134105598

Author: Chan S. Park

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 4P

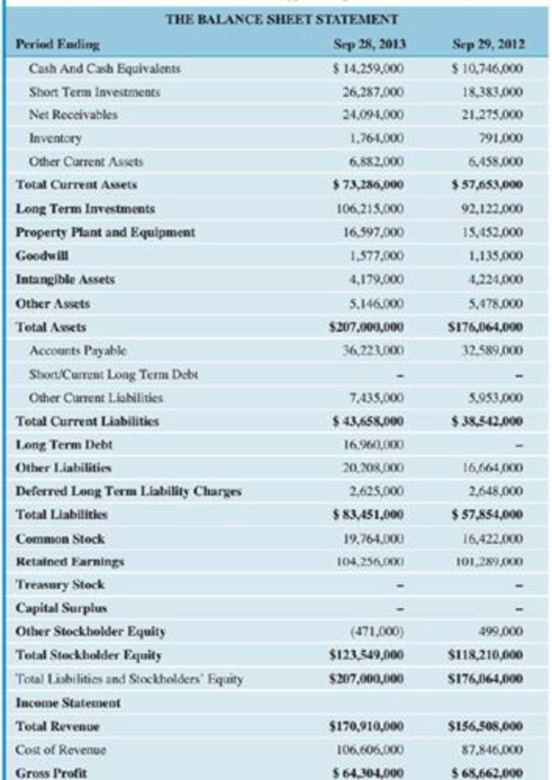

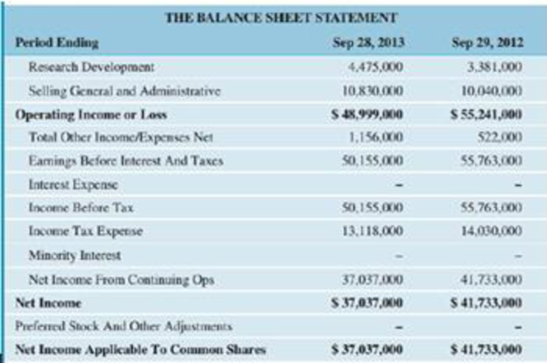

Table P2.4 shows financial statements for Apple Computer Corporation. The closing stock

- (a) Debt ratio

- (b) Times-interest-earned ratio

- (c) Current ratio

- (d) Quick (acid-test) ratio

- (e) Inventory-turnover ratio

- (f) Dav's-sales-outstandine

- (g) Total-assets turnover ratio

- (h) Profit margin on sales

- (i) Return on total assets

- (j) Return on common equity

- (k) Price/earnings ratio

- (l) Book value per share

TABLE P2.4 Financial Statements far Apple Computer (All numbers in thousands)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Not use ai please

Not use ai please

Not use ai please

Chapter 2 Solutions

Contemporary Engineering Economics (6th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Round Tree Manor is a hotel that provides two types of rooms with three rental classes: Super Saver, Deluxe, and Business. The profit per night for each type of room and rental class is as follows. Rental Class Super Saver Deluxe Business Room Type I Type II $30 $35 $20 $30 $40 Round Tree's management makes a forecast of the demand by rental class for each night in the future. A linear programming model developed to maximize profit is used to determine how many reservations to accept for each rental class. The demand forecast for a particular night is 140 rentals in the Super Saver class, 50 rentals in the Deluxe class, and 40 rentals in the Business class. Round Tree has 100 Type I rooms and 120 Type II rooms. (a) Formulate and solve a linear program to determine how many reservations to accept in each rental class and how the reservations should be allocated to room types. (Assume S₁ is the number of Super Saver rentals allocated to room type I, S₂ is the number of Super Saver…arrow_forwardDon't used hand raitingarrow_forwardWhat is the impact of population and demographic trends on our society? How does this continuation of growth impact our project supplies of goods and services? Be specific in your response.arrow_forward

- Please review "Alaska Ranked Choice Voting Implementation" for information to answer , What is the benefit of ranking multiple choices?arrow_forwardDon't used hand raitingarrow_forwardPlease review "Alaska Ranked Coice Voting Implementation" for information to answer, How to win in Round two (and beyond)?arrow_forward

- Please review "Alaska Ranked Coice Voting Implementation" for information to answer, How to win in Round One ?arrow_forwardPlease review "Alaska Ranked Coice Voting Implementation" for infornation to answer, How does Ranked Choice Voting work?arrow_forwardPlease review "Alaska Ranked Coice Voting Implementation" for information to answer question, What is Ranked Choice Voting?arrow_forward

- Consider the following demand and supply functions:Qd= 10-PQs=1+2pFind the equilibrium price and quantity, Producers and Consumer surpluses.Consider the tax size 3. What would be new CS and PS, TS and DL? (hint – it would be easierif you draw them)arrow_forwardWHAT IS IS-LM-PCarrow_forwardnot use ai pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...

Economics

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506756

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

DATA GEMS: How to Access Income Data Tables and Reports From the CPS ASEC; Author: U.S. Census Bureau;https://www.youtube.com/watch?v=BWpVC-Clczw;License: Standard Youtube License